What a happening month July was: Greece and China grabbed the headlines and the markets were quite choppy. How did my portfolio perform during this time?

As always I stuck to my investment plan and bought some index funds, namely the SPDR® Straits Times Index ETF and the Vanguard FTSE Asia ex Japan High Dividend Yield Index ETF. Especially the latter was “on sale” because of the market being lower after the China “mini crash”.

Blog wise I was quite productive: I wrote a post warning about the high cost of most unit trusts, analyzed the difference between both leading Singaporean listed ETFs tracking the Straits Times index and made a short review of the POSB Invest Saver Plan.

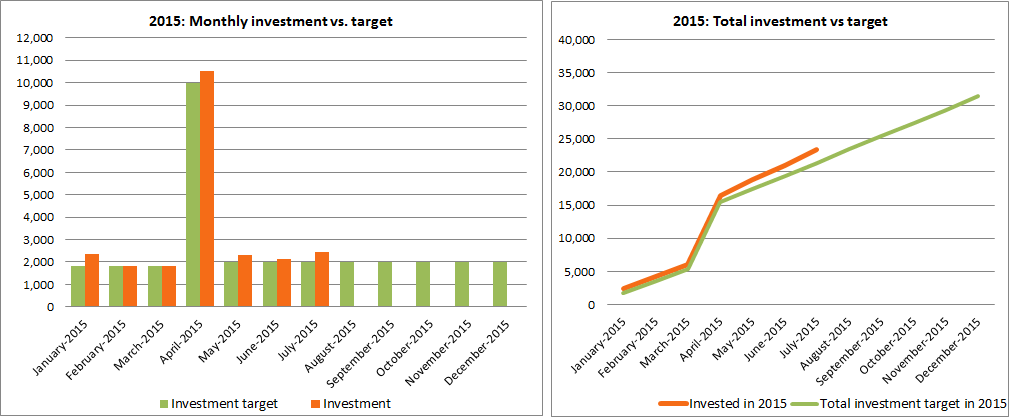

Dividends received and money invested

It was a very nice month dividend wise and I received about SGD 227 in dividends which I reinvested. All in in all I added SGD 2,440 to my portfolio and I am well ahead of my plan.

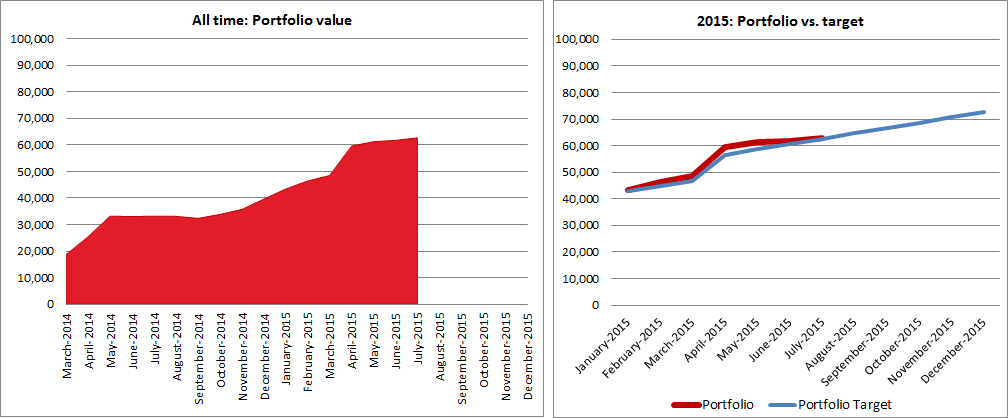

Portfolio performance

The markets sank a bit in July and this is why my portfolio only increased by 1.5% or SGD 923 because of fresh investments of SGD 2,440 which were offset by a reduction in value of a whopping SGD 1,517. All in all my portfolio is increasing nicely and more or less within plan:

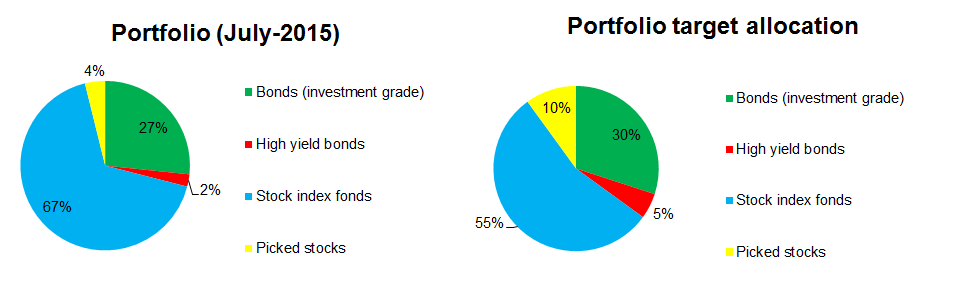

Portfolio allocation

Everything quite good and boring as normal.

It is a slow, long marathon, but I will keep on going!