June was a rather weird month featuring Great Britain’s exit from the European Union, a decision that might just be remembered as an historic blunder for the country. Only time will tell. How did my investments fare in this turbulent month?

In June Standard Chartered announced that they would introduce minimum commissions in Singapore, which compelled me to write a short update about it. I also wrote a short post on HSBC’s ridiculous personal loan promotion.

Portfolio performance

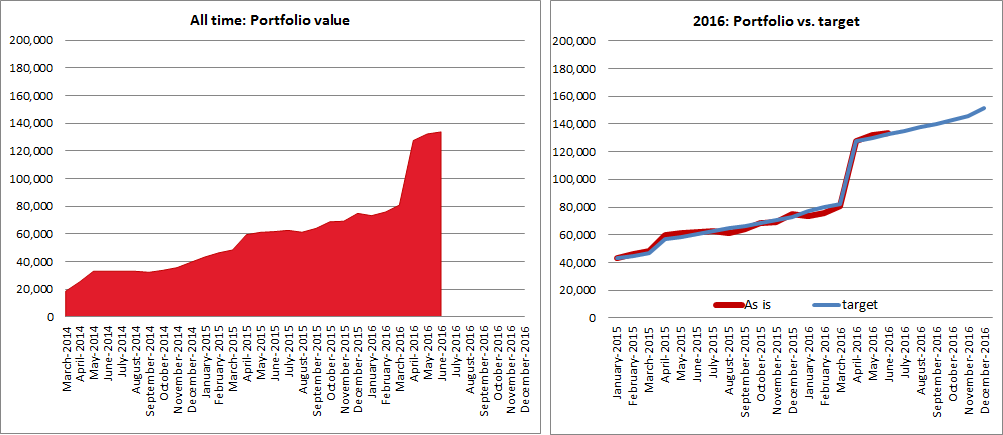

Ups and downs because of “Brexit” made the portfolio rise and fall, in the end my portfolio increased by SGD 1,468 to SGD 133,765 (= USD 99,424). The small gain was made up of fresh investments of SGD 2,692 and a paper loss of SGD 1,224.

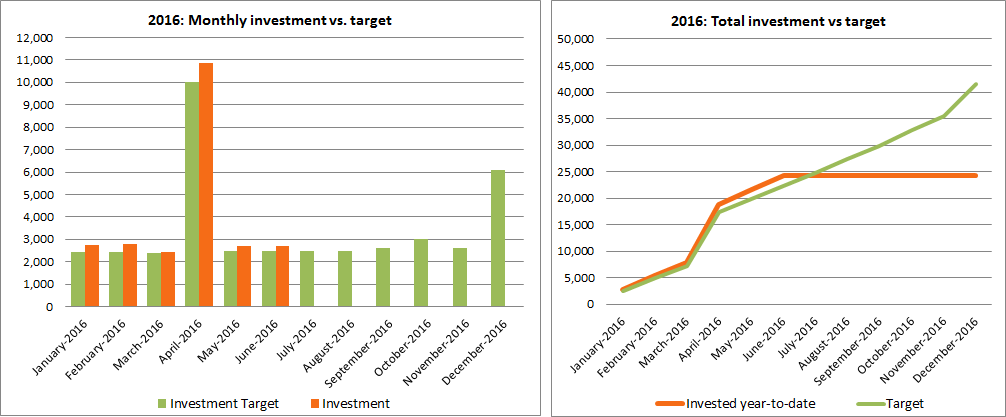

Investments year-to-date versus plan

After investing SGD 2,692 in June I am now SGD 1,936 ahead of my plan, having invested SGD 24,236 year-to-date. All is going quite well and I have the hope to somehow invest SGD 50,000 this year.

