A little bit over 10 years since I started managing my finances, my portfolio finally reached 7 digits. Time for a little review!

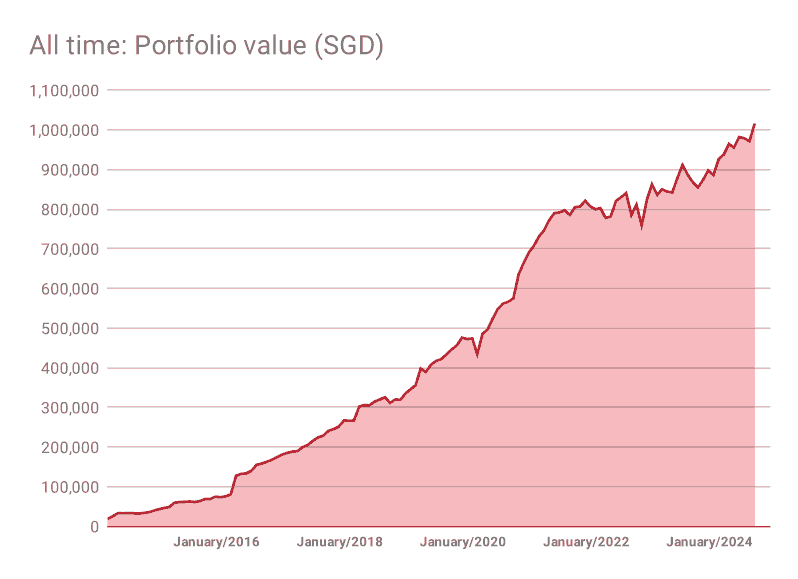

After ten years of investing my portfolio finally exceeded the equally exciting and meaningless SGD 1 million mark:

Time for a more personal, long and rambling post to honor this milestone.

