Am a bit stuck with the new company I set up in Q4 last year. The product is solid, but I am having troubles finding customers. At first many potential clients are interested, but I am quite bad at selling. Something I have to learn! How did my portfolio do in this challeging month? Am I on track?

As planned, I tracked my expenses. Without further ado, here is my table of shame:

| Expenses | |||

| January expenses | EUR | SGD | USD |

| Travel | -1,684 | -2,587 | -1,907 |

| Car | -336 | -516 | -381 |

| Groceries | -311 | -478 | -352 |

| Eating out | -273 | -419 | -309 |

| Business | -254 | -390 | -288 |

| Cleaning & Ironing | -219 | -336 | -248 |

| Eyes, Hair, Health | -195 | -300 | -221 |

| Other | -213 | -327 | -241 |

| Utilities | -142 | -218 | -161 |

| Gifts | -119 | -183 | -135 |

| Entertainment | -108 | -166 | -122 |

| Canteen | -84.8 | -130 | -96 |

| Bars | -74 | -114 | -84 |

| Uber | -42 | -65 | -48 |

| Total | -4,055 | -6,229 | -4,592 |

Arghh, how can I ever retire like that?

These are only my expenses; my wife and I keep separate accounts.

Travel: by far the biggest expense, as I booked a lot of holidays for the next six months and prepaid some of the hotels for a big trip to South Africa in February.

I have focused on the income and investing aspect so long in ERE and neglected the cost reduction aspect. Terrible. Between my wife and me we receive EUR 25 per working day in meal vouchers from our companies which we can use for supermarket purchases. Otherwise the grocery spending would be much higher.

Looking at this table I see tremendous opportunity for saving.

Portfolio update

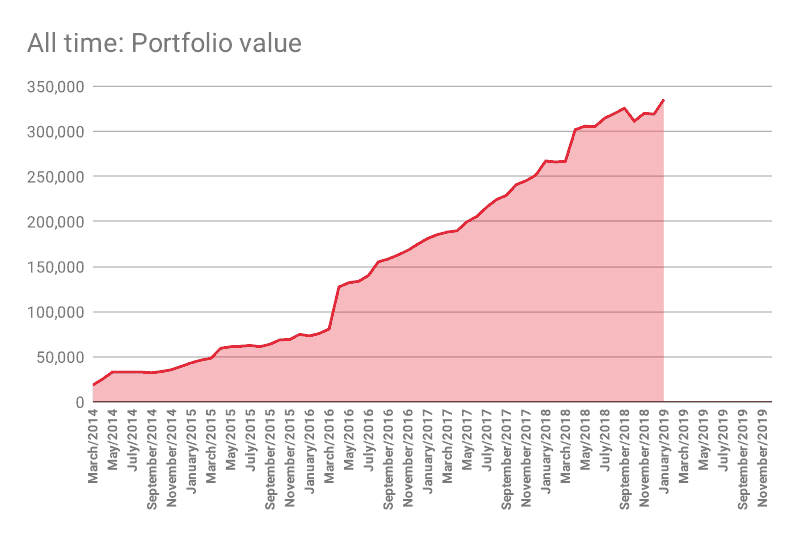

Portfolio increased by SGD 16,122 to SGD 335,254 (USD 248,300). Fresh investments of SGD 5,038 and gains of SGD 11,084 contributed. At the beginning of the month I would have bet on a big market decline in January, luckily I am not trying to time the market.

