2024 marked my second full year working from anywhere in Europe for a startup. It was a crazy year!

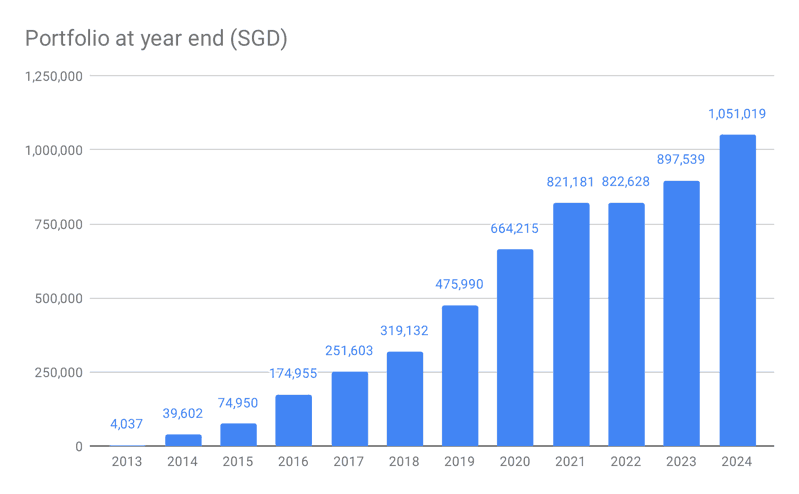

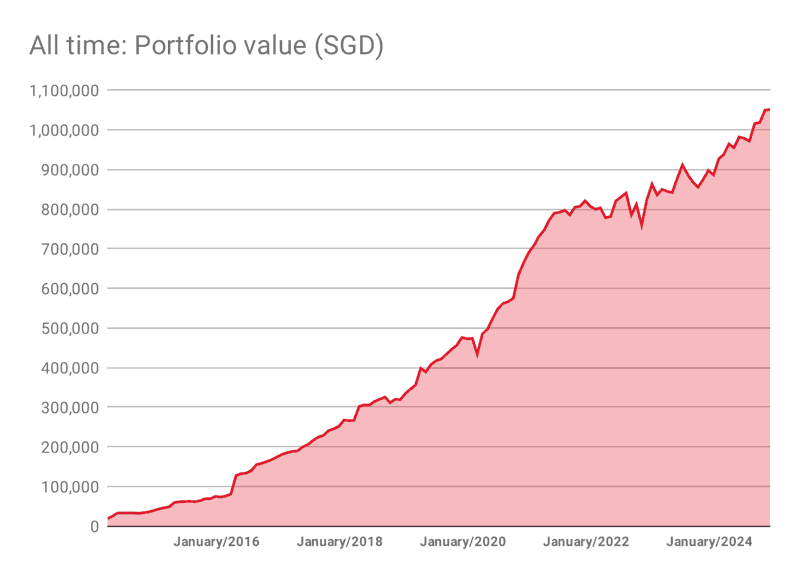

Overall it was an exceptional year, with markets performing like crazy. Despite not investing much, I crossed the emotionally exciting, but rationally meaningless SGD 1m threshold. This prompted me to wrote a long rambling post: ten years to seven digits.

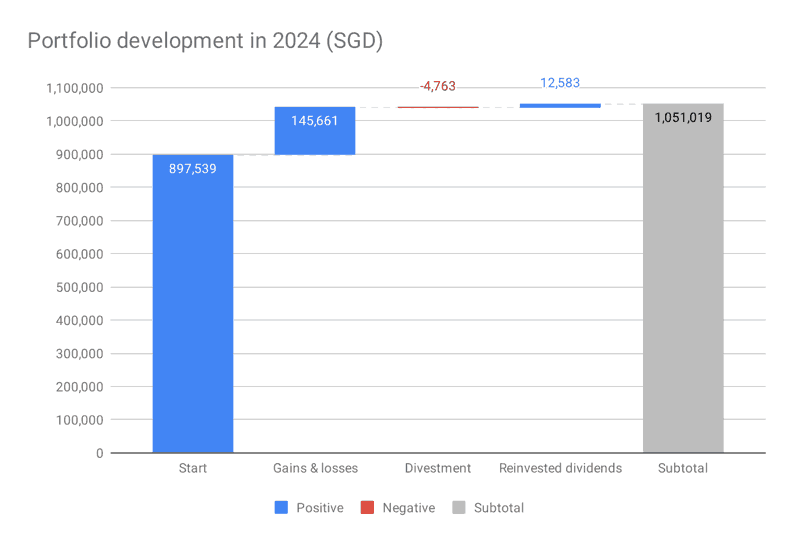

Investment performance

My portfolio ended the year at SGD 1,051,091.

Dividends: I received SGD 12,583 in dividends, which I reinvested. These days I try to minimize dividends, as they are taxed close to 30% in Europe.

Selling shares: I had to sell SGD 4,763 in shares which is the first time in over ten years that I took money out of my portfolio. The reason for this was that I spent around SGD 59k on two investments into private companies and was missing about SGD 5k to complete the transactions.

