Dividends are tax free in Singapore? Yes they are, but there are still bad surprises waiting for investors who want to buy some foreign dividend stocks and funds listed on stock exchanges abroad. Let me explain my silly mistakes and hopefully prevent some of you to fall into the same traps.

Mistake 1: Buying a US listed dividend paying ETF

When restructuring my portfolio from picked stocks to a proper portfolio mix I thought it was a good idea to buy the Vanguard Emerging Markets Government Bonds ETF (VWOB) and at first it seemed like a great idea as this fund offers:

- Low expense ratio of only 0.35%

- Highly diversified with 634 (as of today) government bond holding from all over the emerging markets

- Dividends paid monthly

Sounds great, doesn’t it?

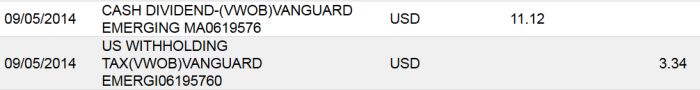

However when I checked my trading account after the first dividend I saw this:

Sure enough – I had received my promised dividend, but was then deducted 30% US withholding tax directly in my Standard Chartered Account. I was expecting a yield of roughly 3.8% every year, but taxes lower this yield to roughly 2.5% making the investment not worthwhile anymore. As you can see in my portfolio, I have sold the stock and bought the Singapore listed iShares J.P. Morgan USD Asia Credit Bond Index ETF instead, which of course is a totally different bond fund. Read more about ETFs available for Singaporean investors to find some other choices.

Mistake 2: Investing in a Frankfurt (Germany) listed dividend paying stock

As you can read in my monthly update for May, I had to find out that Singaporean investors have to pay 26.375% withholding tax on dividends paid by Frankfurt listed companies. Ouch! While investing in individual stocks is a mistake in its own (read more about this in my getting started guide to investing in Singapore) the dividend yield in this investment makes it really unattractive. I am still holding on to that stock, but should I ever break even I will divest it and put it into some Singapore-listed ETFs instead.

Which countries tax dividends for Singaporean investors?

This is a very anecdotal list and I am not a professional investment adviser, so do you own research and read the disclaimer.

What I found out so far:

| Country stocks are listed in | Withholding tax rate on dividends |

| Australia | 30% |

| Canada | 25% |

| France | 30% |

| Germany | 26.375% |

| Hong Kong | 0% |

| Ireland | 20% |

| Japan | 20.315% |

| Luxembourg | 15% |

| Netherlands | 15% |

| Singapore | 0% |

| United Kingdom (all other companies) | 0% |

| United Kingdom (property companies) | 20% |

| United States | 30% |

As this table clearly shows us: Investing in dividend paying stocks and funds outside Singapore is very often a terrible idea as you will get charged withholding tax making your investments a lot less attractive. If you own stocks in these countries you will be taxed on dividends at the rates above, even if you are in Singapore.

Don’t make the mistakes I made! My recommendation would be to limit your investments to ETFs traded in countries without withholding tax for Singaporean investors, e.g. Hong Kong or Singapore.

Picture credit:

I am facing the same predicament with StandChart. I thought upon filling the W-8BEN form we won’t be taxed as we’re non-US citizens?? Apparently StandChart could not advise me on taxation and told me to seek legal advice from tax lawyers.

As far as I know there is no way to get around that hefty withholding tax. What stocks or funds are you holding? Any chance to sell them and buy them again on an exchange without withholding tax?

This is precisely the solution that some people have. Imagine having to do this every quarter or month! An impossible solution for small time investors as the commissions and fees would more than eat up all the profits before even saving costs on withholding tax.

Hi there, thanks for the post. Reading it together with your current portfolio gives me a bit of insight. Now I am keen to find out, if you don’t mind sharing, whether the dividends from your holding of the Hong Kong listed Vanguard funds are charged with withholding tax.

Hi YM, thanks for your question! There is no withholding tax on my funds listed in Hong Kong.

Thanks for the post.

Hi, as I understand, although Hong Kong does not have a withholding tax on dividends, it depends on where the ETF is domiciled. If you buy a US ETF, the fund itself will pay the 30% tax (ref Scenario 4: http://www.turtleinvestor.net/get-to-know-dividend-withholding-tax/)

As for Singapore, although there is also no withholding tax on dividends, I believe this only applies to ETFs traded in SGD? If the ETF is traded in USD, like S27 SPDRs® S&P 500® ETF, dividends will still be subject to 30% withholding tax, because the ETF is domiciled in the US.

That leaves zero options in SGX listed ETFs traded in SGD for the US and Europe markets. The only SGD traded ETFs listed on SGX are for Singapore, India, China and some Asia Pac blends, all of which have very high expense ratios.

Lastly, you said “My recommendation would be to limit your investments to ETFs traded in countries without withholding tax for Singaporean investors, e.g. Hong Kong or Singapore.” What about UK? Although it has a 0.5% stamp duty on buying, it has no withholding tax. But for small time investors the commission and minimum commissions for buying ETFs on the London stock exchange is quite prohibitive (STL55/ Euro70/ USD95 for online trade on iOCBC).

