Being fat and broke used to be two of my key challenges in April 2013. I happily spent my entire paycheck each and every month and always wondered why I could not lose weight or why I was always broke at the end of the month. Curiously I tackled both problems successfully in the same way…

Being fat and broke is absolutely not fun and surprisingly both problems have very similar solutions. I realized that weight and finances healthy have a lot in common:

Realization #1: Healthy weight and healthy finances need budgeting

This one should really be a no-brainer, but I only realized this way too late: food intake and money spending need to be budgeted. In terms of food, not more calories should be eaten than those which are burned, which should be around 2,200 calories each day in my case.

The result of being not so good at budgeting calories (photo from Flickr)

This needs some planning! Obviously if I wanted to have a big dinner with about 1,200 calories I would only have left about 1,000 calories “to spend” for the rest of the day.

In terms of money, spending should also be budgeted for, with expenses < income. The higher the difference, the better of course!

Realization #2: Asset allocation matters

When it comes to losing weight, it does not really matter what you eat, but how many calories. As long as you stay below your daily burn rate you will lose weight, whether you eat French fries or you eat celery. BUT: obviously some foods are healthier than others and not having the right asset allocation can lead to health problems and under performance of your body. So eat your veggies!

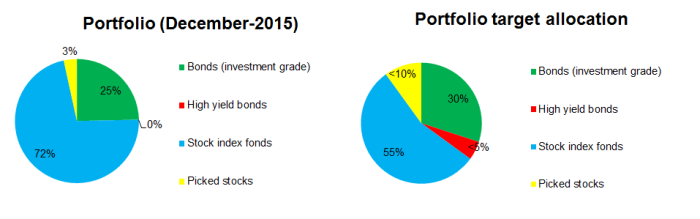

In personal finance asset allocation of course matters a lot as well. Be careful with expensive unit trusts, choose the right portfolio split etc.

Here is my target allocation:

Realization #3: It is all about delayed gratification

Honestly speaking, I love beer. The best beverage ever invented and it is so nice to have a few pints with colleagues. Yet it is not a good idea to have pints (250 calories) each plus bar food very often, for this blows the calorie budget.

It is such a good idea to delay instant gratification to relax with a cold beer after work, but rather “invest” in an hour of gym which will pay dividends later.

The same is true of course for personal finance: whenever you are not buying another item you see in the shop or online and invest the money instead it will continue to benefit you for the rest of your life.

Realization #4: It is okay to cheat sometimes

Sometimes I just have to have french-fries and cold pints and I still enjoy them, despite slightly going over budget the next day. The difference is that nowadays I plan my weeks and budget for 1 or 2 unhealthy days which I then have to even out on other days where I save some calories and exercise more.

The same is true for money of course. I am a bit ashamed to say that I will take a total of 5 vacations this year, totaling 43 hotel nights and 17 flights. To balance this huge cost I eat a lot of hawker food, do not own a TV and buy my t-shirts from Uniqlo.

Realization #5: A long term view is needed

You cannot lose weight quickly and most people also cannot get rich quickly. This is the bad news. The good news is: everyone can slowly but steadily get in shape and most people can get rich slowly. It is not an easy process and takes years, but in the end your future self will thank you for it!