2023 was the first full year working for the startup in Europe. While often busy, it seemed a bit like a form of semi-retirement.

Gone are the days of 8 consecutive video calls a day and big corporate bureaucracy at Megacorp. Startup life can also get busy, but I enjoy living like a Nomad and making most use of my time. Right now I am based at the beach in Southern Spain for two months, looking at the Ocean as I type this. In a way I have achieved the retirement lifestyle I wanted already today.

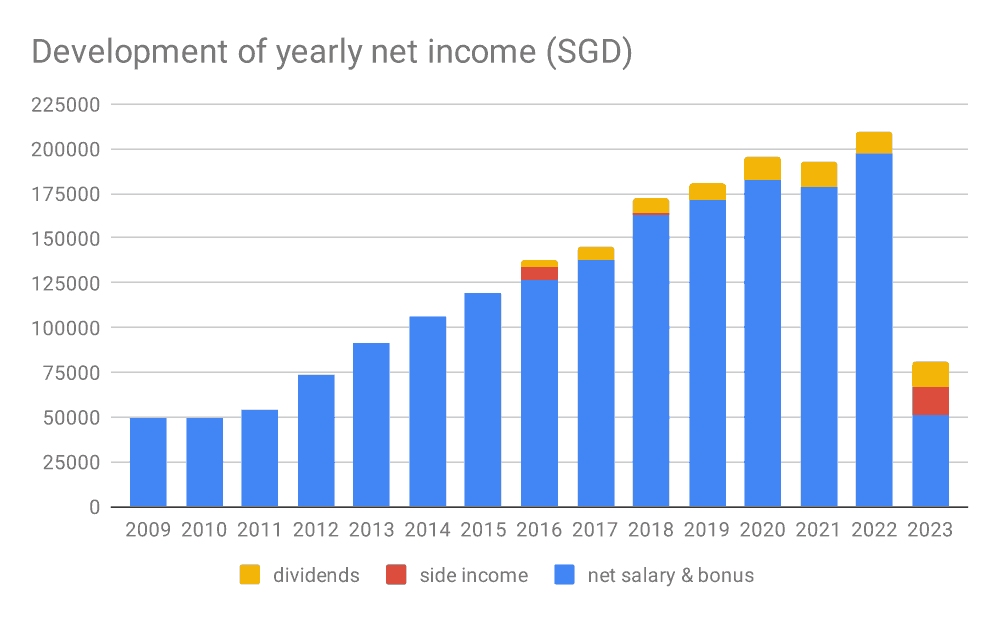

2023: lowest income since 2009

Even when I started working in Singapore I earned more than I did for the European startup in 2023:

Where did the money go in 2023?

- Salary: SGD 51,560

- Side income: SGD 15,500

- Dividends: SGD 14,380

- Spending: -SGD 54,940

European taxes are very high and I was mostly paid in equity. The company is doing well though and I have negotiated for a rather big equity package before starting, so there is a chance for a huge windfall in the future.

I did not expect it to be so easy to make some side-income. This is a feat I will probably not be able to repeat in 2024 though.

As of 2024 my net salary has been increased to about SGD 6,200 per month, which is comfortable by European standards.

