September turned out to be a tough month for my little portfolio. The errors of my stock picking past as well as a sinking China market lowered the value of my portfolio quite a bit.

The “Umbrella Revolution” in Hong Kong as well as unexciting Chinese manufacturing data weighed in heavy on the Chinese market during the end of the month and this was felt in my two Asian Index funds which erased earlier gains. As people fought for their freedom in Hong Kong my portfolio took quite a beating in the last two days of September.

Still I wish the protesters best of luck and hope they will achieve their goals. Freedom and stability in Hong Kong are more important than slight paper losses in my portfolio. It was quite good to see that there are financial professionals who see it the same way: one trading firm even organized a sausage BBQ to feed the hungry protesters, as reported by Bloomberg.

Back to business: Portfolio performance

My portfolio value dropped to SGD 31,715 in September. A huge portion of this is due to Marrone Bio Innovations losing more than half of their value because of alleged shenanigans with regards to their financial reporting. What was I thinking investing in this stock!

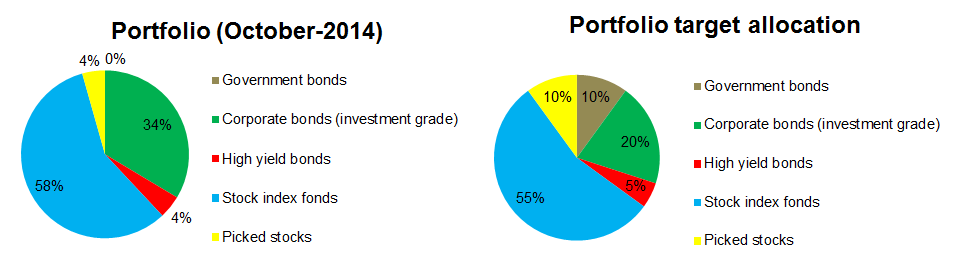

Portfolio allocation

As you can see, things are looking good and in line with expectations.

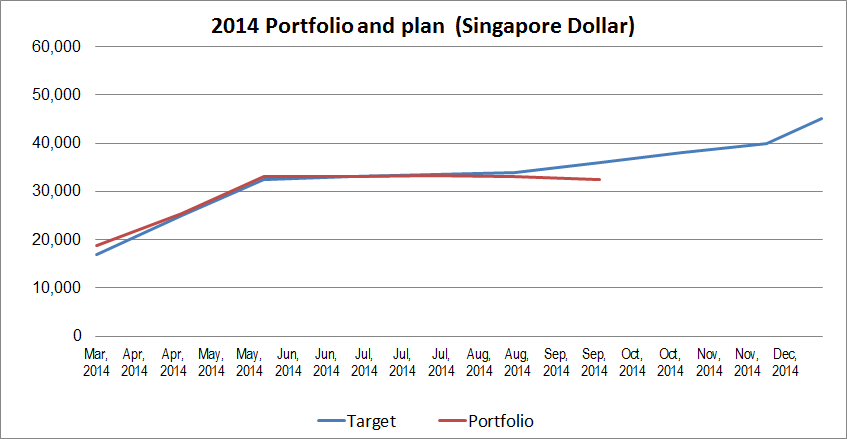

Portfolio performance vs. plan

Performance is lagging behind the plan, mostly due to the steep decline in picked stocks as well as the recent drop in the China/Asia market.

Transactions made and dividends received

On the bright side I received USD 82 in dividends from the iShares J.P. Morgan USD Asia Credit Bond Index ETF.

Furthermore I bought 200 additional shares of Vanguard’s FTSE Asia ex Japan High Dividend Yield Index ETF.

Outlook

All in all things are looking up and picked stocks now comfortably sit at 4% of my portfolio. In the next few months I will be investing quite a bit into it to chase the yearly plan.