In June I finally received my performance bonus for the year and invested it all, as it is my tradition… Investing in the bear market always feels good to me, as I feel stocks are “on sale”

Life updates June

Offer from the European startup is finalized, now I am in the midst of the exit negotiations with my current employer. Sadly this means that I will not return to Singapore. As my employment permit was not approved by the Singaporean authorities, it is probably anyway better this way.

Portfolio in June

In June I finally received my performance bonus for last year. HR had some issues, so it was paid out in June instead of April. In Hindsight this turned out to be a blessing in disguise, as I could invest it all at an ~8% lower price.

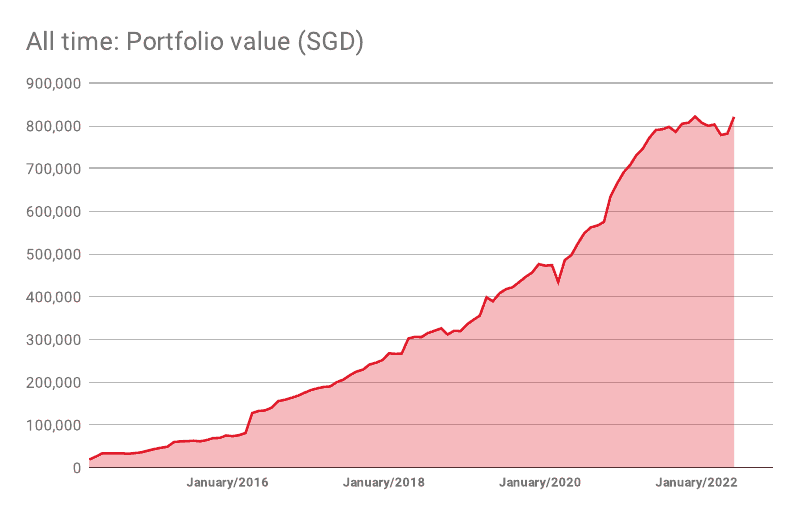

In June my portfolio increased from SGD 781,357 (~USD 568,400) to SGD to SGD 820,557 (~USD 587,700). Investments of SGD 64,929 were offset by paper losses of SGD 25,729. Six consecutive months of losses for my portfolio with no end in sight.

Expenses

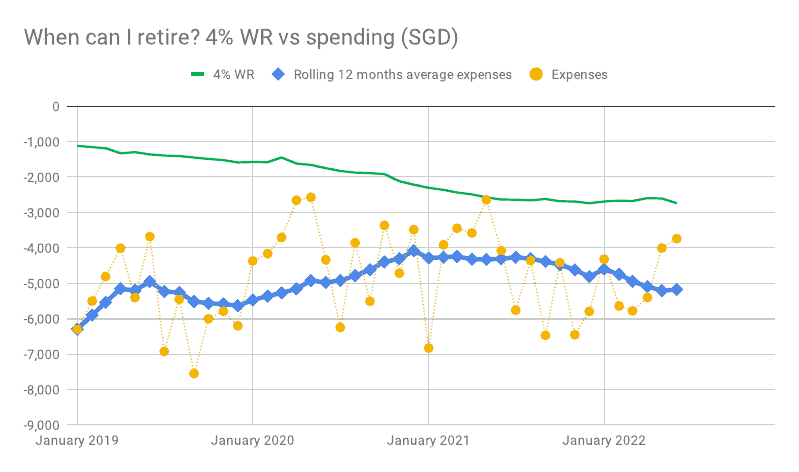

In June I spent SGD 3,738. The biggest expense was hiring a law firm to check the contracts with the startup, which cost SGD 1,560, as well as renting a car SGD 580. Without these expenses, spending was reasonable.

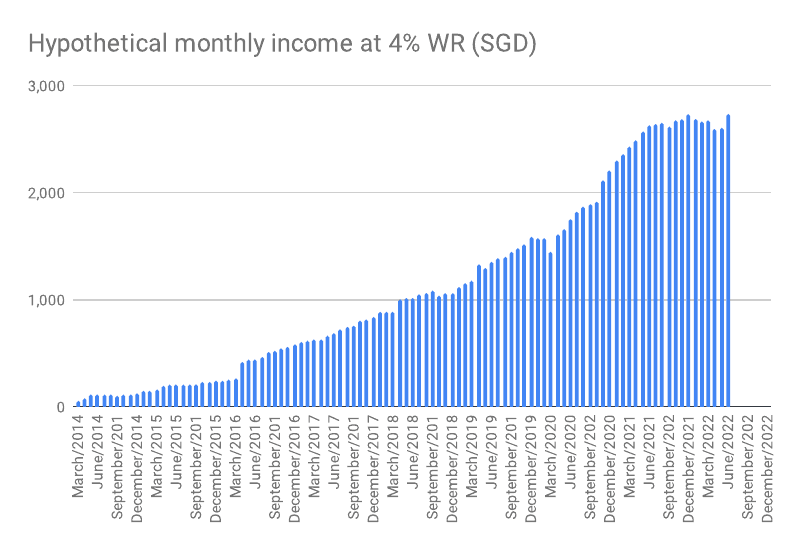

My hypothetical income at 4% WR is now SGD 2,735 – not so bad!

Portfolio allocation

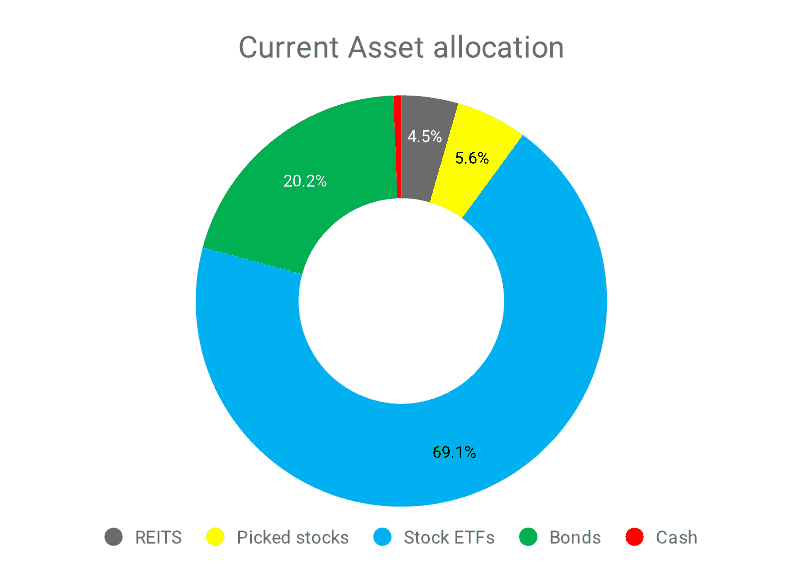

All is on track, maybe a bit light on bonds.

Outlook

In July I should receive the exit contract from my current employer. Afterwards I will get a tiny salary, amounting to <20% of my current compensation. To make up for this, I will receive a good chunk of equity in the startup. Might be worth a lot, or nothing in the end, we will see!