At the end of a very crazy 2020 I analyzed all my spending and investments for the year. Read on for the charts and details!

I realize that I am incredibly lucky to have kept my job and all privileges in 2020 and I know that I did not do anything to deserve this – I was just lucky.

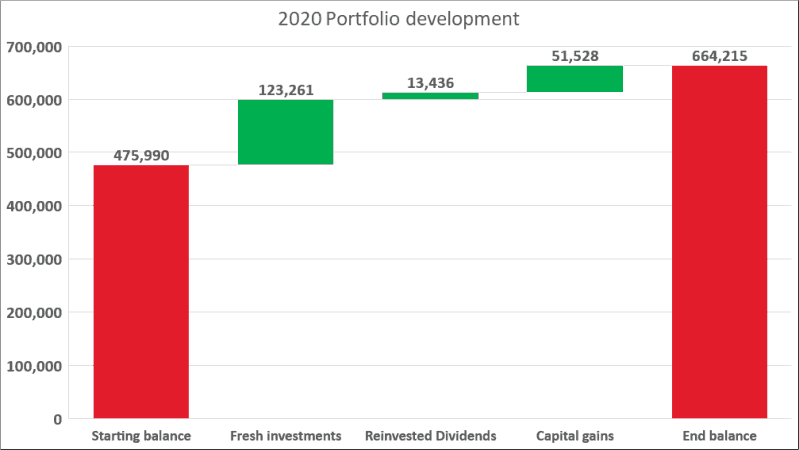

How did my portfolio perform in 2020?

I invested a total of SGD 136,697 and enjoyed capital gains of SGD 51,528 excluding dividends.

In March I sold off quite a lot of bonds to buy REITs and stocks on discount, it turned out to be a good idea.

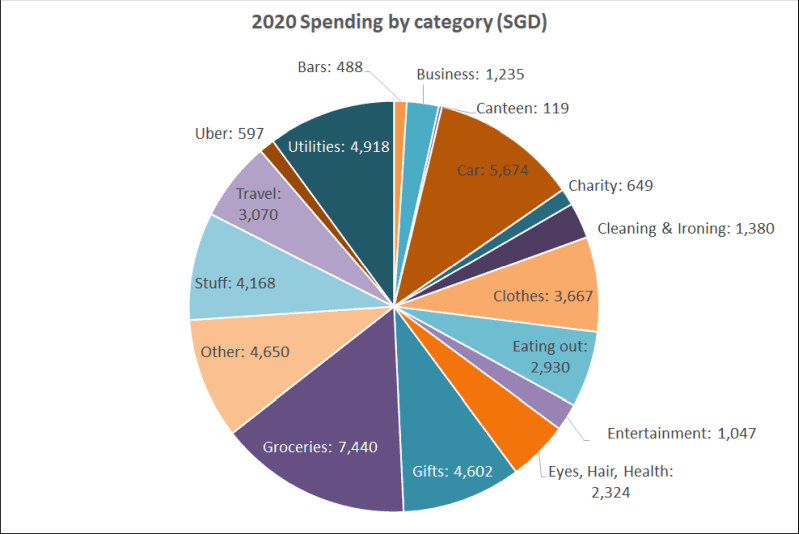

How much did I spend in 2020?

In 2020 I carefully tracked all my expenses. I spend a whopping SGD 48,958 – despite receiving free housing and grocery vouchers.

There is a lot of potential to optimize… I was impressed reading fellow finance blogger Kyith’s yearly spending report for example.

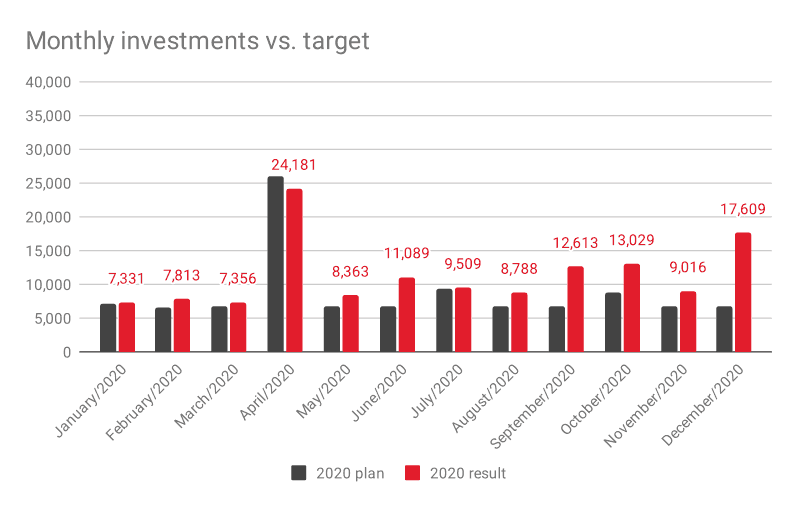

Investment vs. plan

In 2020 I invested a total of SGD 136,697, exceeding my plan for the year by over SGD 30,000. During lockdown I could not spend much money on travel, which had been a huge cost in previous years.