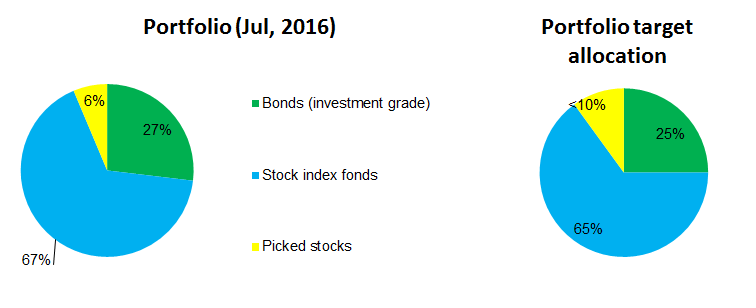

Portfolio allocation

All going well so far…

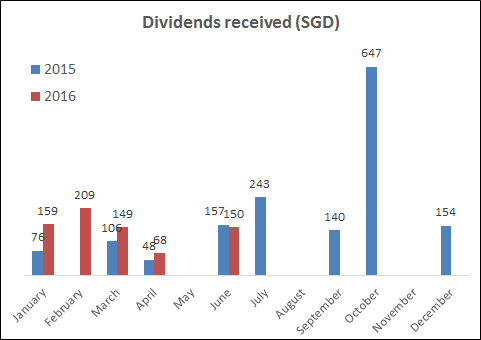

Dividends received

Dividends received

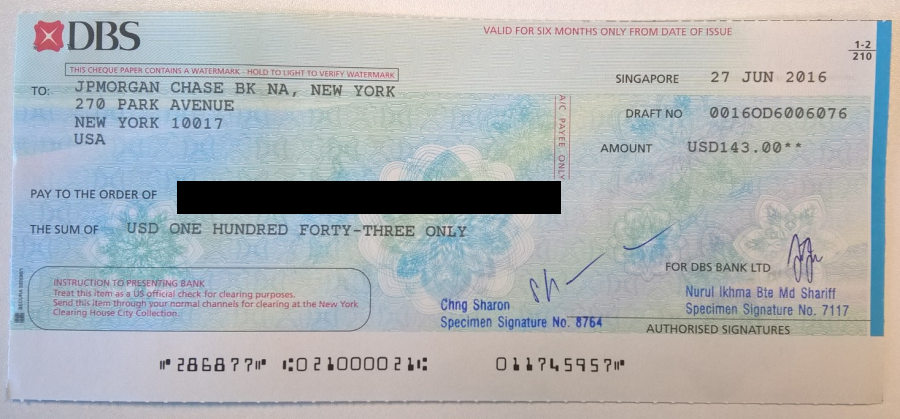

In June I received SGD 150 in tax free dividends. It should be more, but I got mailed me a cheque for my dividend and it only arrived in July. Receiving a cheque for a dividend in the mail seems so 1980s… Very inconvenient. After asking my bank what to do, they advised me to treat it like a normal Singaporean cheque and to just write my account details on the back. Hopefully I will not have to pay ridiculous fees for that…

In times of the internet and electronic transfers I still received a printed cheque by snail mail…

In times of the internet and electronic transfers I still received a printed cheque by snail mail…

Outlook

I am pretty much on auto mode after some years of budgeting and investing. My only fear is the Singaporean economy which does not look too good at the moment. Mood is quite subdued in many sectors and some of my friends seem to be having a hard time getting jobs. I miss the boom times…

I would be perplexed about a dividend check in the mail. Do you think the Singaporean economy will change it’s mood for better or worse soon?

Congrats on another good month!

It is a bit hard to say, but I am cautiously optimistic for the second half of 2016. Singapore is a resilient place and it might bounce back quickly once the growth in China as well as the oil price pick up again. Let’s hope for the best!

Hey Singvestor,

Firstly, I appreciate the amount of knowledge and transparency you have shared with the public (Including me). It have inspired and taught me a lot about the importance of financial literacy. I’m an amateur blogger that seeks to improve at anyway possible! Would it be in your reach to provide me feedback on my blog or even on a single post?

Here’s my blog link:

https://financialveracity.wordpress.com

I sincerely appreciate your time to even read this comment, hope to hear from u soon!

Cheers,

Clive