The year ended and while it did not go exactly according to plan my portfolio still increased by quite a bit over the year. I learned a lot about investing and restructured my portfolio to a proper allocation in 2014. Read on to find out how exactly I fared in 2014!

Portfolio performance

In December I made some investments and thus my portfolio increased by SGD 3,550 to SGD 39,602 despite declining markets. I mainly invested in index funds as usual, but also decided to take a small gamble and bought roughly USD 1,000 worth of the United States 12 Month Oil Fund, LP which tracks the oil price.

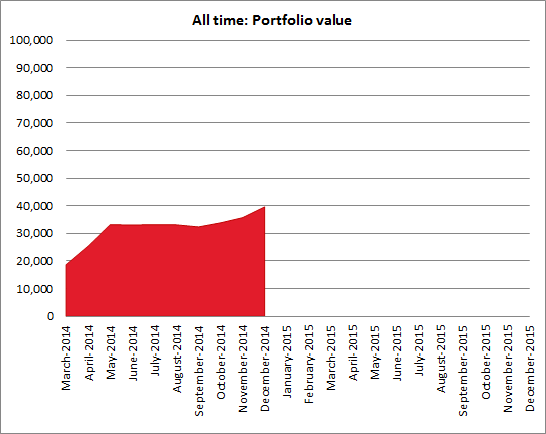

Yearly perfomance

As you can see from the chart above I have been making quite nice progress ever since I started properly taking care of my finances in last March. Sometimes I would like to kick myself in the nuts for not doing this years earlier.

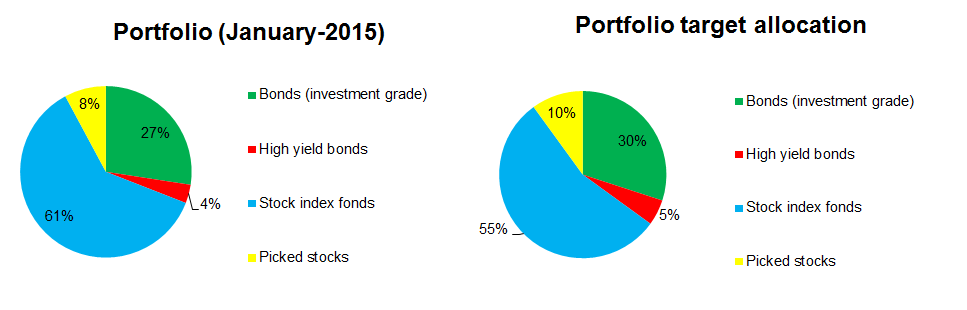

Portfolio allocation

Overall it is very much on track, with the picked stock portion increased slightly reflecting my oil fund purchase.

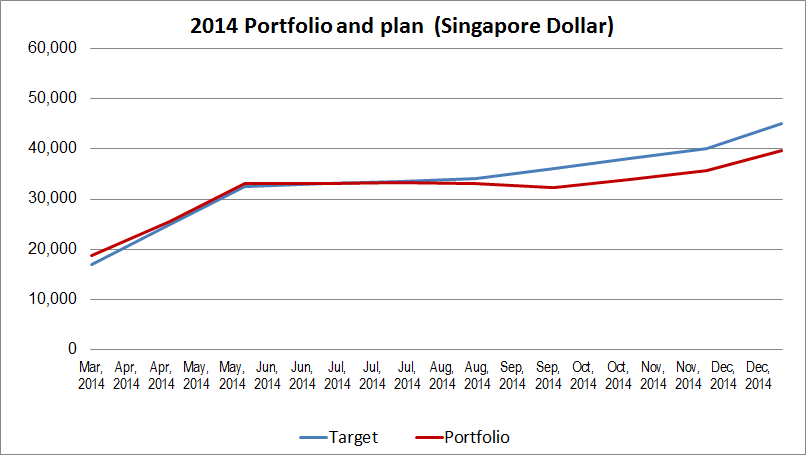

Portfolio performance vs. plan

There is no way to sugarcoat it: I missed my ambitious target for 2014. Setting a portfolio target is not very smart anyway, since short-term market fluctuations cannot be predicted. This is why I will come up with a revised set of targets for 2015 very soon.