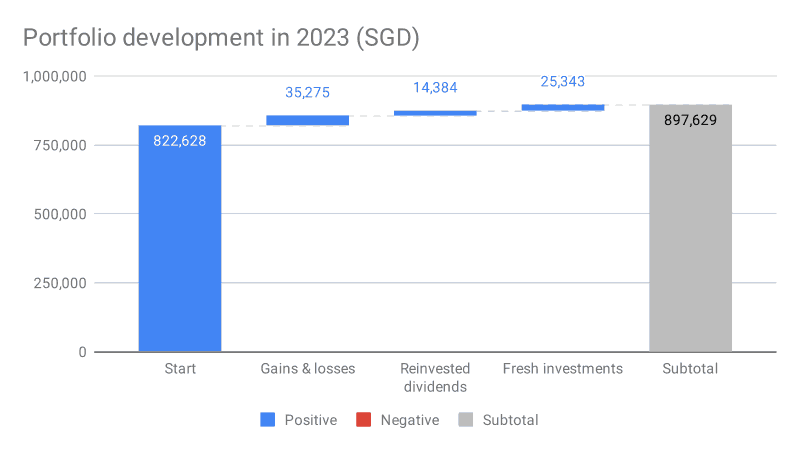

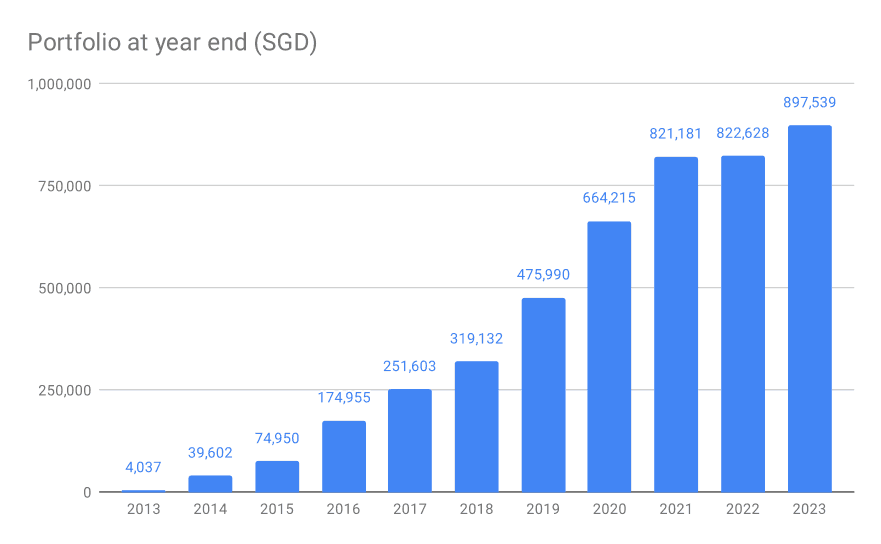

Portfolio update

My investment portfolio had a better year after the tough 2022 and finished the year just under SGD 900k.

In the long run, my portfolio enjoyed nice growth thanks to a high saving rate in the high income years.

