June was a rather happening month, with the economic crisis in Greece reaching new heights, rattling my small portfolio. Am I still on track?

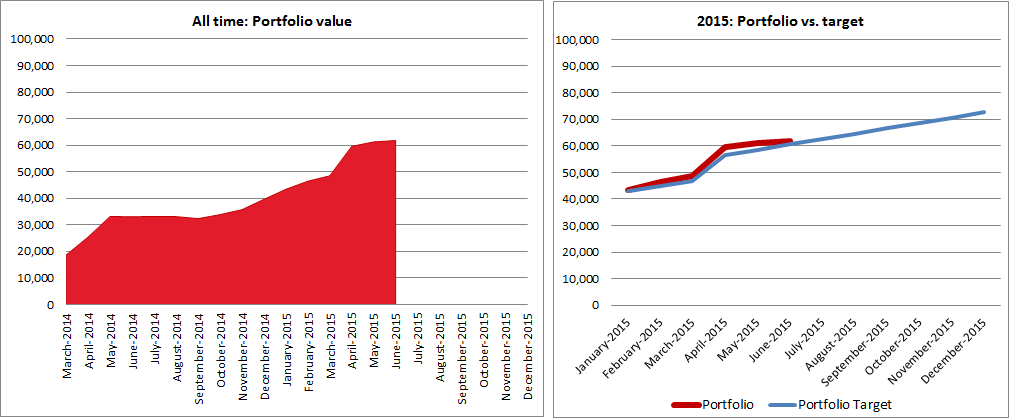

The value of my portfolio increased only a tiny bit, namely by SGD 512 to SGD 61,760. This increase was made up of SGD 2,133 of fresh investments which were offset by a SGD 1,621 drop in portfolio value.

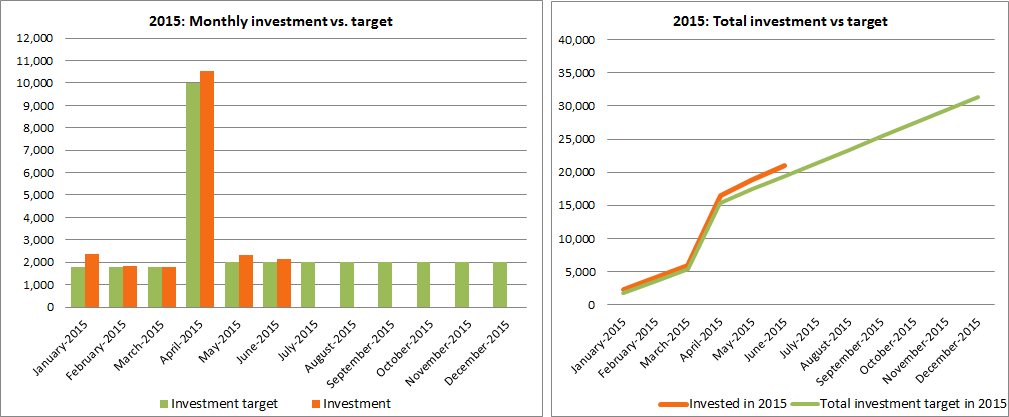

As I am investing for the long turn I do not really care much about the ups and downs of the market and I stoically keep implementing the investment plan for this year:

As you can see things are moving very much as planned and I am well on track of reaching my goal of investing SGD 31,400 this year.

Newly added to portfolio: Nikko AM Singapore STI ETF

I decided to add a Singaporean index fund tracking the Straits Times Index of Singapore’s top listed companies. Unfortunately I did not research properly and went with the Nikko AM Singapore STI ETF, instead with the much better SPDR® Straits Times Index ETF. Edit: I just wrote an article about which ETF is best to track the Straits Times Index.

The portfolio value is in line with expectations, growing steadily thanks to fresh investments.

Dividends received

In June I received USD 115 in dividends from my various bond index funds, which is always nice.

| Fund | Shares in portfolio | Dividends received in June |

| iShares J.P. Morgan USD Asia Credit Bond Index (USD) | 300 | USD 30 |

| iShares J.P. Morgan USD Asia Credit Bond Index (SGD) | 700 | USD 70 |

| iShares Barclays USD Asia High Yield Bond Index ETF | 100 | USD 15 |

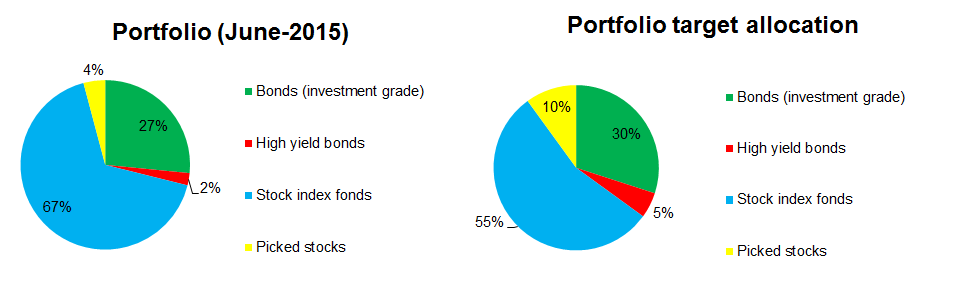

Overall my asset allocation is nicely on track, no complaints here:

Nothing much interesting to report, as I keep trucking on slowly investing in my portfolio. Sometimes I feel quite bad as I do not really save much money and allow myself a way too highly inflated lifestyle with plenty of overseas trips. On the other hand life needs to be enjoyed to the fullest.

How to balance?

Singvestor,

Nice graphs! Very clean and detailed presentation – loved reading through it.

You seem to be a bit ahead of target, even with the badly performing markets!

I’m not sure how old you are, but you’re pretty heavy into bonds already. Any specific reason?

Best wishes,

NMW

Hi NMW, it is nice to see you here! Lately I have read through all of your blog and I enjoy it a lot.

I chose ~30% bonds and ~70% stocks based on Vanguard’s analysis here: https://personal.vanguard.com/us/insights/saving-investing/model-portfolio-allocations

It seems like a 30% bond allocation will only have a small effect on yields, but it offers quite a bit of diversification and security for the “price” of slightly lower yields (0.4% in the long run). Another reason was that I am hoping to follow your example to increase my savings rate and maybe “retire” in 12 years when I will be 45. This would mean my time horizon is rather short, comparable to a 53 year old planning to retire at the “normal” retirement age.

Having said all that, lately I have been thinking about changing my asset allocation to maybe 25% or 20% bonds, but I have not decided yet.