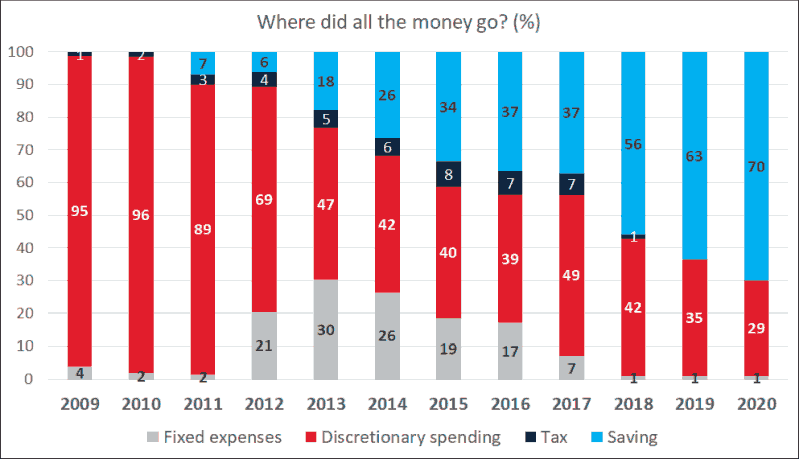

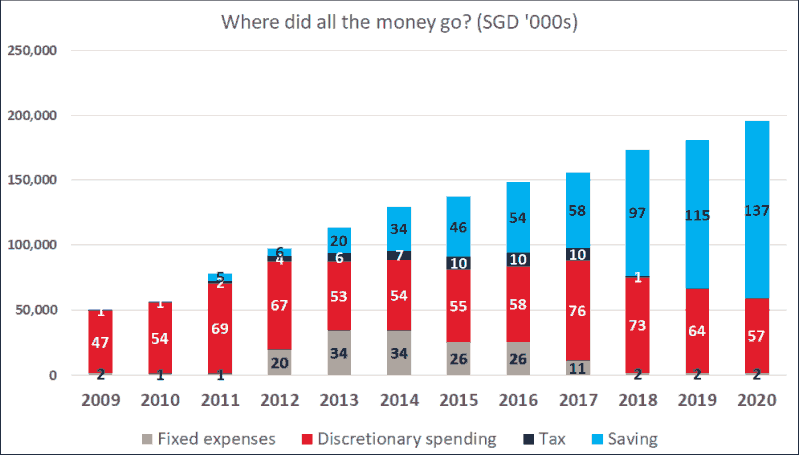

Where did the money go?

In relative terms I have improved my saving rate year over year. In 2020 I saved 70% of my income.

In absolute terms the picture is mixed, I still spent a lot of money, but have not succumbed much to lifestyle inflation – my spending is pretty similar to five years ago.

The spending number here is higher than the real number, as some cash is in my buffer account, earmarked for moving expenses this year.

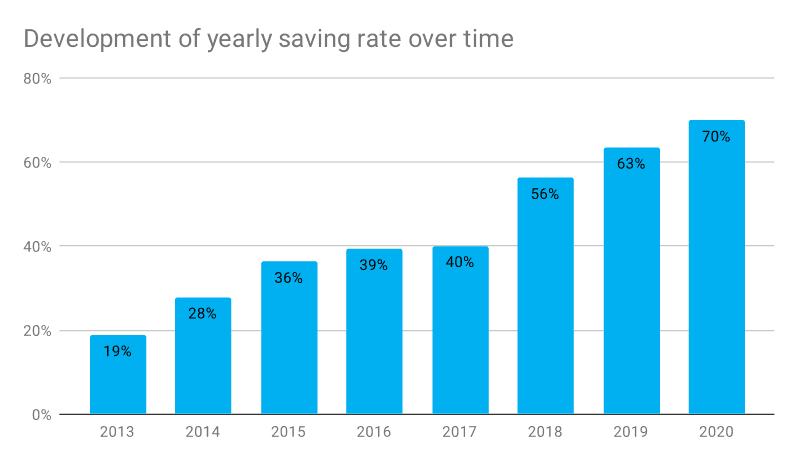

Development of saving rate over time

The saving rate slowly increased over time. Free housing and expat benefits helped of course. I am not frugal at all, just lucky. Also my salary increased every year, so I just avoided lifestyle inflation for the most part.

