After nearly seven years of keeping track of my finances I feel that I am now in the boring middle of the journey. At the same time, I can see the goal on the horizon – just a few years to go! How did I do in March?

Some days ago I wrote a long post revisting and re-evaluating all my trades done during the bottom of the market in March 2020. It was really interesting to look back and see what happened… In hindsight it is so easy and clear, but in the peak of the market turmoil it felt very different.

Spending and saving rate

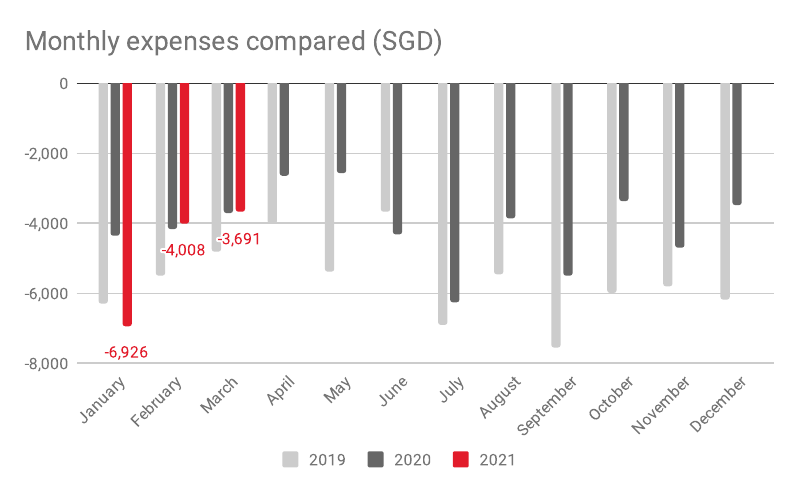

In March I spent SGD 3,691 which was much less than January. Out of this SGD 720 was spent on gifts as I bought a birthday present and also contributed to a fund raised for one of the workers in my building who had passed away due to Covid-19. The people who cannot work in a cushy home office like me are the ones hardest hit, so I have no rights to complain…

April will be quite frugal, as I am now back on in my locked down European current homecountry. I hardly can leave the house or spend any money.

My saving rate in March was 62%.

Portfolio development

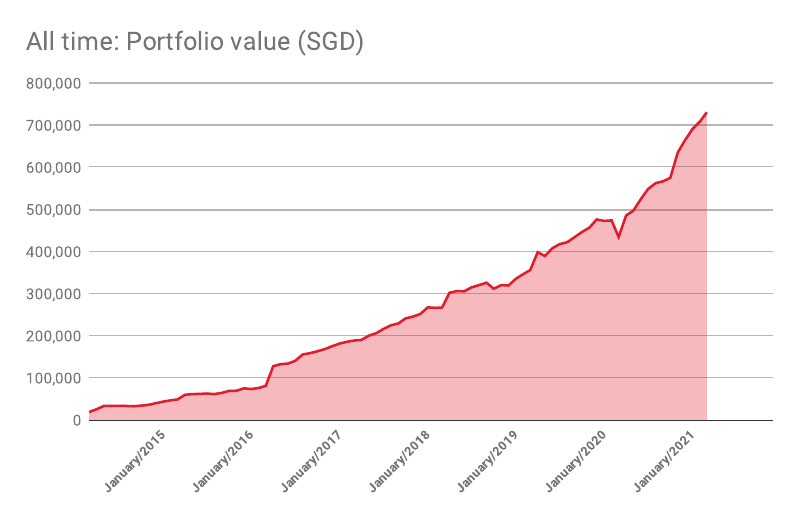

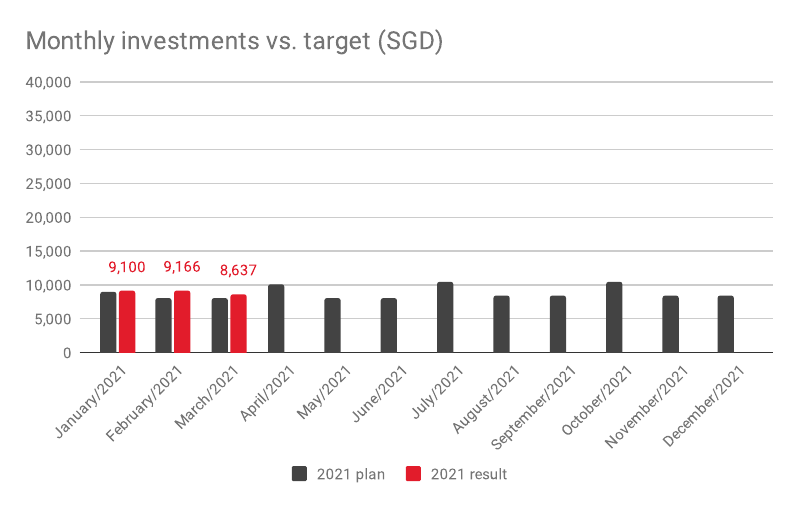

In March my portfolio increased from SGD 708,437 to 730,511 (~USD 543,000). Fresh investments of SGD 8,637 were supported by gains of SGD 13,437.

