2022 was a crazy year for me. How did my investments do? Let’s dive into the full year update!

Portfolio performance

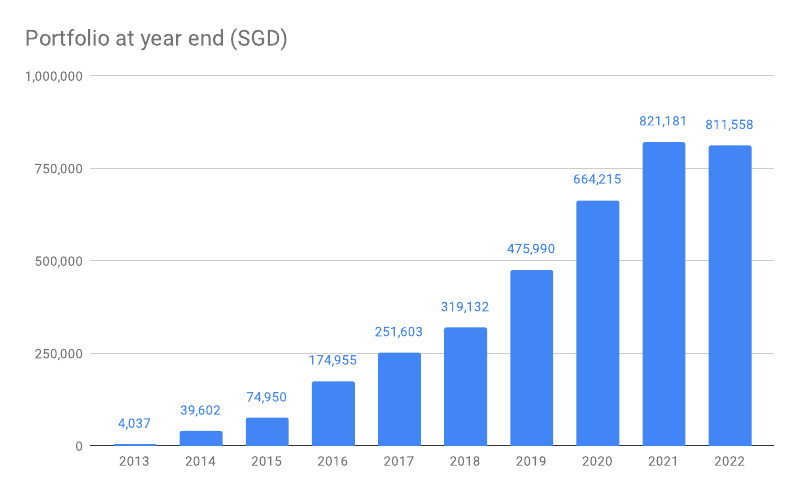

2022 was a tough year in the markets and my portfolio ended the year lower than the previous year – the first time this happened since I started tracking:

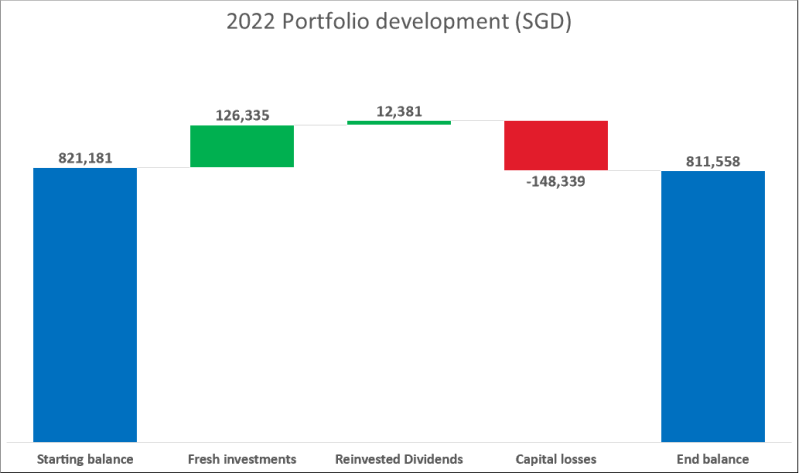

What was the reason? In short, strong fresh investments could not make up for the sinking markets:

I managed to save and invest SGD 126,335 from my salary and reinvest SGD 12,381 in dividends. This was offset by capital losses of SGD 148,339. On the bright side, I managed to save quite a bit of cash and ended the year down only ~SGD 10k.

Where did all the money go?

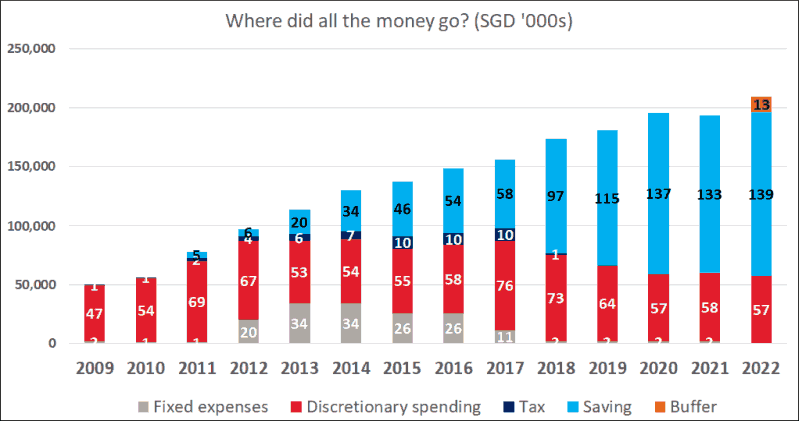

For years I have been tracking my finances carefully and 2022 was no exception:

My salary had been nicely growing all these years with 2022 being the first year with a net income over SGD 200k. Interestingly, expenses stayed on the same level during the last three years. In 2022 the highest spending category was again “travel” amounting to 19% of expenses.

