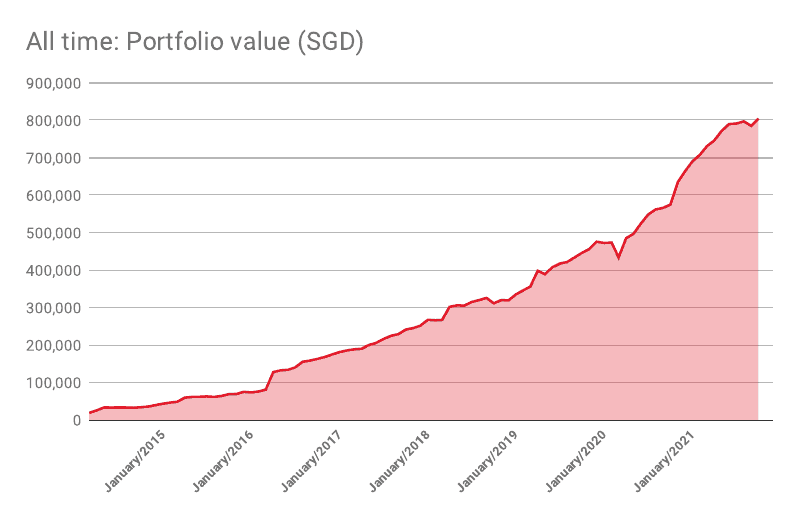

In October my portfolio exceeded SGD 800,000 for the very first time. It took me a bit over 7 years to reach this milestone. When I first started, I would never have imagined that it would go so fast.

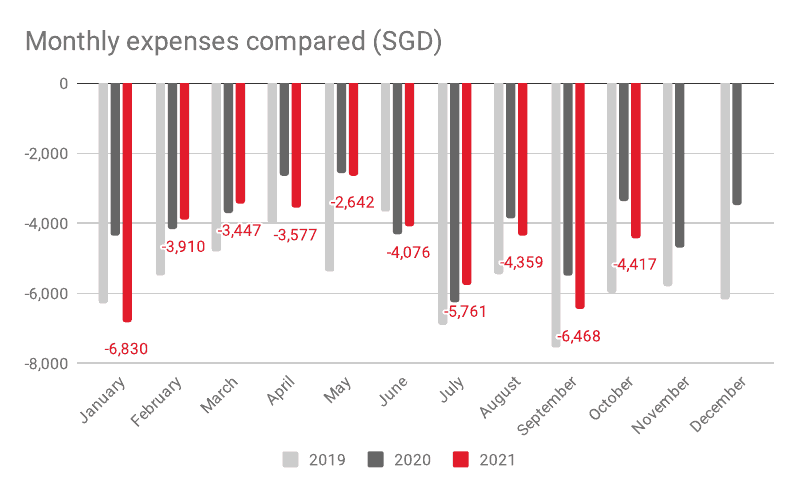

Spending and saving rate

In October I saved 67% of my income.

Overall I spent SGD 4,417 (= USD 3,277) in October. Various gifts to family members made up nearly 19% of the total spending. This includes some shares I bought for my godson. He is three years old now and I will hand him over his portfolio at 18 years old. I am investing while he is still young and while I still have my well paid job.

Portfolio development

In October my portfolio increased from SGD 785,474 to SGD 804,579 (~USD 597,000). Fresh investments of SGD 10,604 and gains of SGD 8,501 contributed. This marks the first time that my portfolio exceeds SGD 800,000 and the classic lean financial independence target of USD 600,000 is so close now.

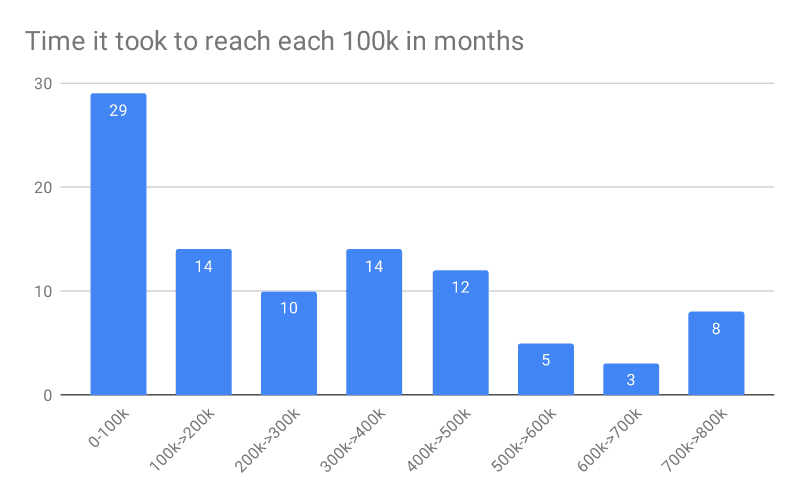

The power of compound interest, how long did it take to reach each 100k milestone in months?

