Nearly one year has passed since Singapore Saving Bonds were introduced with much fanfare. Now things have quieted down somewhat. How has the scheme fared? Let’s look at some numbers together!

Please note: As it is our Singapore tradition to give things three letter names to abbreviate them later (MRT, PIE, NUS, NUH, MAS, SGX etc. etc.) Singapore Saving Bonds were soon abbreviated to SSBs.

Question number 1: Have SSBs been popular?

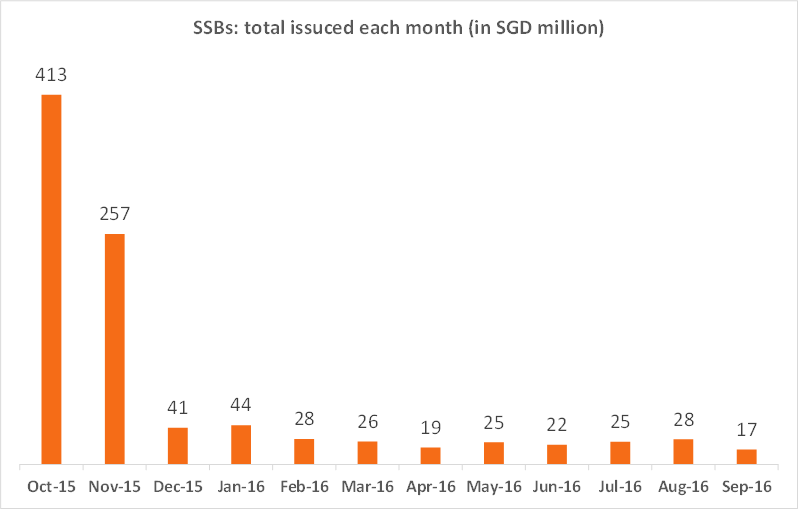

As you can see, demand has fizzled after the first two issues. While over SGD 410 million of Singapore saving bonds were snapped up in the first issue the figure has now dropped to an all-time low of SGD 17 million in September.

SGD 945 million of SSBs were issued until today, which still is less than the SGD 1.2 billion offered in the first month of the scheme.

Detailed data:

| Issue Date | ISIN Code | Max Offered($) | Amount Issued($) | Uptake (%) |

| Oct-15 | SG6YI1000007 | 1,200,000,000 | 413,161,000 | 34% |

| Nov-15 | SG6YI2000006 | 1,200,000,000 | 257,328,500 | 21% |

| Dec-15 | SG6YI3000005 | 1,200,000,000 | 40,987,500 | 3% |

| Jan-16 | SG6YI4000004 | 300,000,000 | 43,957,000 | 15% |

| Feb-16 | SG6ZG0000009 | 300,000,000 | 28,400,500 | 9% |

| Mar-16 | SG6ZG1000008 | 300,000,000 | 25,765,500 | 9% |

| Apr-16 | SG6ZG2000007 | 300,000,000 | 18,989,500 | 6% |

| May-16 | SG6ZG3000006 | 300,000,000 | 24,678,000 | 8% |

| Jun-16 | SG6ZG4000005 | 300,000,000 | 21,999,000 | 7% |

| Jul-16 | SG6ZG5000004 | 300,000,000 | 25,220,000 | 8% |

| Aug-16 | SG6ZG6000003 | 300,000,000 | 28,017,500 | 9% |

| Sep-16 | SG6ZG7000002 | 300,000,000 | 16,808,500 | 6% |

| Total | 945,312,500 |

Source: MAS/SGS

It can be said that the uptake has been relatively low.

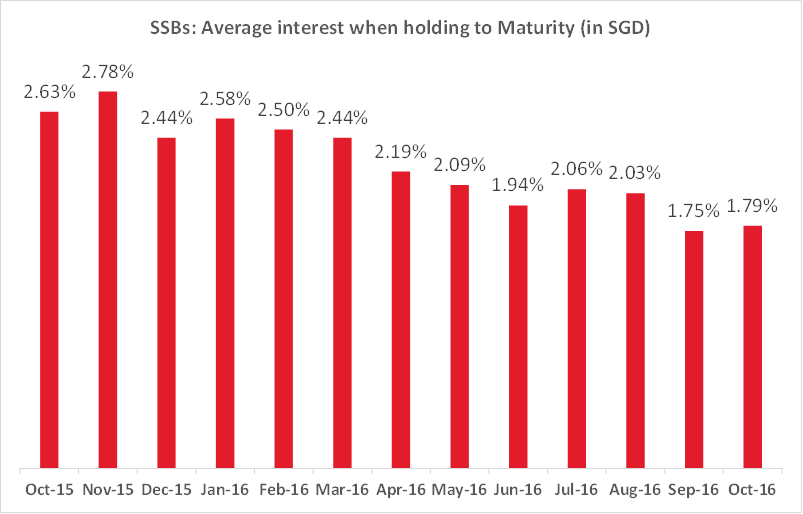

Question number 2: How have the interest rates developed?

As you can see in the chart above, the average interest rates when holding the SSB to maturity have been dropping steadily since they were issued for the first time. While people investing in November 2015 could enjoy an average of 2.78% per year, the average has now dropped nearly a full percentage point to 1.79%.