2022 I got rid of my car on which I spent about SGD 5k per year in parking fees, fuel, maintenance, taxes etc. Selling the car felt great, one less thing to worry about.

I also built up a small cash buffer, since I quit my job this year and wanted to keep some cash just in case.

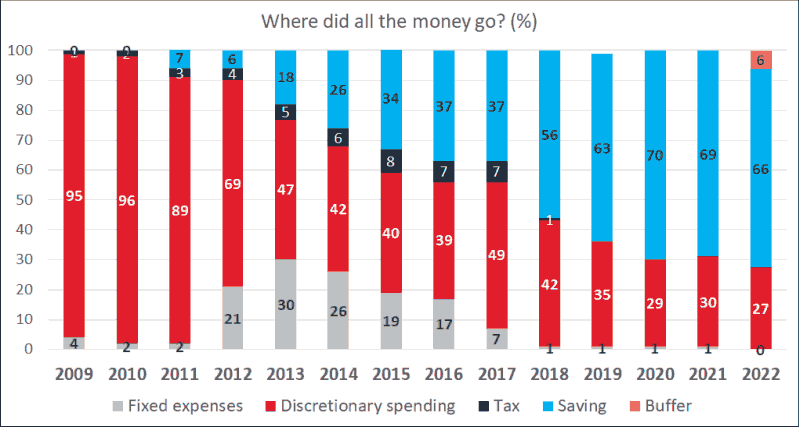

In relative terms, this is how my money was used in 2022:

I am proud not to have succumbed to lifestyle inflation and to have managed a 66% saving rate (72% when counting the cash buffer) in 2022.

Investments in 2022

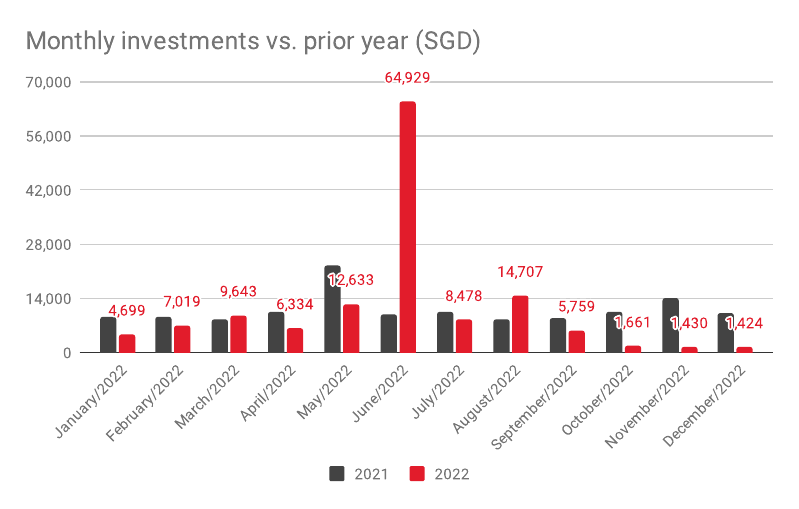

As I had planned, I invested money each month throughout the year: In June I got paid a large bonus in my old corporate job. It was especially high, since I “over-performed” and got a special award. I do not think it was justified, as I was spending most of my time preparing to resign and sort out the new life.

In June I got paid a large bonus in my old corporate job. It was especially high, since I “over-performed” and got a special award. I do not think it was justified, as I was spending most of my time preparing to resign and sort out the new life.