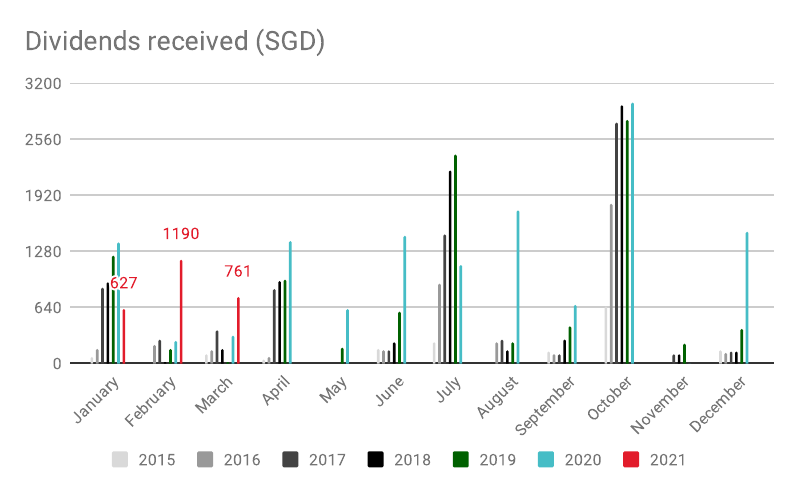

Dividends received

My holdings paid out SGD 761 of tax free dividends.

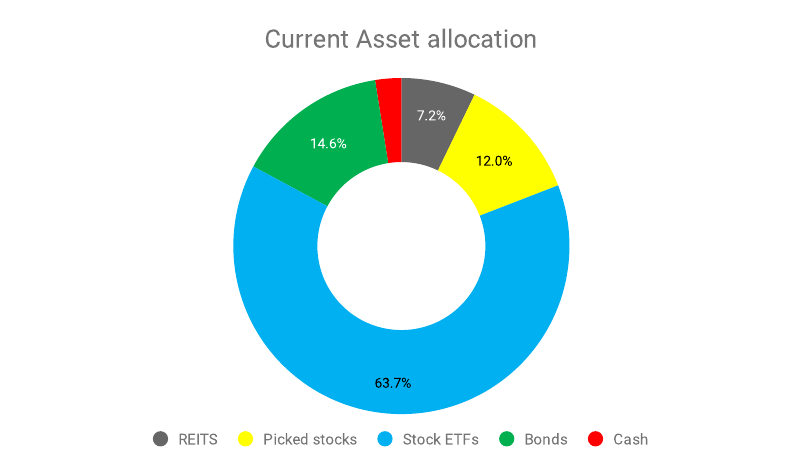

Asset allocation

Bought more bonds and some more REITs.

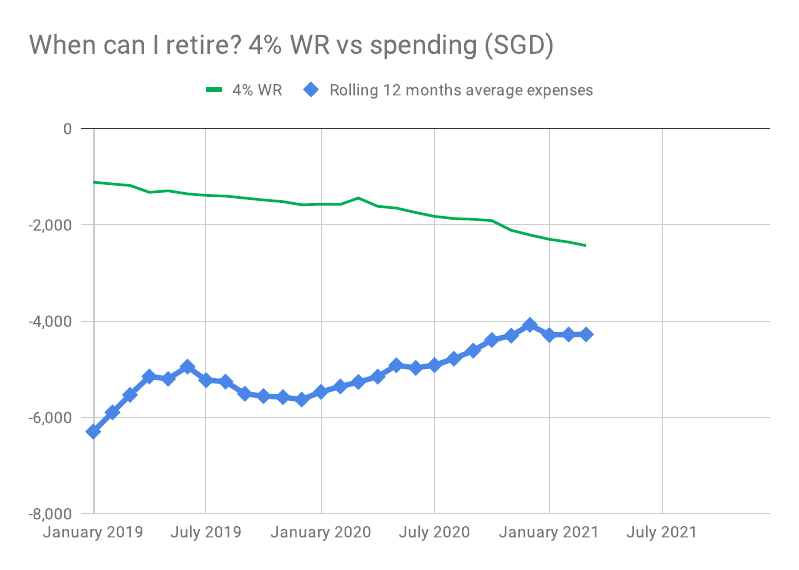

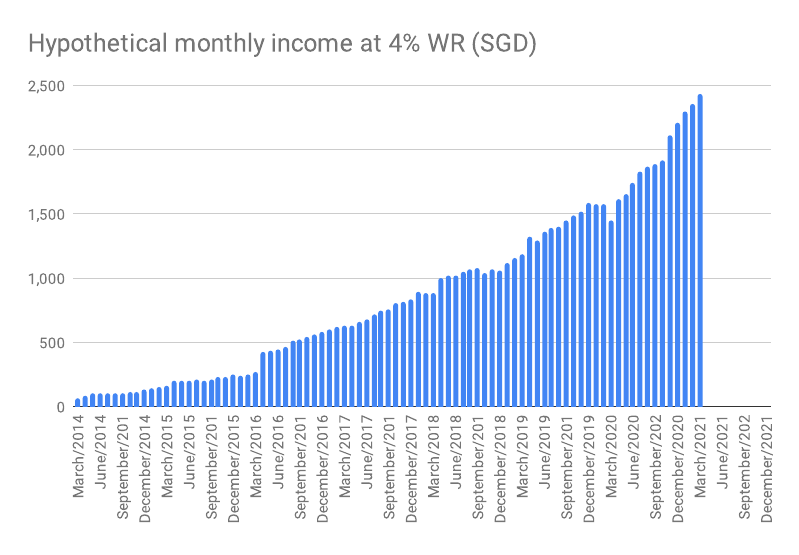

Hypothetical income at 4% WR

SGD 2,435 – not bad at all…

Outlook

I hope to be vaccinated in June/July and then life should slowly get back to normal. This is the last year of my Europe assignment – cannot believe I am here four years! All this time I have not been back to Singapore once – strange… I feel a pang of nostalgia when I think of touching down in Changi… I wonder if my favorite shrimp dumpling auntie is still active in the kopitiam of my old neighbourhood?

That WR vs annual expenses graph is the best thing.