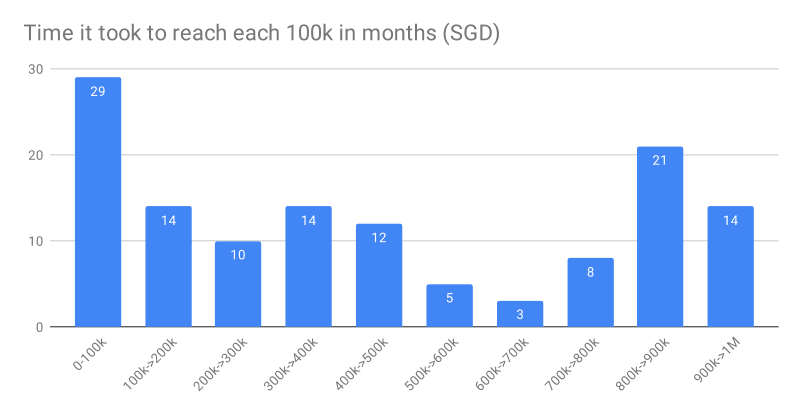

The first 100k is indeed the hardest

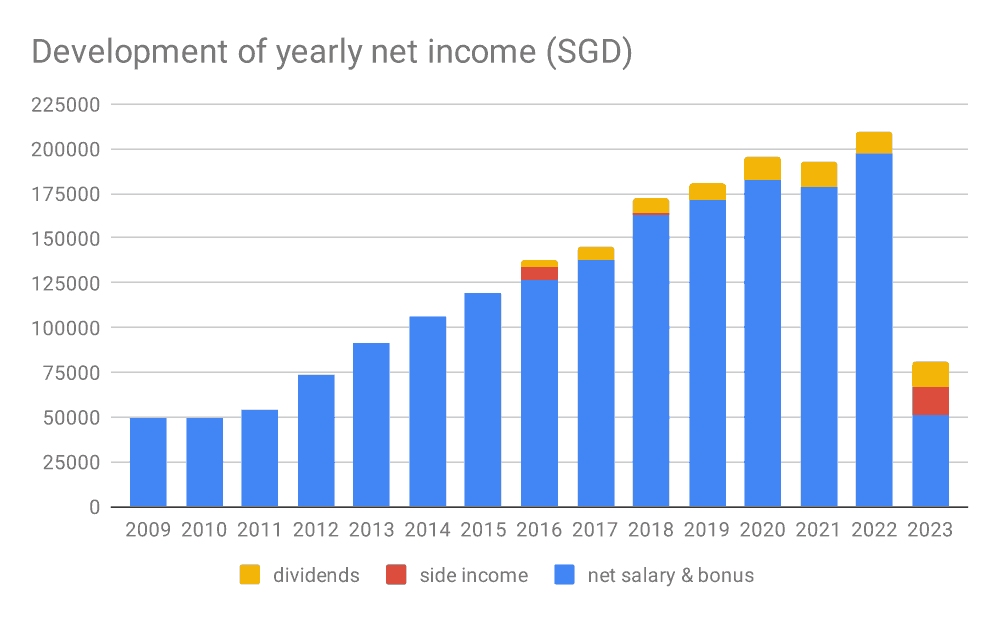

Just like everyone says, the first 100k is the hardest. It took 29 months… The first 500k took much longer than the second 500k. It was less a case of high returns than increasing salary, as my career progressed:

I tried to avoid lifestyle creep and could save more of my salary. I was also lucky to be posted to Europe on a Singapore salary. Now that I left corporate life towards entrepreneurial pursuits my salary is tiny, but potential upsides are high.

How did I get here?

In early 2014 I decided to finally take control of my finances. At this time I was 32 years old and had never bothered to think about money much. Prior to this my approach had been waiting eagerly for my salary and then spending it all every month. I was busy working, dating, seeing the world as much as possible, throwing myself into experiences – money was not important, as long as there was enough to last till the end of the month.

With a social science degree, money was never the priority, I was and am still more motivated by a sense of adventure, which is why I had left my dull European homeland and buggered off to Asia at the ripe age of 19 in the first place.

Still at the age of 32 after some wild times it dawned on me that I would need to spend the rest of my life in an office, if I did not change something. Getting out of the dull corporate existence was my main motivation. I discovered the financial independence, early retirement extreme, Mr Money Mustache – the usual suspects and decided: to escape the office, I would need to save enough to live off my portfolio somehow.

This is how the AI imagines the cubicle life… Not far off

In hindsight this approach might have been not needed, there are much faster ways to escape the corporate office, unfortunately I did not know them at that time. But I digress, back to the plan.

I am not really the penny pinching type, that is why I lived by the following 10 principles:

- Keep cost of housing low: while in Singapore I moved to Joo Chiat around 2012 or so – way before it was cool and when my local Singaporean colleagues disapproved of such a wild choice. The result: 2 floor penthouse for SGD 2.8k. Later I got free housing while on delegation for my company in Europe. Paying little for housing was the biggest boon to my saving rate

- Avoid expensive transportation: In Singapore nobody needs a car (my controversial, personal opinion). Public transport is superb, taxis cheap and cars outrageously expensive. In Europe I happily drove an “economy shitbox” which I proudly parked in my designated spot as one of the leadership team members. My little dinghy compact sat lost among the Mercedes and BMWs. Now that I escaped the corporate world, I do not need a car anymore.

- Be generous: I calculated that over the years I spent about 8% of my salary on gifts. Meals for friends and families, taking my parents on trips etc. I believe in saving money for myself, so I can afford to be generous.

- Keep investing through crises: there were a number of crises, including Covid, Europe financial crisis and many more that are long forgotten by now. Here is a summary of my investments during Covid. Whatever happened, I always bought more stock and never sold.Do you remember this crisis for example? Saudi-Russia oil price war in 2020? It made the S&P 500 drop 7.6% but I guess that you cannot remember. I sure forgot all about it a few weeks later.

- Use geographical arbitrage: countries differ widely in terms of cost, salary level and taxes. I was lucky to maintain my Singapore salary while being posted to Europe and getting it tax equivalized. Nowadays with remote working it is easier than ever to relocate. I lived in Spain for months on end enjoying sun, food and low cost of living. You can also purchase services remotely cheaply in other countries. I hired an online Spanish teacher, outsourced parts of my work etc. If you are flexible, geographical arbitrage is a huge boost for investments.

- Never do or buy things to impress other people or because people tell you it is necessary. Many people fall into this trap.

- Avoid buying depreciating items or things that cost money to maintain: we do not realize that almost every item we buy needs to be either replaced or maintained at a cost. For example: I love having good Thinkpad Laptops. They cost about SGD 3k and last 5 years. So having a good laptop costs SGD 50 per month. It is important to decide what to value and what you can do without. The worst are things that are cheap to buy and have expensive running costs or maintenance – looking at you, Nespresso!

- Buy quality where needed: for things that I use often, I buy high quality and go for durability: cooking knives and pan (daily use), belt, shoes…

- Take the path less traveled. It pays off to look at the choices the majority of people make and then see if it is possible to do something different. This saves money and often is more fun.