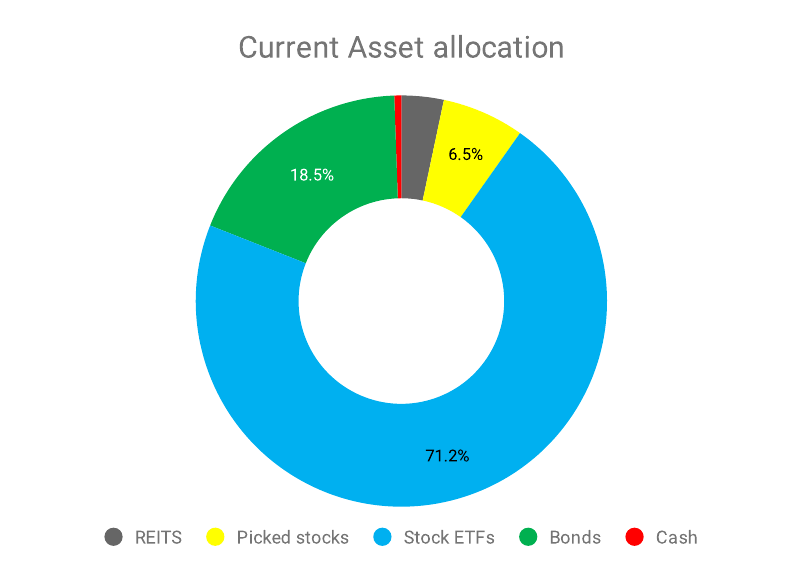

Portfolio allocation

These days, my portfolio consists mostly of stock index funds, held in ETFs. I did not add to my bond holdings and am not planning to. I sold most of my REITs and only keep a small position. I will only add to the index funds in the future.

These days, my portfolio consists mostly of stock index funds, held in ETFs. I did not add to my bond holdings and am not planning to. I sold most of my REITs and only keep a small position. I will only add to the index funds in the future.

Can I retire yet?

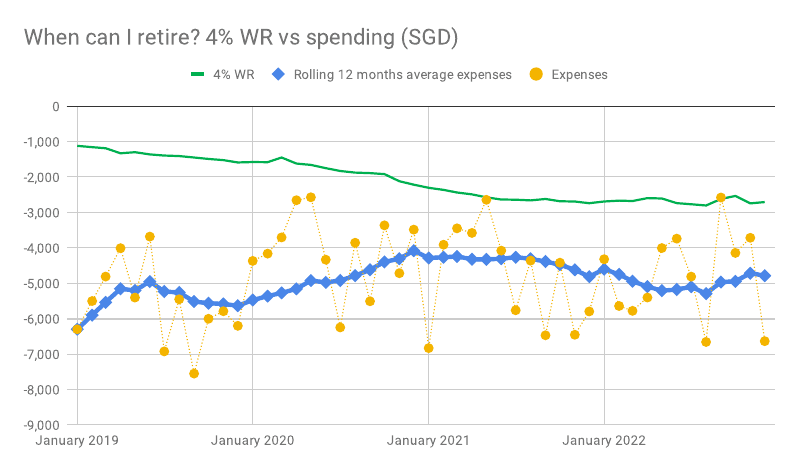

This chart shows the 12-month average of expenses, vs. a monthly retirement income (green line), which my portfolio can support.

Unfortunately, my spending is too high / portfolio is too small to retire at current income level.

Big life change: quitting my cushy job

In 2022 I quit my very well paid job at megacorp and made a plan on how to survive on less than 20% of my previous income.

It is a high-risk, high-reward strategy, as I have equity in the startup and there is a 5-10% chance for a huge windfall.

From a pure financial perspective, it would have been better to tough it out 5 years more at the large company and then retire at the ripe old age of 45. From a lifestyle perspective though, the startup is hard to beat: instead of 6-8 MS Teams meeting per day, I just have 4-5 a week. I do not need to commute to any office and can live wherever I like.

I am typing these lines from the Spanish coast, my small apartment overlooking the sea and treating me to spectacular sunsets every day. Later in the year I will live in other places, wherever I like. In a way I have achieved my dream retirement lifestyle already now.

Work wise, it is nice to be making real differences in a small business, as compared to being just one of >100.000 employees in megacorp, so I could not be happier for the time being.