Thoughts on investing in private companies

In 2024 I made two so-called “Angel Investments” into two private companies. I used about SGD 5k from my stock portfolio and another SGD 54k that I still had in cash savings. One company is a software startup, the other one is a travel business.

I don’t think either company was a bad investment, but I will not continue investing in private companies in the future. It is too stressful, risky and hands-on. One example: In the travel company I became operationally quite involved, at some point it felt like I bought myself another job. We had to fire the developers, change the product, I had to hire a lawyer to help me with the paperwork… Fortunately, the company is now profitable and if all things go to plan, 2025 will see a nice income to be distributed via dividends in 2026.

At the end of the day, angel investing is not the right thing for me at this time. Angel investment is performing much worse than other asset classes and it is much riskier: 95% of startups fail. Angel investment feels the right thing for bored rich people, who can allocate <10% of their portfolio to invest into at least 25 companies. For people with invested assets of SGD 8 million plus who need a new hobby I would say: go for it. The rest should stick to index funds.

I will not count my 2 private company investments as part of my portfolio and have mentally written off the investment. Should the companies perform, it will be a nice upside. On the bright side, I learnt much more about startup valuations and even was asked to be a jury member in a startup competition.

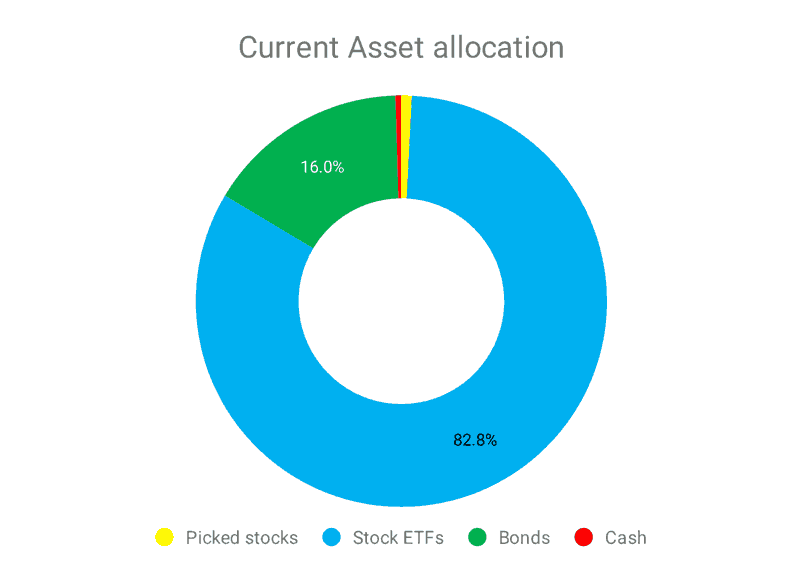

Portfolio allocation

My investment portfolio is nice and boring. 83% index funds, 16% bonds and the tiny remaining 1% in picked stocks and cash. Shares in my main startup and the 2 company participation are not counted and valued at 0.

Income in 2024

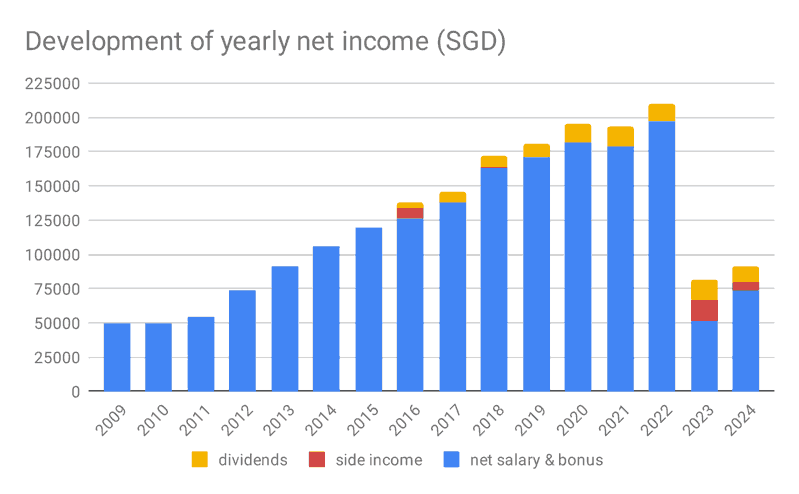

Main income after tax in 2024: SGD 73,563

Gone are the days where being imprisoned in an office was rewarded with a high salary, but the new freedom comes with a price of low wages…

Startup salaries are not that exciting, especially in Germany where taxes are high and incomes are rather low to begin with. I am having a big equity package in the startup, it either will be worth a lot or nothing at all. The good thing is, that my startup life comes with a time limit – in two years the company is either well on track to be sold or bankrupt.

Side income: SGD 5,654

My side income was much lower in 2024 than in 2023. My experience in big corporate is becoming outdated and I am not booked as a consultant in my old field that often anymore. Furthermore, I was extremely busy in Q3-Q4 and could not bid for many jobs.