The first 100k is indeed the hardest – took me 29 months. After 500k things really started picking up with the constant bull market. This cannot go on forever and the market might just drop again – who knows maybe some of the above milestones I will need to cross more than once.

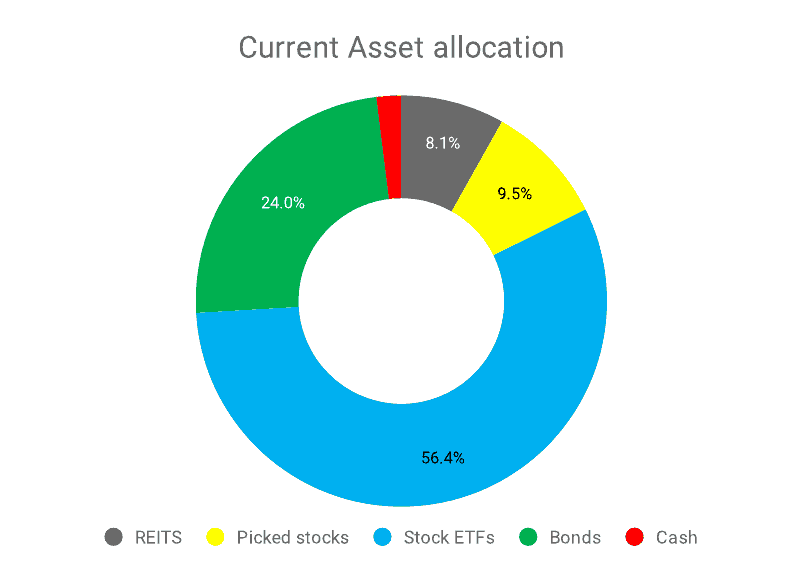

Asset allocation

Pretty much on track

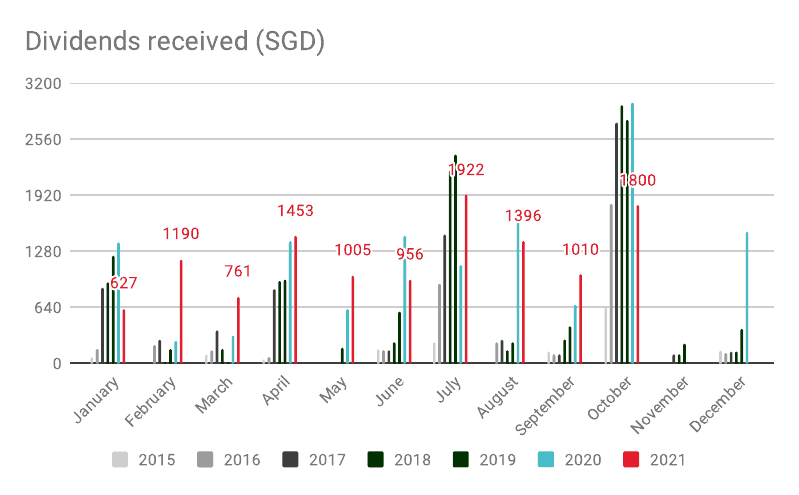

Dividends received

My holdings paid out SGD 1,800 of tax free dividends.

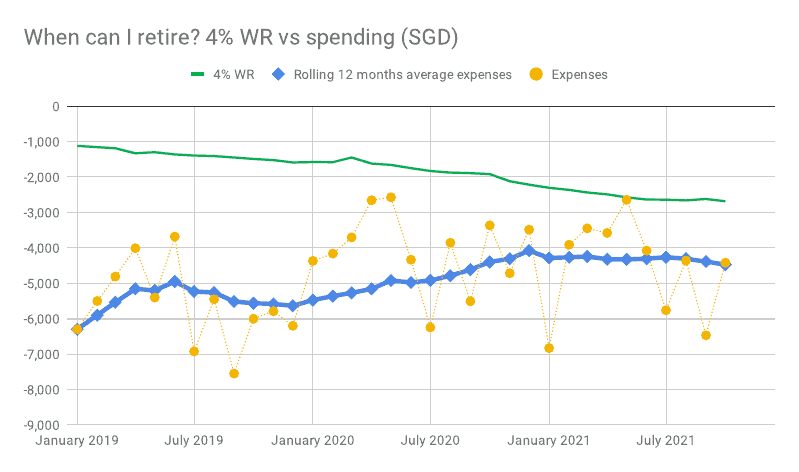

When can I retire?

Outlook

I am reaching a level of hypothetical passive income, where “retiring” is more and more feasible. My current hope is to get an offer from the sidegig and join them as a partner in their startup. Payment would probably be mostly in equity, but I could get rid of the car and easily cut some further costs. Cushy expat assignment will still last till March next year – after this I could still get my bonus in April and then switch – fingers crossed that all goes well!

Congrats on Lean FIRE. Love the updates, keep it up!