One year has passed since Covid escalated and markets hit rock bottom in March 2020. How did my trades perform and what did I learn?

In March 2020 I made 27 trades across 10 counters. Today I got inspired by fellow investing blogger My 15 Hour Work Week who revisited all his trades from the worst time of the Covid market turmoil last year. Following Mr. 15HWW’s example, here is what I did…

March 4, 2020

Stocks are selling off, what a bargain!

- Bought: 100 shares of DBS for SGD 23.9 each for a total of SGD 2,390

- Bought: 1,100 shares of SINGTEL for SGD 2.99 each for a total of SGD 3,289

March 10, 2020

Is this the begin of a major sell off? STI ETF below SGD 3, so cheap!

- Bought: 900 shares of STI ETF for SGD 2.85 each for a total of SGD 2,565

Financial Times cover for March 10 looked like this:

Do you remember the oil price crash?

Surely now stocks are on sale. Or aren’t they?

March 11, 2020

Wow, those DBS shares I bought a week ago have fallen even more. I should have waited?

- Bought: 100 shares of DBS for SGD 21.08 each for a total of SGD 2,108

March 12, 2020

Started selling bonds to buy more stocks. Felt a certain sense of panic as I was sitting in homeoffice after our office was closed and the world seemed to be going crazy.

- Bought: 1,300 shares of STI ETF for SGD 2.7 each for a total of SGD 3,510

Could not leave the house, we did not know what was going to happen.

March 13, 2020

Bottom seems far away, situation is getting worse.

- Bought 100 shares of DBS for SGD 19.92 each for a total of SGD 1,992.

- Bought 900 shares of SINGTEL for SGD 2.68 each for a total of SGD 2,412

- Bought 1000 shares of STI ETF for SGD 2.68 each for a total of SGD 2,680

- Bought 4000 shares of EC World REIT for SGD 0.61 each for a total of SGD 2,440

March 16, 2020

I start watching Bloomberg each evening and see the US market fall. I keep telling people to buy stocks on sale, they think I am nuts “this will go much lower” is a common statement I hear.

This is how Bloomberg looked like on March 16, 2020. What a ride:

- I sell a huge chunk of bonds.

Nobody knew what was coming next. A year later it is so clear, but at March 16 it was total madness.

March 17

Jittery feelings, but also somehow elated at the multi-year lows in many stocks. Portfolio is down about SGD 90,000. I have a hard time focusing at work, as I keep watching the market, feeling part of a historic moment.

- Bought 10,000 shares of ESR REIT for SGD 0.345 each for a total of SGD 3,450.

- Bought 1,800 shares of AIMS APAC REIT for SGD 1.08 each for a total of SGD 1,944.

- Bought 4,000 shares of EC World REIT for SGD 0.555 each for a total of SGD 2,220

- Bought 1,100 shares of STI ETF for SGD 2.498 each for a total of SGD 2,748

March 19

Just two days ago I bought ESR Reit at SGD 0.345 a share, now it is SGD 0.245 a share. Market is in full panic, I am sitting on huge losses from stocks bought at a “bargain price” just 2 days ago.

Supermarkets empty here in Europe, cannot buy pasta or toilet paper, but beer available.

I have a bidet. Best investment for the apocalypse, I tell you. SGD 30 gets you a good one. You do not have to battle the crazy hords for toilet paper and can save space in the trolley for what is really important (beer).

At the same time stock prices seem even better now. At this valuation everything feels cheap. I have no idea if things will collapse further and it feels really wrong to buy in this crazy market, but I decide to double down.

- Bought 600 shares of STI ETF for SGD 2.33 each for a total of SGD 1,398

- Bought 10,000 shares of ESR REIT for SGD 0.245 each for a total of SGD 2,450

- Bought 6,000 shares of EC World REIT for SGD 0.415 each for a total of SGD 2,490

- Bought 1,200 shares of HSBC for SGD 44.55 each for a total of SGD 9,267

March 20

At this point I am expecting a multi year financial crisis. Stocks just keep falling. DBS is below SGD 18 a share.

- Bought 1,000 shares of SINGTEL for SGD 2.38 each for a total of SGD 2,380

- Bought 1,700 shares of STI ETF for SGD 2.369 each for a total of SGD 4,027

- Bought 200 shares of DBS for SGD 17.75 each for a total of SGD 3,550

Strangely, I am not really worried anymore at this point. I spend my days checking the markets non-stop and browsing the Financial Independence Forums on Reddit. People are panicking. A few “all in 100% stocks” people discover that their risk tolerance is not what they thought. People are selling.

March 23

I am nearly out of cash. Large share of bonds sold… It is time to invest most of the emergency fund – bad idea.

- Bought 2,300 shares of STI ETF for SGD 2.248 each for a total of SGD 5,170

- Bought 8,000 shares of KEPPEL INFRA TRUST for SGD 0.385 each for a total of SGD 3,080

- Bought 6,000 shares of FIRST REIT for SGD 0.58 each for a total of SGD 3,480.

In hindsight this was pretty much the bottom.

March 27

Salary came in. Time to buy some more stocks.