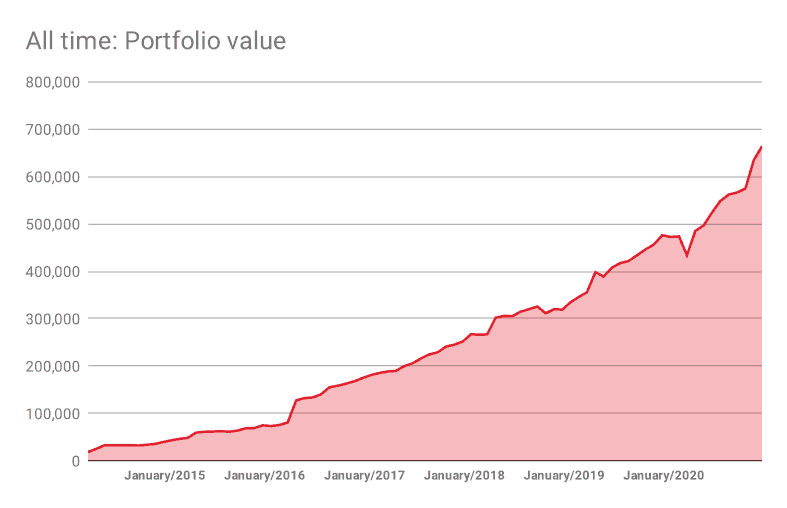

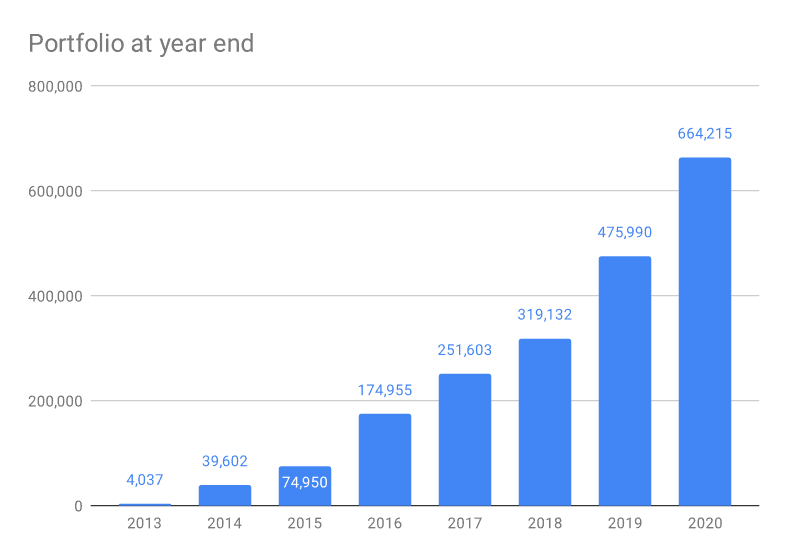

The portfolio is growing faster every year, driven by the increased saving rate and compound interest:

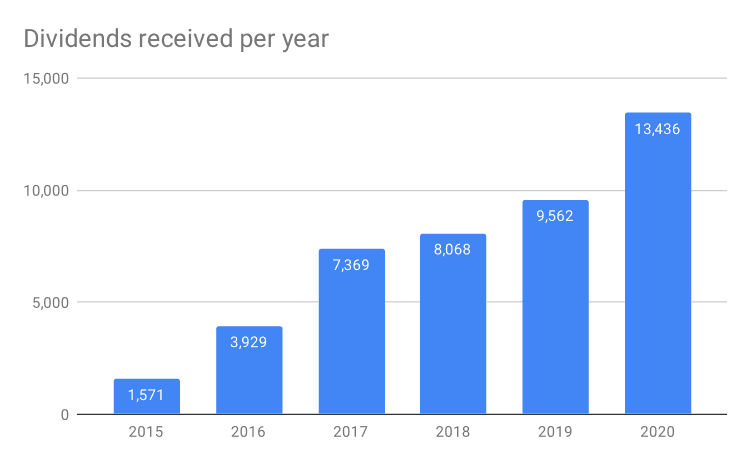

Dividends received

In 2020 I received SGD 13,436 in tax free dividends from my Singaporean holdings. My European holdings are in accumulating ETFs to optimize taxes, so the dividend yield of my portfolio is not so high.

Outlook

2021 is looking to be quite a different year. Most likely my company will send me back home to Singapore and I will probably not be able to save as much money. Nevertheless, I hope to reach my lean financial independence goal of SGD 750,000 this year.

I have not been back in Singapore since early 2017 and I miss home quite a bit. Even though I am an ang moh guy and not a real Singaporean, Singapore is where I spent 13 or so years – I never get this kind of home feeling that I get when I touch down in Changi and see the orchids and smell the Dettol cleaner they use all over the airport 😊

What I also miss is my favorite prawn dumpling auntie in Joo Chiat, Laksa, Meerebus and the joy that is crispy prata and kopi si kosong for breakfast.

On the personal front I will focus on relationships, fitness and peace of mind in 2021. Lots to do!

I wish everyone a peaceful and healthy 2021!

Great savings rate and congrats from being able to pulled through 2020 well!

Thanks, Kyith! 🙂 What a wild year it was!

Congrats – nice accomplishment thus far.

I guess the big chunk of expenses – housing/mortgage – is removed from your equation, which helps immensely as it typically forms close to 20-30% of most people’s expenses.

All the best.

thank you pointman! you are right, it is so easy without housing expenses, I should have managed a better saving rate… Will try again this year 🙂