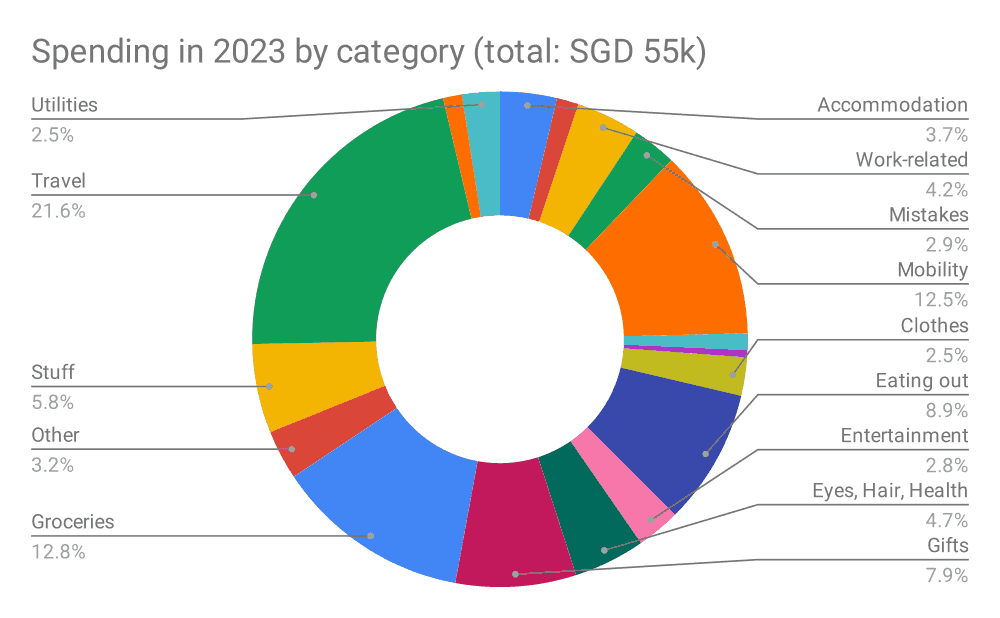

Expenses were high – despite living in Europe

From a Singaporean perspective, European countries like Germany, France, Spain… are rather cheap. Despite this, I spent too much money, most of it on wants vs. needs.

In 2023, close to SGD 12k was spent on traveling around the continent, around SGD 7k was used for subscribing to a car, as I lived in some mountains for a while. I could not resist the restaurants in Spain and France and eating out cost close to SGD 5k a year.

When not being tied to a certain location, massive cost savings can be realized. Some of Europe’s beautiful areas are not economically strong and living there can be cheap.

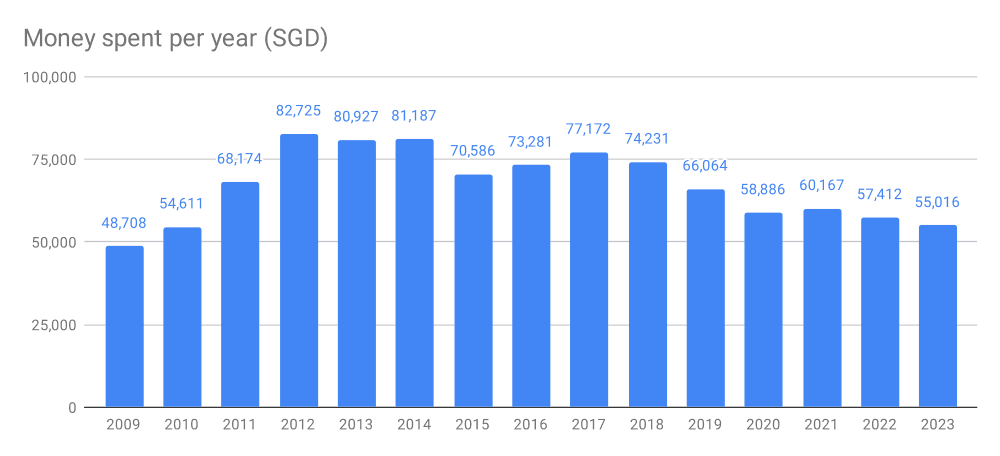

Yearly expenses, somewhat constant

Ever since I started tracking, my yearly expenses were quite constant in recent years, despite life having changed so much.

