The first quarter of 2023 zipped by so fast, how did my investments do?

The second quarter of my “retirement test drive” is over and it worked quite well. I lived in Southern Spain for a bit, did not have to set foot in an office and most importantly: I managed to live cheaply.

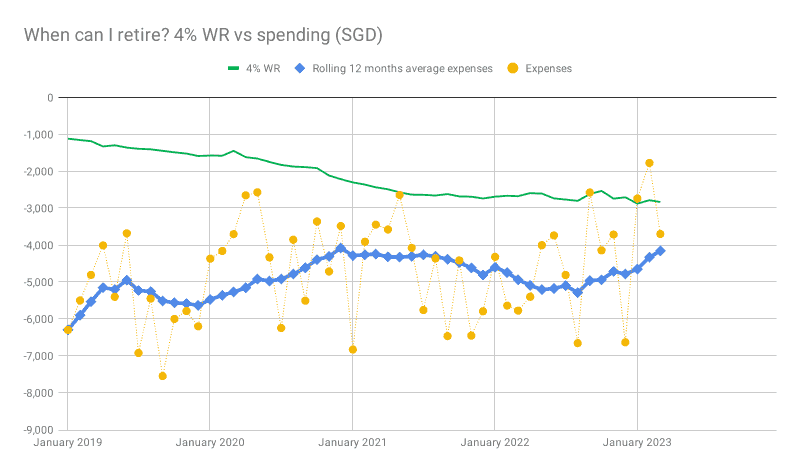

In fact, my expenses were much lower these three months and I could live on the equivalent of a 3.9% withdrawal rate of my portfolio.

Q1 Overview

- Salary: SGD 12,409 – these days I earn less in quarter than I used to earn per month…

- Other income: SGD 5,612

- Dividends received (before tax): SGD 3,876

- Expenses: SGD 8,272

- Savings: SGD 13,036 (Savings partly came out of a ~SGD 58,106 cash buffer I created before quitting)

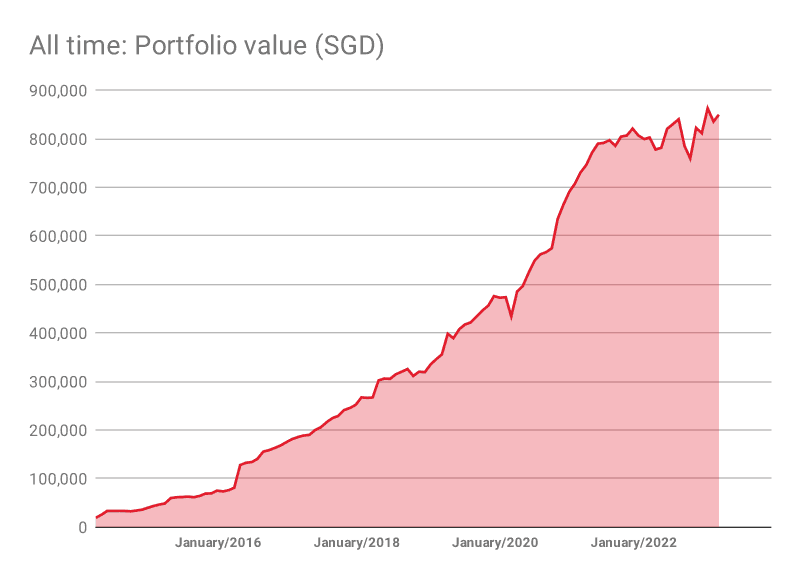

Current portfolio value: SGD 849,567 / =USD 638,700 / = EUR 585,097

In the first quarter, my portfolio increased from SGD 819,509 to SGD 849,567. This increase of SGD 30,058 / 3.67% was made up of fresh investments of SGD 13,020 and portfolio gains of SGD 17,038.

Money vs. happiness?

I tried matching the happiness to money spent in certain months. Interestingly there was no correlation. In my lowest spending month I was the happiest, as I had settled into a routine of sport, mediterranean diet and long walks along the beach.

Higher spending was often correlated to less happy times, e.g. a quarter of my spending in March was work-related and I had larger health-related costs. The only times I perceived a positive correlation of spending money to happiness was when I was buying gifts for people (small presents, nice dinner etc).

Spending less sometimes takes indeed more time, especially when it comes to cleaning or cooking. It does not bother me much though. Both tasks feel quite good when successfully achieved. In some cases spending less means more time, for example after getting rid of my car. No more taking care of a car with constant inspections, tire changes, maintenance and tax & parking issues feels liberating.

Other insights

Expenses averaged SGD 2,757 per month, which is well below my salary and equal to a ~3.9% withdrawal rate of my portfolio.

Other income was higher than expected. I participated in a few expert network calls, where I would be paid about SGD 390 per hour, received some sign-up boni as well as other incentives.

I never bothered about these extra opportunities while I still had a high paying job, but now I made a little bit of an effort to supplement my income. I also paid myself some profits that were still inside my former small consulting company. Life felt quite luxurious – I spent a lot of money on unnecessary stuff – so there would be room for further improvement, still I reduced quite a bit of expenses in the first quarter.

The key chart

Still quite a gap to fill – only once the 12 months rolling average spending falls below the 4% WR line, I can start considering myself financially independent. This quarter shows that it is indeed possible.

Outlook

April is looking to be quite expensive, especially because of medical expenses (nothing bad, but I had to pay some stuff out of pocket to get faster treatment) as well as some spending to replace a computer screen which I accidentally destroyed etc.

I hope that the startup will manage to enter the next phase this year, after which my salary will be increased from the current SGD 73k to a better SGD 123k. Still a far-cry from my old salary, but I would be able to save quite a bit more.

While it is annoying at times, the work at the startup is still much better than at Megacorp, so I try not to complain too much.