In April I was supposed to be back in Singapore for good, but as my employment pass is delayed I get to enjoy life in Europe a bit longer.

Life updates April

I am still waiting for the final job offer in Europe from the startup and at the same time my Singapore visa for the current job has not come through. It is a weird situation. I am keeping the spirits up and enjoying the time as the situation develops.

On the bright side I exercised 19 days in April and did not drink any alcohol for 21 days, so KPIs overachieved.

Portfolio in April

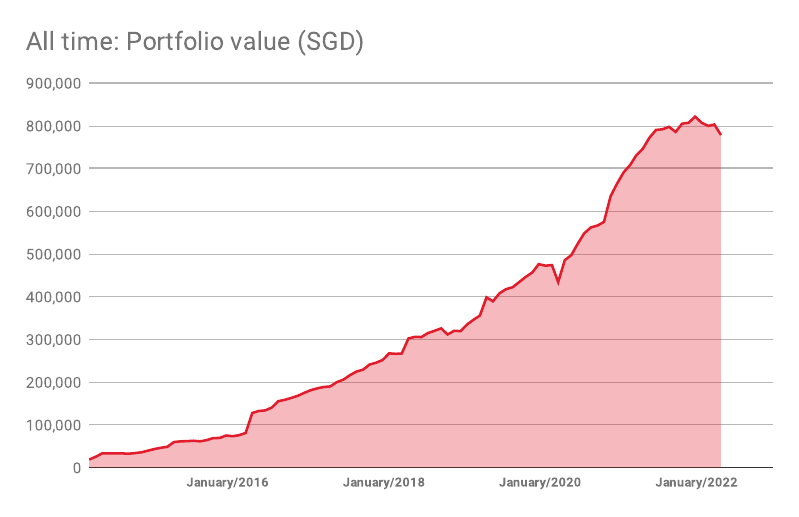

In April my portfolio dropped further to SGD 778,122 (USD 566,086). Investments of SGD 6,334 were offset by paper losses of SGD 31,049. At the time of writing my portfolio sank even further to around SGD 750,000.

Expenses

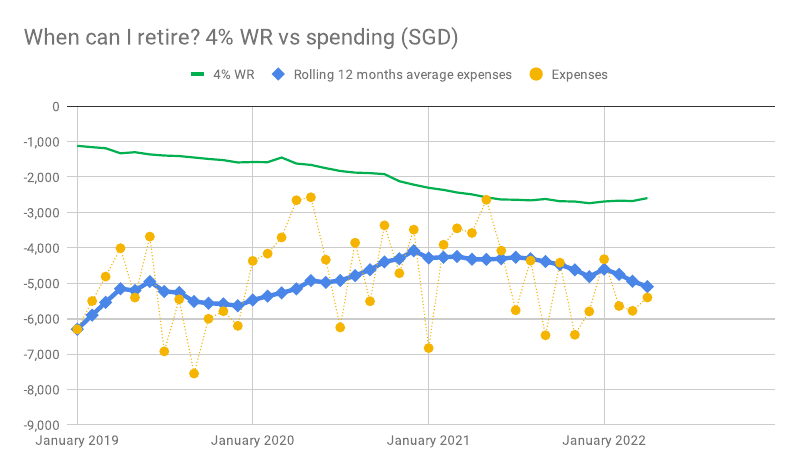

In April I spent tons of money, SGD 5,401 to be precise. We went on a trip to France and had some nice dinners, plus it was also my wife’s birthday. Spending will have to be dramatically reduced to SGD 4,000 / month or below if I take the new startup job. Official saving rate was only 39%, as I do not count the money buffered into savings.

I have saved up about EUR 36,000 in cash so far (not counted in the Portfolio) to have a large cushion to buffer the small salary from the Startup, should the contract come through.

Dividends

In April I received SGD 1,124 in dividends.

Portfolio changes continue

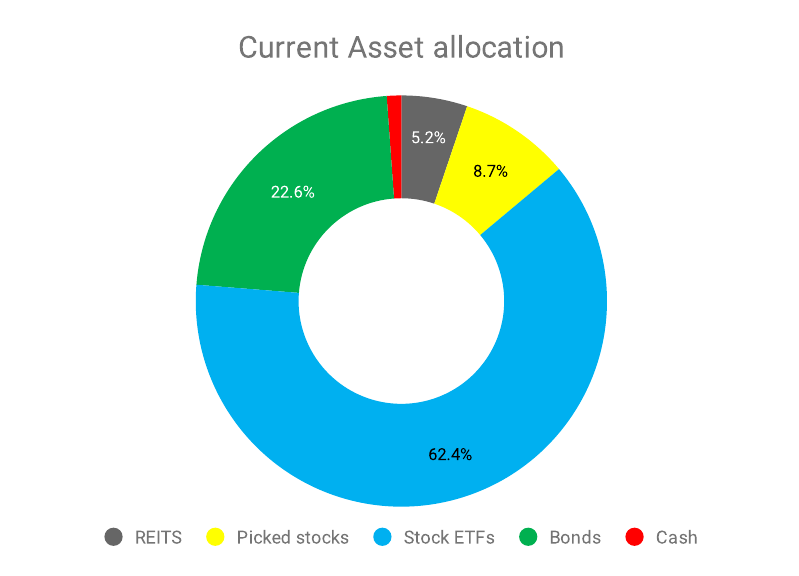

I sold some picked stocks to buy index funds and the ESR – ARA Logos merger simplified my portfolio further. I also built up a position in the Lion-OCBC Securities Hang Seng Tech ETF, as Chinese tech stocks in HK are on discount.

Outlook

Fingers crossed that the startup contract will come finally, I am exhausted from working 2 jobs at the same time and also feel like I am only doing a mediocre job at each of them…