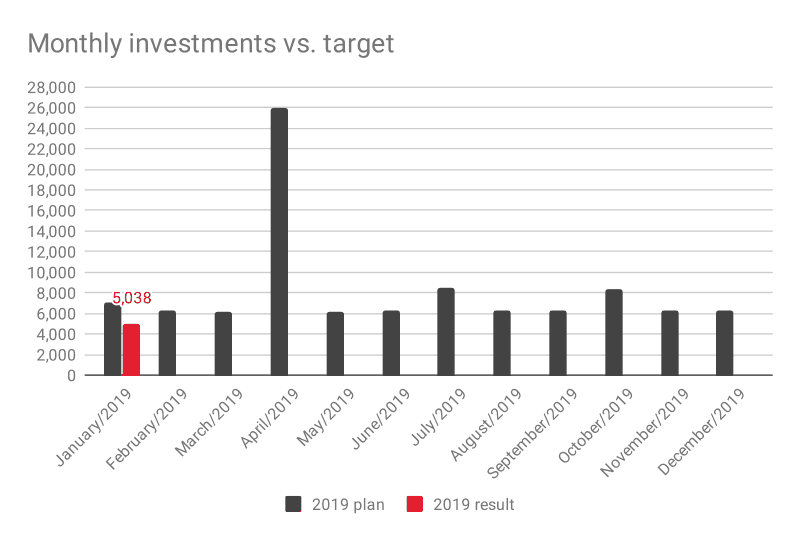

Investments vs. plan

I invested SGD 5,038 into my portfolio which was less than planned (SGD 7,000). This puts me in catch-up mode already in the first month of the year. Clearly all the expenses copied above are to blame.

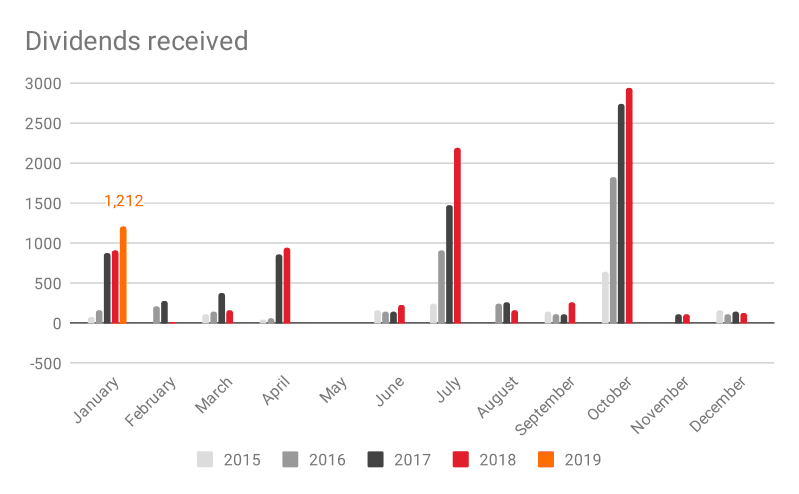

Dividends received

SGD 1,212 – nice.

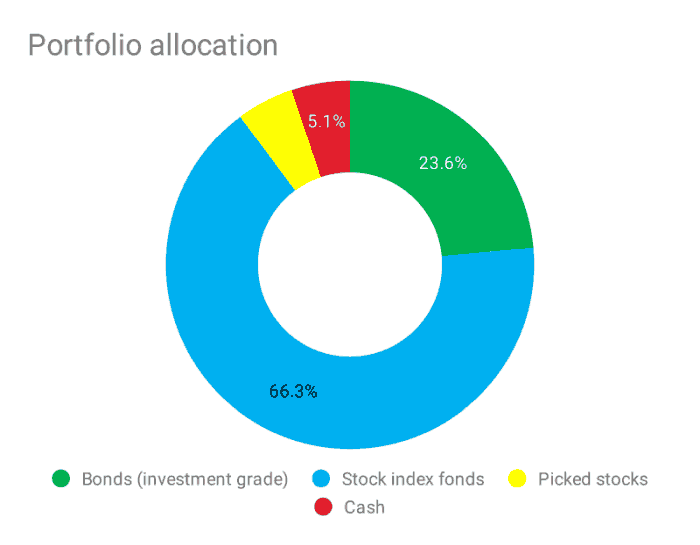

Portfolio allocation

Getting a bit light on the bonds, as my Singaporean broker does not allow me to buy bond ETFs while living in Europe and I have not figured out how to buy individual bonds, or if this is a bad idea.

Outlook

Am typing this from the airline lounge on my way for a holiday in South Africa. Hope I will stay disciplined and not spend too much money there!