- Tracking expenses: In March 2015 I started tracking all my expenses. Everyone recommends this and it is indeed a game changer.

This sounds like a self help book now, but if I am honest I have messed up so often.

Major mess-ups:

- Nearly got divorced and had lots of ups and downs in the marriage. Marriage turns out to be quite challenging, especially when two very different and equally strong minded people from different cultures try to make it work. My wife and I keep finances separate, she has a high paid job and a rather large portfolio as well. Money has never been an issue in our marriage, which is why my wife also never appears on this personal finance blog.

- Did not enter startup life earlier while still working for big corporate – could have built company participations earlier and broadened my horizon.

- Accidentally destroyed or lost so many items and forgot so many things that I had to enter “mess-ups” as a separate category in my budget. Life as a scatterbrain is expensive.

- Did not continue to improve French beyond A2 level and now have to restart – I should be fluent by now, but I am not really and am mad at myself.

- Wrong portfolio allocation: Bought individual stocks and had too high a bond allocation at the beginning. A simple MSCI all world portfolio would have outperformed my portfolio, but for the last ten years I found US equities overpriced. Big mistake!

- Did not negotiate hard enough for my startup contract, as I was glad to get out of the big corporate job.

This is it!

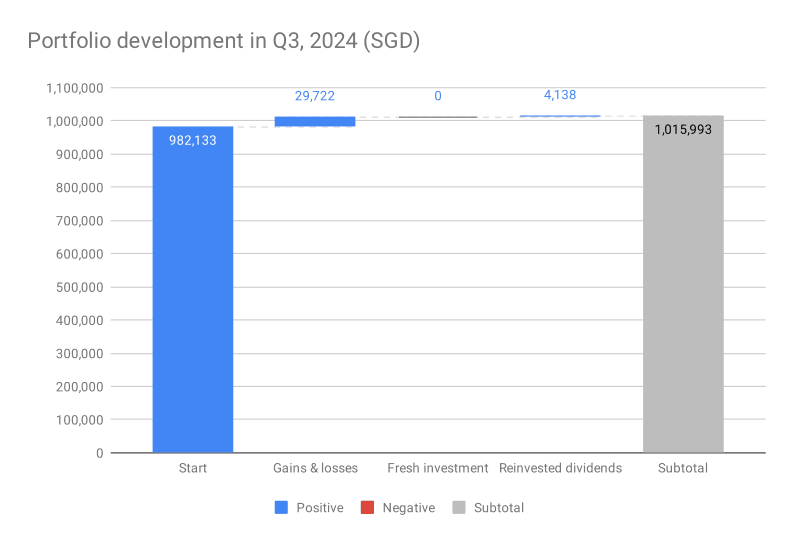

Short quarterly financial overview:

In the Q3 my portfolio increased by SGD 33,860 to SGD 1,015,993. SGD 29,722 of this increase were capital gains of the portfolio, the rest reinvested dividends.

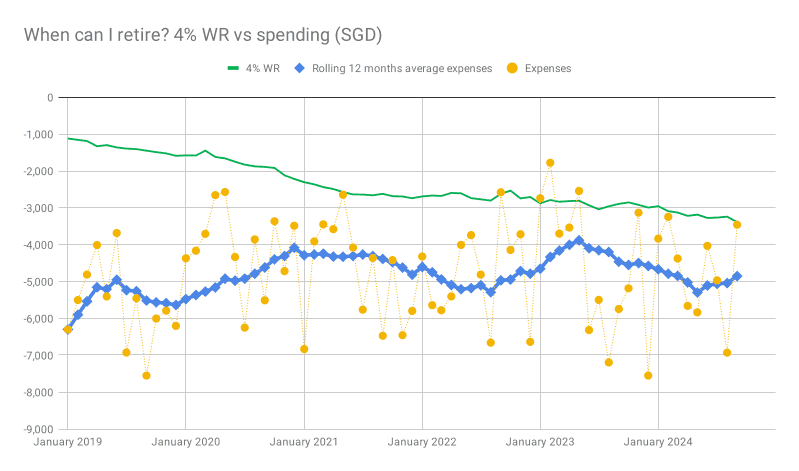

Outlook – when can I retire?

at the current spending level, I would need around SGD 1.45 million invested in order to retire.

But then my current spending is rather high and has so much room to be reduced. 2014 my portfolio target was SGD 1.2 million – it could still work today if needed.

Achieving the SGD 1 million mark was definitely a nice milestone – hard to imagine when I was starting out in 2014. November and December will be extremely busy with business trips and moving to another country again, hope all will go well!