Expenses in 2024

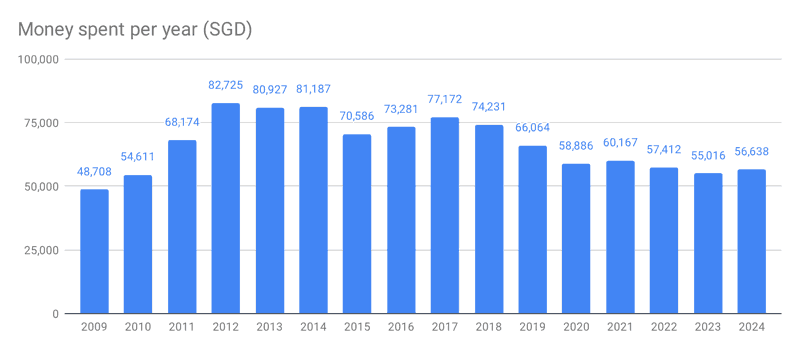

Spending SGD 56,619.

My expenses have been rather stable the last few years.

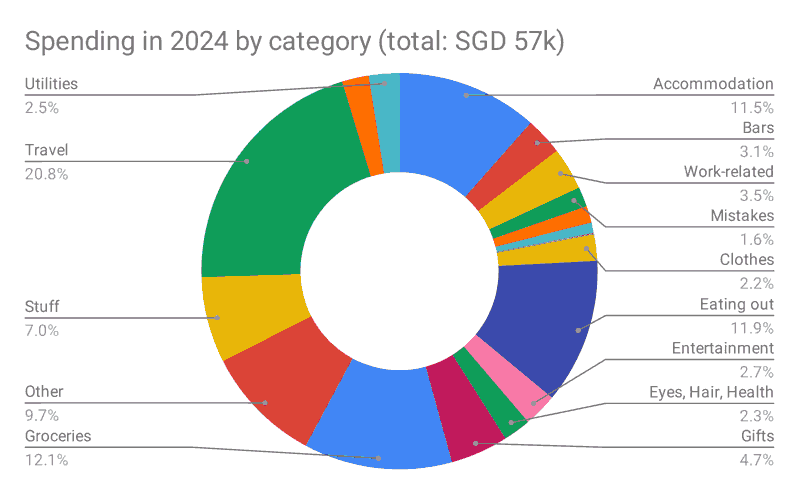

As in previous years, I spent most money on “wants” vs “musts”. This is going to change in 2025, as I moved to Switzerland for my wife’s job and have to pay rent again. My wife and I keep separate finances out of habit and laziness and her portfolio, income and expenses are not part of this blog, which I started way before getting married.

Travel is by far the biggest category in my spending, with SGD 11,834 spent on travel in 2024. I do not travel like a tourist, but I tend to just go to a nice country and hang out there for a while, working remotely. It is not expensive compared to traditional holiday travel, but staying in a place for weeks on end it still adds up. Also I like to visit my aging parents as much as possible.

When can I retire?

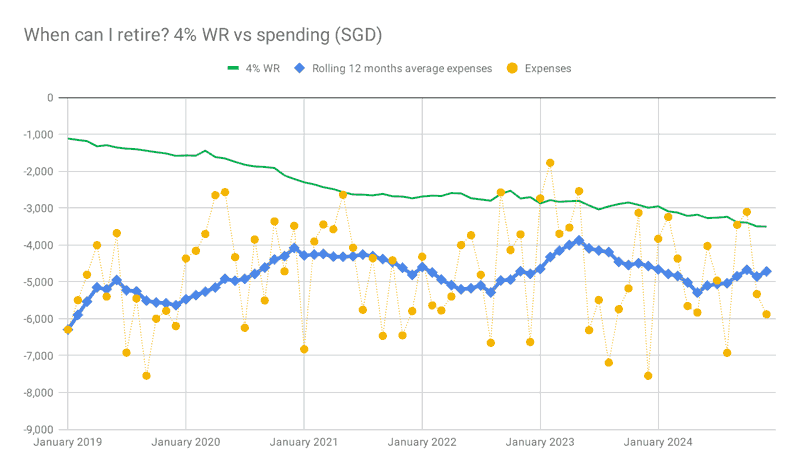

The most important chart. The green line shows my hypothetical passive income which I could draw from my portfolio (4% each year). The blue line shows the trailing twelve month average of my expenses, the yellow dots are my monthly expenses.

Once the lines green and blue lines intersect, I could retire even at my current high expense level. In reality, I know that my current startup job will most likely be my last real full time job, in two years I would be able to retire – either on a lean budget or with a huge budget if the startup works out.

Outlook

I feel like I have 99 problems, but personal finances ain’t one. Finances are a bit on Autopilot and I reached my goal not to work in an office ever again. In 2025 would like to take care of my parents, learn new dishes to cook, speak better French and Spanish, do more sports and make sure to enjoy my days on earth.

In two years I should hopefully be able to retire from fulltime work for good. Should the startup go bankrupt or should I get fired, I will be able to retire immediately on a budget of SGD 3,500 / month – easily doable in Southern Europe.