- Bought 106 shares of BASF for EUR 41.59 each for a total of SGD 12,035

So what is the result for these trades one year later?

| Ticker | Total bought | Average price | Price now | Total return |

| AIMS APAC | 1,800 | 1.08 | 1.310 | +28% |

| BASF | 106 | 41.45 | 71.88 | +79.7% |

| DBS | 500 | 20.08 | 29.00 | +48.8% |

| EC World REIT | 14,000 | 0.51 | 0.715 | +49.7% |

| ESR REIT | 20,000 | 0.30 | 0.395 | +42.8% |

| FIRST REIT | 6,000 | 0.58 | 0.240 | -51.6% |

| HSBC | 1,200 | 7.72 | 45.45 | +4.3% |

| Keppel Infra Trust | 8,000 | 0.39 | 0.545 | +50.6% |

| SINGTEL | 3,000 | 2.69 | 2.460 | -5.2% |

| STI ETF | 8,900 | 2.48 | 3.197 | +32.2% |

Total result: +31.84%

I only invested around SGD 78,000 in March 2020. I simply had no more cash available, no more bonds to sell. The vast majority of my portfolio was in stock index funds, where I left it. Even my emergency fund was nearly fully invested.

Rating my performance

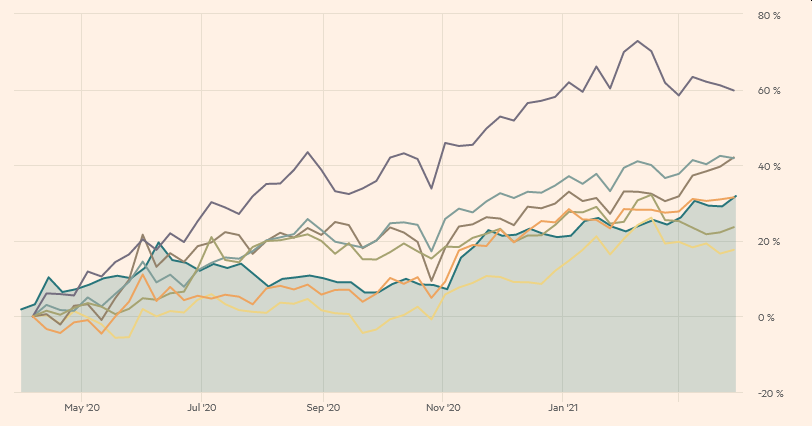

So following the example from Mr 15HWW I am now going to rate my investment performance. I just compare my own crisis portfolio vs. some benchmarks:

2020 March Bargain Hunting Portfolio vs. Benchmarks

My stocks bought in March 2020 (shaded in light green), returned 31.8% and painfully underperformed Nasdaq (+59.8%) as well as the German DAX and the SP 500 (both +40%).

I beat the Hang Seng Index (+17.6%) and the Shanghai Composite (+23.6%)

My performance is poor. If I had bought a global index it would have been better. Still I had so much fun, so no regrets!

What are my top lessons learned for the next sell-off?

I am bad at stock picking and I should just not do it. I bought Singtel and First REIT at rock bottom last March and am deep in the red one year later on both counters. Should have bought the index!

Keep doing:

- Never sell stock

- Timing the bottom is hard – buy often

- Rebalance from bonds to stocks

Start doing

- Buy diversified index funds – do not buy individual stocks on sale

- Do not invest the emergency fund (too stressful)

- Do not tell people to buy stocks on sale

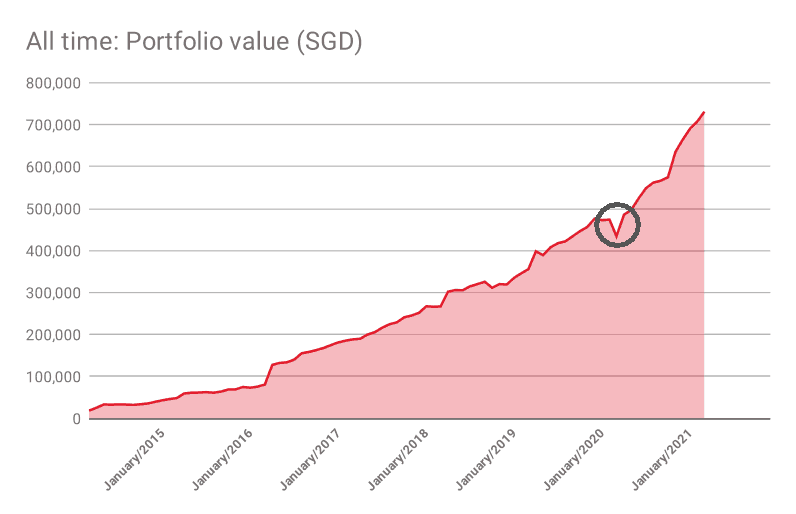

The big picture…

All the panic, all the Bloomberg watching, browser refreshing, pacing up and down my living room, but it the end, it was all nothing, but a small dent:

My biggest lesson: stay the course, stick to the allocation, keep buying and do not time the market.

Did you also do any bargain hunting? How did it work out one year later?