I was asking myself this some time back after having decided not to spend all my money on fun & frivolous activities. My first steps were stupid to say the least and I made many silly mistakes including: trying to pick hot stocks to buy, trying to time to market and so on. This is when I realized some more research was in order and I came up with some leading principles which hopefully will work better in the long run.

My ambitious goal: be financially independent by 2027. What does financially independent mean? Passive income covering my costs.

This blog is here to share some of the things I learned and to prevent you from making the very same mistakes I did.

My very simple investment guide:

Step 1: Live below your means and save some money

After you get paid, pay yourself first. These means transferring a fixed portion of your savings to your brokerage or savings account to save or invest it. Easy right? Not so easy for me when I started out. I just kept spending all the money I earned and never saved anything. Gadgets, flying to Europe for a long weekend (seriously!) and lots of similar expenses. As my salary kept increasing so did my lifestyle. I moved into a condo, got a cleaning lady, took more trips to recover more from the harder work, went to all the fancy dinner places etc.

The key to financial freedom is to live below your means, which does not mean living a miserable life and counting every penny, but what it means is not spending all the money you earn and paying yourself first. The easiest way for doing this is to set an automatic deduction from your savings account right after your salary is credited. Money you do not have is money that you do not miss.

Step 2: Save up 3-12 months of expenses as an emergency fund

This fund needs to be kept as cash in an account which is accessible immediately. This fund is not there to generate interest and provide income, but it is there to minimize risk. If you lose your job, have unexpected expenses coming – this is the fund to keep you covered.

How big an emergency fund you need depends on the nature of your job and life. If you are single with a stable job and no kids a fund covering 3 months expenses might be enough. If you have a family, plan to switch jobs soon or run your own business with unpredictable cash flow you will need a bigger emergency fund.

Step 3: Decide on when you will need the money.

This blog is focusing on investing for the long term. Generally I would not recommend investing any money that you will need in the next three years as cycles in the economy might force you to sell at a loss.

To illustrate this point:

| When do you need the money? | Where should you put it? | Expected returns |

| Within 3 years | Singapore saving bonds or current cash account | Close to none |

| 3-6 years | Investment grade bonds | Medium |

| 7+ years | Low cost index funds and bonds | Higher |

| 10+ years | Low cost index funds | Highest |

Step 4: Build you target asset allocation

Depending on the principles from step 2 you should now build your target asset allocation.

There are many ways to do this, but I would recommend using the tool which the clever people at Vanguard have put together:

https://personal.vanguard.com/us/FundsInvQuestionnaire

After taking the test you should get a result showing you what part of your investment you should keep in bonds and in stock. Based on this information you can make your own target asset allocation.

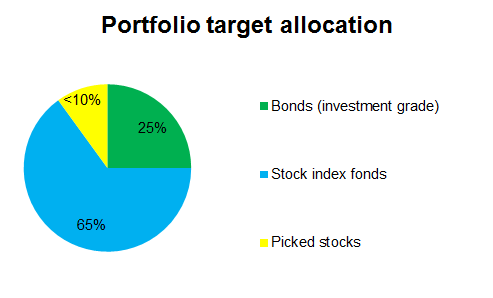

This is mine:

As you can see in a simple but clever analysis by Vanguard different asset allocations carry different historic risks and rewards.

Step 5: Decide on what bonds and stocks you would like to buy

A word of caution: do not be an idiot like me when I started out and try to buy individual stocks or try to time or beat the market. Beating that stock market would mean achieving better returns than the index of said market and there is virtually nobody who has managed to do this 10 years in a row.

The truth is that there are huge cooperation’s out there, employing countless traders, analysts and researchers and not even they can outperform the market consistently. If they are not able to, why should you?

Most people can get lucky picking stocks and see good returns once or twice, but doing so consistently over years is close to impossible. The reason for this: the market is actually pretty good at what it does and it is highly efficient at pricing stocks. So do not try to pick stocks!

So if you are not supposed to pick stocks what should you do?

The answer is easy:

Diversify your portfolio by picking low cost index funds which let you buy a share of the total market. This will minimize risk and optimize returns in the long run.

Read on:

- How to open a trading account in Singapore

- Beginners guide to exchange traded funds (ETFs) for Singaporean investors

I’m really bad with money and have pretty much led a life you described above ~ blowing all money as soon I’ve earned it on things like trips and gadgets and not having saved any of it. I’ve read a lot of articles about how to get my money life in order but this is the first one that really made sense to me ~ it’s simple and straight to the point. Thanks for writing this; Imma hold on to it and hopefully things will be better for me money-wise going forward.

Wish you best of luck on this new part of the journey! The first step is the most important 🙂