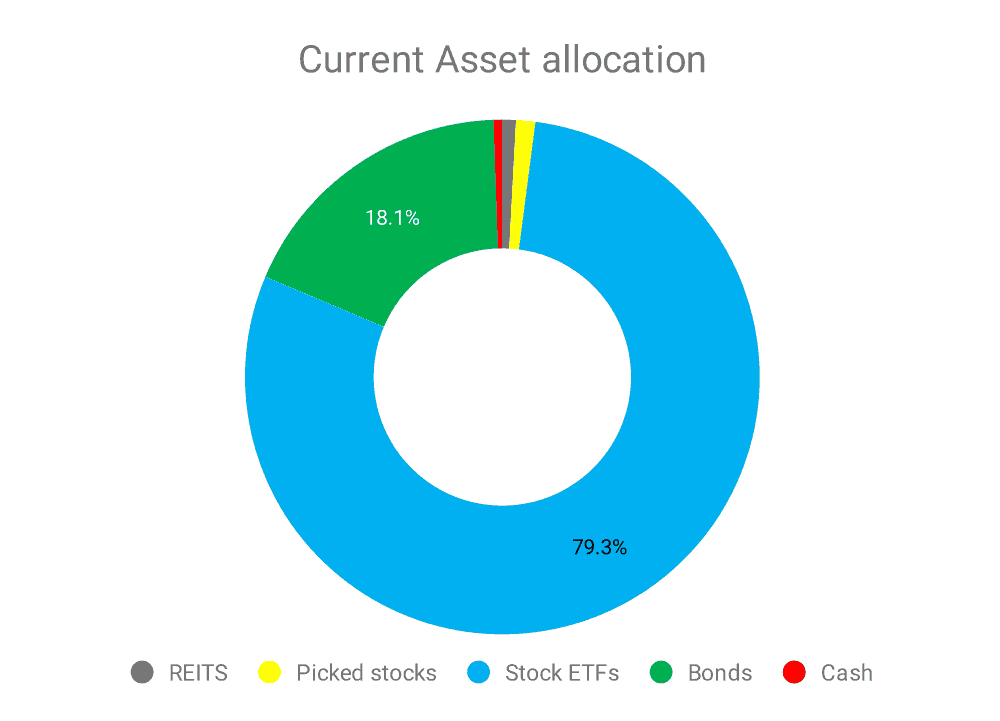

Portfolio allocation – nice and boring index funds…

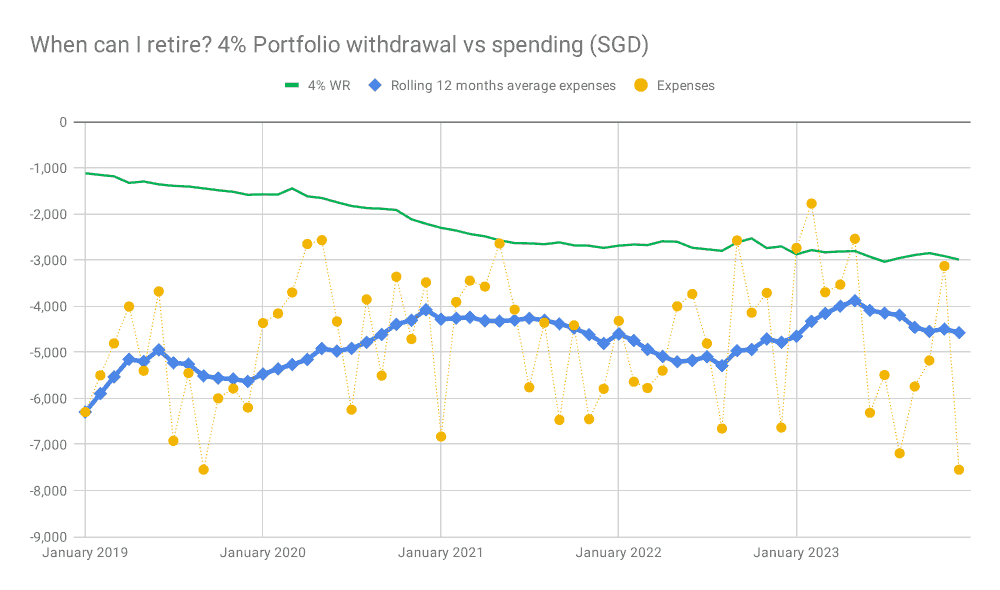

When could I retire?

If I needed to, I could possibly retire today and would be ok. To allow for a more comfortable life, I will probably need to save a bit more.

As soon as the green and the blue lines intersect, I would definitely be done!

Outlook

2024 will be rather exciting. I have decided to use about EUR 25k of my cash buffer to do an angel investment in another startup which looks promising – let’s see how it goes. The cash buffer had been set aside to supplement my income, but I do not need that anymore after the salary increase.

Seems like 2024 will be a great year – fingers crossed!

Wow! You are living the dream life most Sinkies can only dream about. How did you find this Europe gig in the first place? Which EU country or city?

I chose Germany, because I have the Passport. Generally it is easy to find a job in Europe, but the taxes are super high and salaries are low, compared to Sg. Any tax you can imagine – we have it.