The second quarter of 2024 my portfolio grew nicely – even though I did not manage to invest much. Read on for the details!

Portfolio in Q2, 2024

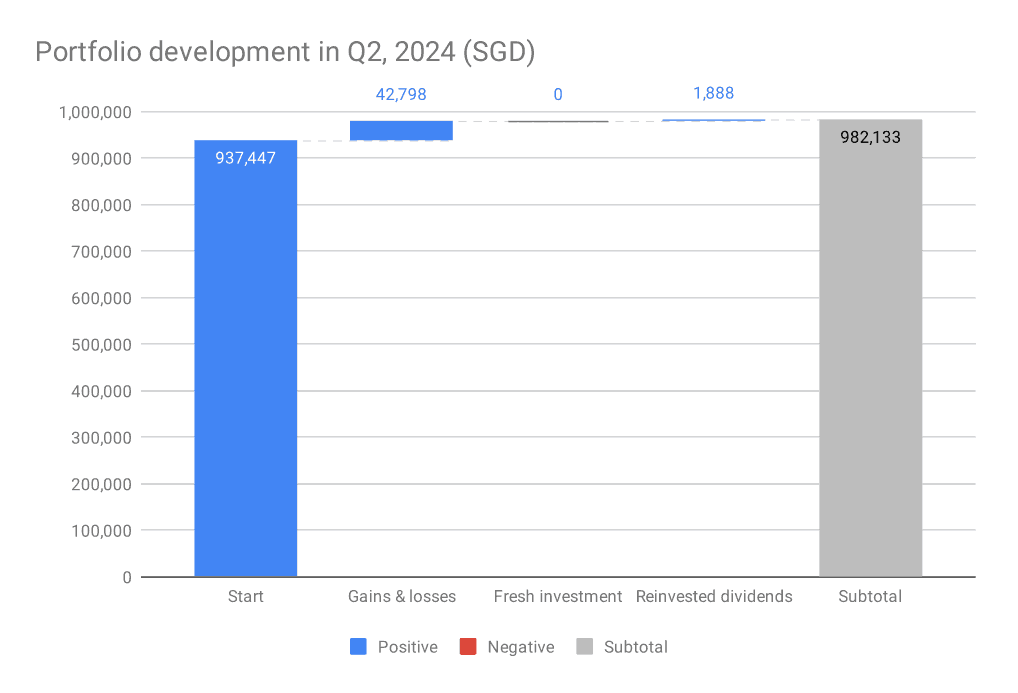

In Q2 my portfolio grew by SGD 42,798 and on top of that I received SGD 1,888 in dividends, which I reinvested. I try to minimize dividends, as they are taxed by nearly 30% in Germany.

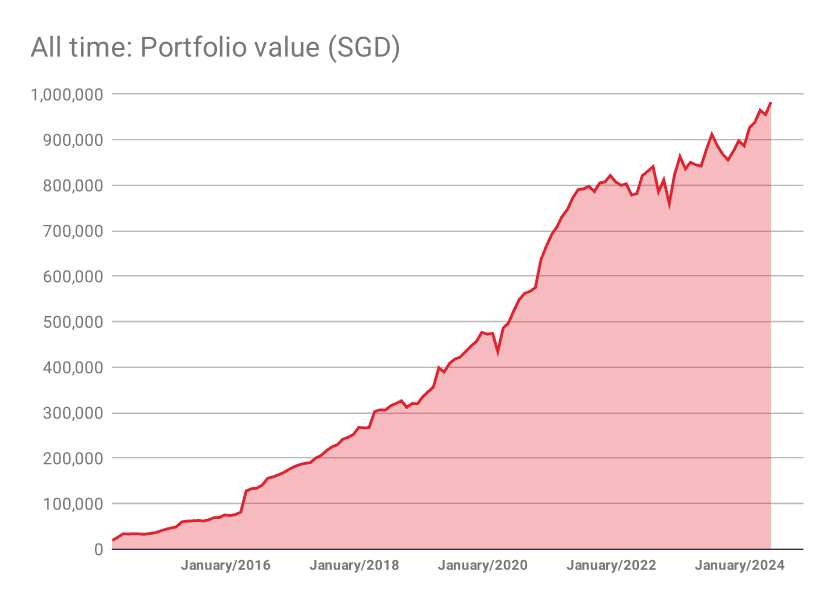

My portfolio is getting quite close to the SGD 1 million mark – but there might just be another correction or massive downturn around the corner. Unhatched chickens will not be counted!

