November is always a bit of a dull month, but I stuck to my plans, invested and saved as usual. Read on for the details!

Now that I am back in Europe I got reminded of the misery that is November in Europe. It rained, rained and rained and then it rained some more. It rained when I got up, it rained when I walked to my car or did my shopping, it rained at night, it rained during the weekend, it rained every time I looked out the window or went to the office canteen for lunch. It rained a lot.

At some point I fled the rain to spend a week on some Spanish island, which was nice.

Portfolio update

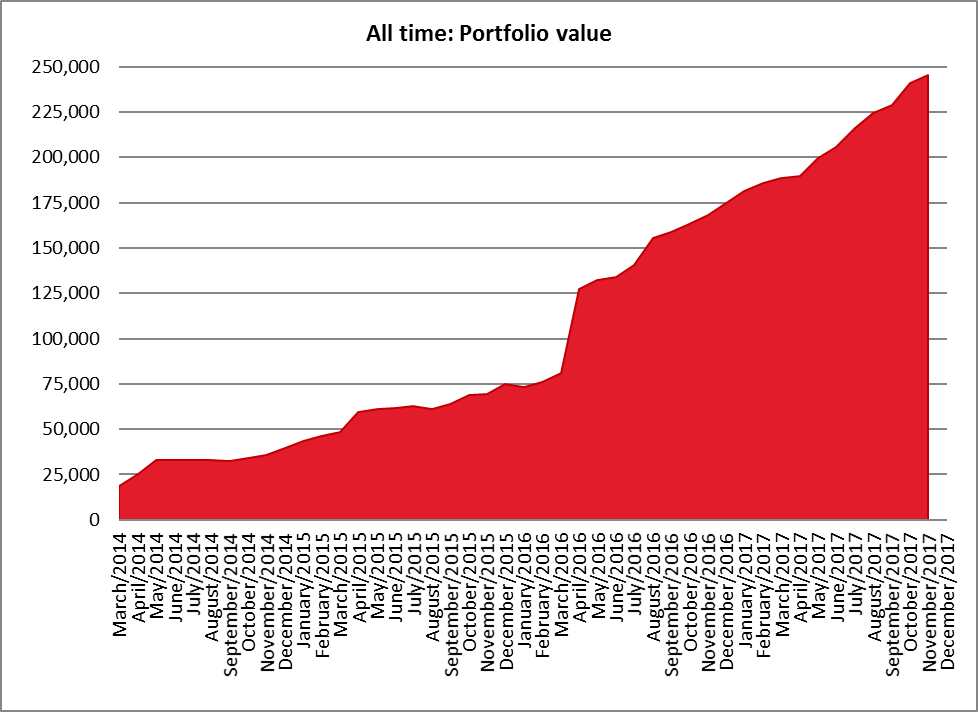

In November my portfolio increased by 5.2% or SGD 4,294 to SGD 245,283 (=USD 182,100).

This gain was made up of SGD 6,235 of fresh investments which were offset by a decline in portfolio value by SGD 1,941.

Investment vs. plan

In November I invested SGD 6,235 which was more than the plan (SGD 5,700).

Dividends

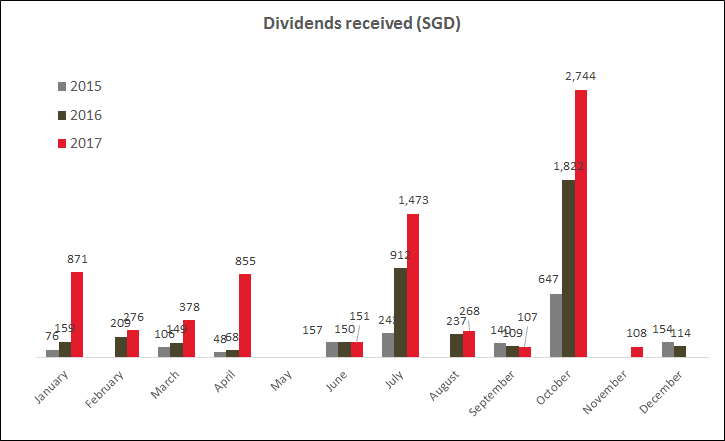

SGD 108 were received from my small holding of HSBC stocks. Year-to-date my holdings paid out SGD 7,230. Not bad! It is quite motivating to see this number. Maybe there is life after work? A man can dream.

Portfolio allocation

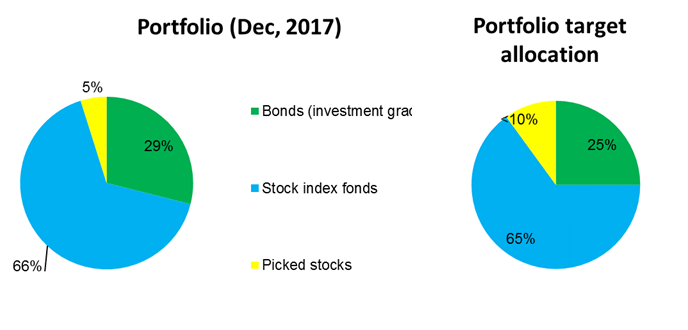

The portfolio allocation is normal and boring as it should be. I feel like adding a small (~3%-5%) cash component to it, to add some stability for a potential downturn. In theory this is not the right thing to do, but might make me feel better.

Outlook

Stocks have increase so much after I wrote the “The market is dropping what should you do” post in January 2016. At that time I felt like stocks were on sale. Right now I feel the opposite. Colleagues in the office are talking about flipping houses, crypto is in a bubble, a lot of people talking about investing again… In theory the best is to stick with the asset allocation and never change it. I will try my best to stay the course. Having said that: Is this the time to be fearful, as everyone is greedy?

Since finance is so personal, it may be wise to listen to yourself and have little extra cash on hand if you think it will make you sleep better. If it turns out that having so much cash is not the right choice, you can always deploy it later.