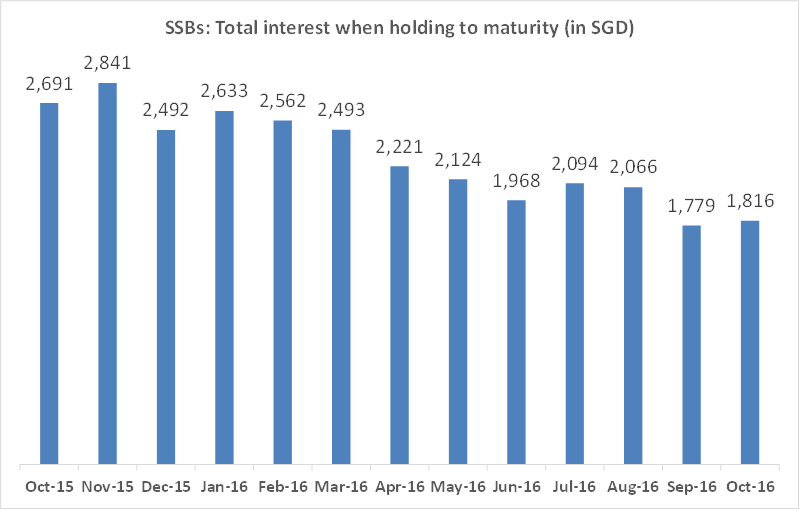

Let’s assume someone invested SGD 10,000 in each of the issues. How much interest would she receive when holding the bond to maturity?

As you can see, there is a huge difference! This does not take into account re-investing the dividends, in which case the difference would be even bigger.

Detailed data:

| Interest per year | ||||||||||||

| Issue Date | ISIN Code | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 | Average interest when holding to Maturity |

| Oct-15 | SG6YI1000007 | 0.96% | 1.09% | 1.93% | 2.93% | 3.25% | 3.25% | 3.25% | 3.25% | 3.30% | 3.70% | 2.63% |

| Nov-15 | SG6YI2000006 | 1.18% | 1.20% | 2.06% | 3.10% | 3.40% | 3.40% | 3.40% | 3.40% | 3.44% | 3.83% | 2.78% |

| Dec-15 | SG6YI3000005 | 1.15% | 1.15% | 1.65% | 2.41% | 2.81% | 2.81% | 2.93% | 3.08% | 3.29% | 3.64% | 2.44% |

| Jan-16 | SG6YI4000004 | 1.21% | 1.31% | 1.92% | 2.63% | 3.00% | 3.00% | 3.07% | 3.16% | 3.34% | 3.69% | 2.58% |

| Feb-16 | SG6ZG0000009 | 1.00% | 1.12% | 1.81% | 2.62% | 3.01% | 3.01% | 3.03% | 3.10% | 3.27% | 3.65% | 2.50% |

| Mar-16 | SG6ZG1000008 | 1.09% | 1.15% | 1.84% | 2.67% | 2.95% | 2.95% | 2.95% | 2.95% | 3.03% | 3.35% | 2.44% |

| Apr-16 | SG6ZG2000007 | 1.04% | 1.04% | 1.71% | 2.55% | 2.62% | 2.62% | 2.62% | 2.62% | 2.62% | 2.77% | 2.19% |

| May-16 | SG6ZG3000006 | 0.97% | 0.97% | 1.59% | 2.42% | 2.52% | 2.52% | 2.52% | 2.52% | 2.52% | 2.69% | 2.09% |

| Jun-16 | SG6ZG4000005 | 0.90% | 1.01% | 1.53% | 2.14% | 2.31% | 2.31% | 2.31% | 2.31% | 2.31% | 2.55% | 1.94% |

| Jul-16 | SG6ZG5000004 | 0.93% | 1.15% | 1.62% | 2.15% | 2.41% | 2.41% | 2.42% | 2.46% | 2.57% | 2.82% | 2.06% |

| Aug-16 | SG6ZG6000003 | 0.89% | 1.08% | 1.52% | 2.00% | 2.28% | 2.33% | 2.42% | 2.52% | 2.68% | 2.94% | 2.03% |

| Sep-16 | SG6ZG7000002 | 0.87% | 1.02% | 1.35% | 1.72% | 1.93% | 1.98% | 2.05% | 2.14% | 2.26% | 2.47% | 1.75% |

| Oct-16 | SG6ZG8000001 | 0.84% | 0.89% | 1.28% | 1.75% | 2.00% | 2.04% | 2.13% | 2.23% | 2.38% | 2.62% | 1.79% |

Source: MAS/SGS

Question number 3: Are Singapore Saving Bonds still a great deal?

In my opinion the answer is quite simple:

Are Singaporean Saving Bonds as good a deal as they were when they first launched? Obviously not! Interest rates have now dropped to a new low and we will get lower returns when investing now.

Are Singaporean Saving Bonds still a great deal? Of course they are! If you need the money in a few years, or if you are looking to build a nest egg with minimum risk then SSBs are the best choice in town. No other investment has this low level of risk combined with relative high interest and no lock-in period or penalties (SSBs can be sold once a month).

Possible Applications for Singapore Saving Bonds

- Save money for a down payment or other investment goal for which cash is required in the future

- Minimize risk by allocating (part of) the bond portion of the portfolio to SSBs

- “Park” any savings that you need within a 1-3 year horizon

… and many more!

Last but not least: Singapore saving bonds had one more unexpected benefit for consumers: they forced the banks to innovate as they now have to compete with higher interest rates. This can only be good news for consumers.

Disclaimer: While I made an effort to ensure that the data is accurate I cannot guarantee it. I recommend you visit the official website for the statistics (http://www.sgs.gov.sg/Statistics.aspx). I am not a professional advisor, just a nerd who likes charts and numbers. This is not investment advice.

I am not surprised with the low take up rate at all.

A recent study by Schroeder reveals that younger Singaporeans are expecting close to 10% annual returns in their investment while their older counterparts had a slightly lower (relatively) expectations of 8+%.

With such unrealistic goals, they would have found the ~2% returns offered by SSG derisory. It is also no surprise majority would take on excessive risks in pursuit of higher returns and end up with disappointing negative or below CPF 2.5% guaranteed returns.