Portfolio Allocation:

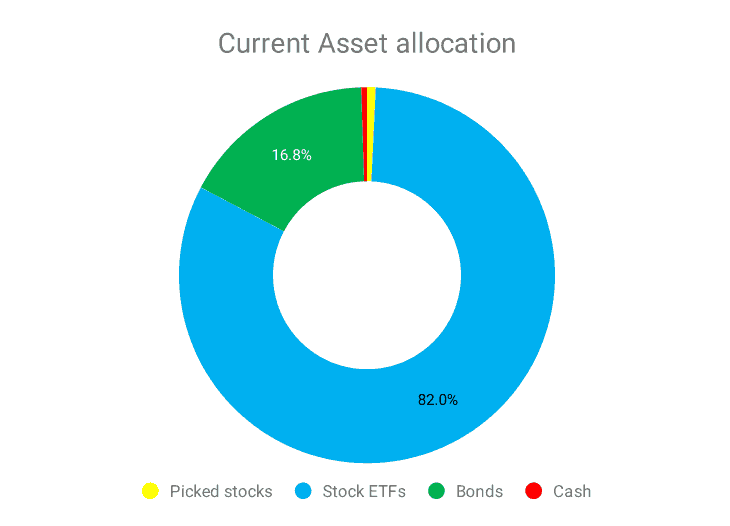

Approximately 82% of my portfolio is in stock index funds, about 17% is in bonds, and around 1% is in cash. I have not purchased any additional bonds for a long time, leading to a decrease in their share from about 25% three years ago. In hindsight, my portfolio performance was hurt by my stock picking, REITs, bonds etc – I should have just kept it at 100% index funds right from the start.

Not included: company participations

Not included in the portfolio are the stakes in 2 companies I have bought. These are illiquid investments and I cannot sell them. For the purpose of accounting, I value them both at zero, even though I am optimistic in the potential. Shares in my current employer are also not counted for the same reasons.

Income:

In the second quarter, I had the following income sources:

- Salary: SGD 18,559

- Side gigs/other: SGD 1,885

- Dividends: SGD 1,888

- Total: SGD 23,793

Spending:

In the second quarter, I spent SGD 15,443 or 83% of my salary. This is obviously far from ideal. Additionally I had to pay extra taxes and do a tax prepayment of SGD 3,153. Total spending was SGD 18,596 or 83% of my total income.

When can I retire?

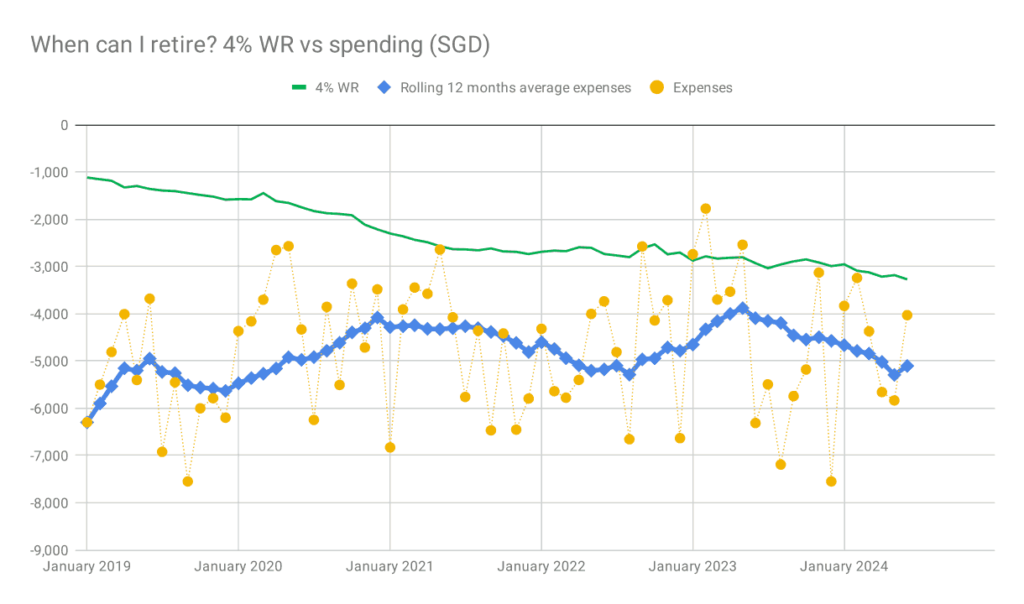

The mother of all charts is quite stable, I can retire as soon as the blue and the green lines intersect. Technically, I could probably already retire today and live on SGD 3,200 per month somewhere cheap, but it would not be ideal.

When I started this blog in 2014, my goal was to retire in 2027. That’s about 3.5 years from now. Two years ago, I switched to working at a startup, which means I earn a lot less. Despite this, I still think I can achieve financial independence by 2027 if there are no major disasters.

My original plan was to retire with SGD 4,000 in monthly expenses, backed by a portfolio of SGD 1.2 million. However, due to inflation, what cost SGD 4,000 in 2014 now costs at least SGD 5,000. This means I would need a portfolio of SGD 1.5 million, which is a big jump from my current SGD 0.98 million.

It seems more realistic to stick with a SGD 1.2 million portfolio and cut back on expenses a bit. Let’s see how it goes!

HI Singvestor, I chanced upon your blog when looking for inspiration towards financial independence. I really wanted to say a big thank you for being transparent and shainrg your journey towards FIRE with the community. While reading your blog, i learned alot by the way you do your tracking and monitoring. It has been educational and at the same time, motivational for me personally.

I initially struggled with increasing my savings rate, and definitely the lifestyle creep has also crept into me. Over time, i still managed to subdue the lifestyle creep, but i definitely should work more diligently on increasing the savings rate, because that is the only way i am paying myself a “salary”.

Thanks for your mid year and year end round ups, i am also very pleased to hear about your venture into your startup as do I. We should all continue and hustle, and work towards our financial goals ultimately. Take care

Thank you so much, Alex! Wishing you lots of success on your journey!