Being an ETF investor in Singapore is really quite terrible!

Really good comments Ivan, totally agree on your assessment of the situation in Singapore. The Turtle Investor article you linked is great at explaining the details.

Standard Chartered has quite cheap commissions for trades in London – 0.25% with no minimum commission. Quite attractive for smaller investors I think.

It seems like there is no improvement for this issue in sight. On the bright side at least dividends are tax free in Singapore, as opposed to many other places. So I guess the glass is half full?

Hi! Thanks for your reply!

In the previous reply I said “If the ETF is traded in USD, like S27 SPDRs® S&P 500® ETF, dividends will still be subject to 30% withholding tax, because the ETF is domiciled in the US.”

I had a closer look at the ETFs listed on SGX and I realized that this is only partly true! From a glance it looks like the company with the most ETFs listed on SGX is Deutsche, and all their ETFs, although traded in USD, are domiciled in Luxemborg! This mean only 15% withholding tax right? There are some nice ones with low expense ratios like

S&P 500 UCITS ETF 1C (swap/indirect ETF) (code K6K), tracks S&P 500, 0.20% expense ratio

db x-trackers Euro STOXX 50® UCITS ETF (DR) D (code IH0), tracks DJ Euro STOXX 50 Index, (expense ratio on SGX website is 0.00% (typo?), but on Deutsche website it is 0.09%)

Seems like a nice substitute for the USA domiciled ETFs right?

Good tip on StanChart for low commissions on London. I’m small time so I can’t afford the 70 Euro commissions at Philips/OCBC/UOB etc. at all. But is StanChart still ok to use since your assets are custodized by them not CDP? I read some early 2015 news that they are shutting on stockbroking business???

Lastly, I’m trying hard to find ETFs domiciled in UK (0% withholding tax) that are listed in foreign exchanges with lower commission cost to us like Hong Kong, Thailand, US… My ultimate objective is to find one good ETF (0% withholding tax, low expense ratio) that tracks total US market (or S&P 500 at least) and one that tracks Europe (multiple developed countries), and pay low commissions. Any ideas?

If the fund manager of the ETF is in a particular country, does that also mean that is the country in which the ETF is domiciled?

Check out https://www.vanguard.com.hk/portal/investments/detailoverview.htm?portId=9583#/overview

Vanguard S&P 500 ETF traded on HKSE in HKD. Is this domiciled in Hong Kong? Is this a way Singaporeans can buy a vanguard ETF with no withholding tax?!

Nvm…I forgot that despite being HK domiciled the withholding tax will happen at the fund level.

p.s.Sorry about spamming your comments, feel free to delete!

No, thanks for the comments! Maybe they will help some other trying to understand the confusing withholding taxes 🙂

Can buy UK listed shares/etf’s for flat 6GBP with Interactive brokers. No stamp duty on ETF’s. Problem of course is that the Pound is going down the toilet!

The first ever UK domiciled ETF was only launched in March 2015. It looks like there are very little and no good options I can find for Singaporean investors. I’m beginning to think that Hong Kong is the one and only foreign country where we can hope to find ETFs with no withholding tax.

http://www.ftadviser.com/2015/04/01/investments/do-not-expect-a-deluge-of-etfs-domiciled-in-the-uk-iwLiOfAmyR9FM69ulOQ6pM/article.html

http://www.investmentweek.co.uk/investment-week/news/2401425/first-uk-domiciled-etf-launches-will-others-follow

I seem to have found info that Ireland has no withholding tax.

https://www.bogleheads.org/wiki/Nonresident_alien_with_no_US_tax_treaty_%26_Irish_ETFs#No_Irish_dividend_tax_withholding_for_Ireland-domiciled_ETFs

Some conclusions of my research, for Singaporean investors:

USA domiciled: 0% Tier 1 tax, 30% Tier 2 tax

UK/Luxembourg domiciled: 15% Tier 1 tax, 0% Tier 2 tax

Hong Kong domiciled: 30% Tier 1 tax, 0% Tier 2 tax

And note that the above information is meant for ETFs that holds US securities, because all tax mentioned refers to US withholding tax. Furthermore, this refers only to physical/cash ETFs. If the ETF is synthetic/swap, to figure out US withholding tax you need to look at the underlying substitute basket of securities that physically constitute the collateral of the fund since it doesn’t actually hold the securities of the constituents of the index the fund is replicating.

How about withholding tax for Swiss share?

There is a huge report from Deloitte available on the internet: Taxation and Investment in Switzerland 2015 (pdf)

Quote: The domestic withholding tax rate on dividend distributions (as well as deemed profit distributions) is 35%. (…) In addition, many of Switzerland’s tax treaties provide for a 0% or 5% residual withholding tax rate for qualifying investments

Singapore does have a tax treaty with Switzerland and you can read the full text here.

I am not a lawyer or tax expert and I might be wrong, but it seems that the withholding tax for Singaporean investors on Swiss dividends is 15%. Someone with a legal or tax background could have a look at the document and provide better info.

Hi!

This raises a few questions.

1) I thought if you met the non-us citizen and tax resident requirments (reside in the US <180 days per year) you are not subject to withholding tax on capital gains?

2) If I am a Singaporean investing in US stock exchange through a Hong Kong brokerage and capital gains are remitted back to Singapore, am I subject to any witholding tax or capital gain tax in Singapore?

To my best knowledge there is no way to get around this tax if you are investing as a Singaporean. You will not be taxed on capital gains as far as I know, but you will have to pay the tax on dividends.

With regards to your second question: your dividends would already be taxed by your brokerage in Hong Kong and directly subtracted. There would be no further tax in Singapore.

Hi, thanks for the blog post, but I was wondering why you were charged withholding tax on *interest* (given your Vanguard ETF was purely EM govt. debt). My impression is that only dividends are taxed – capital gains and interest are not. There is a good guide (by Citi from 2008) here: http://www.crossborderalliance.com/Resources/NRA%20Tax%20guide.pdf.

The workaround to investing in the US and reducing withholding tax is to invest in growth indices (e.g. Vanguard large-cap growth) where the dividend payout in the underlying corporates is low.

Thanks for the informative article. Amazing how little info on this topic is out there. Even when you ask brokers in the respective countries they often don’t have clue (particularly Australia, which has some very high yielding etf’s).

Hi Guys,

I am currently in the same situation. I have an account with 1 of the stock brockers in Singapore and I see a 30% tax deduction on my dividends from US stock.

Does anyone know if I really need to pay that tax as I am not a Singapore resident. I have an account in Singapore, under which I have foreign stocks…. BUT I DO NOT LIVE IN SINGAPORE. I came across some articles which said for non resident, tax on dividend for foreign stock is not applicable… But it is also unclear the way it is explained.

Thanks in advance.

Hi Andre, you should call your bank to find out. The issue is that this tax is not imposed by Singapore, but by the US. Once you got any news from your bank can you maybe post here? I am very curious about the outcome and others might face the same issue.

Hi just wondering whether you are taxed on proceeds when you sold the stocks?

No, I was not taxed.

Did you also factor in the foreign exchange risk when considering which country to buy the ETFs in? E.g. buying the Vanguard ETF (domiciled in Ireland) on the London Stock Exchange attracts 15% tax on dividends which is lower than the 30% tax if the ETF is bought on the Hong Kong Stock Exchange. However, the British pound and Hong Kong dollar carries different exchange rates risk against the Singapore dollar.

Hi Edwin! There are two parts to this question. When buying the Vanguard ETF in HK dividends are not taxed, but of course I am exposed to the foreign exchange risk. The risk is somewhat smaller as the HKD is tied to the USD and the SGD-USD are trading in a narrow band. Still as the example from Switzerland shows there can be changes to such policies which can have terrible consequences for some investors. Exchange risks are a bit of a weak spot in my strategy, but I try to balance better between EUR/SGD/HKD.

Would buying synthetic based ETF’s eliminate and withholding tax on distributions? Although generally fees are higher, it may still be net net better off.

hey guys, I owned a couple of US stocks and the company merged with a EU company. This was FMCTechnip. There was 30% tax withholding for “taxable exchange of stock” when the merger happened. They used a Fair market value to calculate the amount. I made a loss on this counter but I still am being asked to pay this WHT (withholding tax for taxable exchange).

Anybody know if its worth consulting a tax lawyer on this matter?

Anybody have any experience facing this issue previously?

Hi, do you know if the withholding tax apply to capital gain. For example, I bought one Apple stocks at $100 & then sold at $110. So, I earn $10. Will the $10 gain get taxed?

I believe it will not be taxed, but I am not 100% sure

For Singaporean investors, capital gains from US stocks are not subjected to withholding tax. The dividend withholding tax rate is 30%, however.

How did you find out the stocks listed in Frankfurt are subject to withoulding tax. I do not think that the listing is even relevant, its the country of doimicile.

I do have several ETFs from Frankfurt and cannot see any WT deductions on the dividends.

They are subject to withholding tax in Singapore. Are you based there or in Austria?

Here is an interesting situation,

Lloyd’s is trades as a adr on nyse as well as on lse in London. The dividend yield is 5%

As a singaporean, am I taxed 30% on the adr ?

If I buy directly from lse am I subjected to dividend tax as well ?

Thanks

I guess whether you invest in overseas dividend stocks depends on the yield… if it’s a company with a long track record of paying, and growing, dividends, then I’m ok with Uncle Sam taking a 30% as long as the yield is at least 5%. That leaves me with a reliable 3.5% yield that’s likely to grow, which is at least on par if not better than most tax-free Singapore and Hong Kong dividend stocks.

I have bought US Listed Stock and ETF in Singapore . Will it be taxable by US when I sell the ETF and Stock

i believe that only the dividends will be taxed

Hello . Does this means if

I buy a dividend paying stock in London exchange I will have 0 withholding tax?

If your dividends are reinvested, does it mean you do not have to pay the withholding tax?