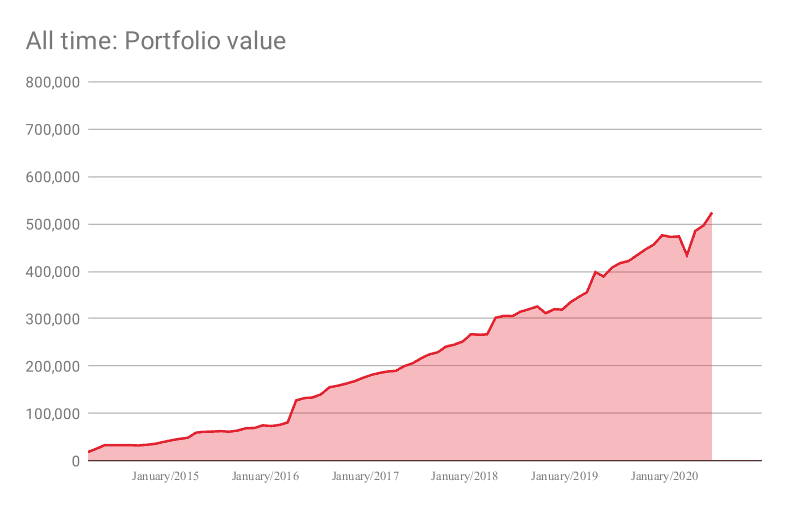

In June my portfolio finally grew to over SGD 500,000 – six years after I decided to finally take care of my finances. How did the portfolio do?

June expense report

| June expenses | |||

| Category | EUR | SGD | USD |

| Utilities | -582 | -918 | -660 |

| Groceries | -560 | -884 | -635 |

| Car | -553 | -873 | -627 |

| Stuff | -230 | -363 | -261 |

| Gifts | -181 | -286 | -205 |

| Eyes, Hair, Health | -154 | -243 | -175 |

| Other | -120 | -189 | -136 |

| Eating out | -118 | -186 | -134 |

| Cleaning & Ironing | -90 | -142 | -102 |

| Bars | -85 | -134 | -96 |

| Business | -53 | -84 | -60 |

| Charity | -10 | -16 | -11 |

| Entertainment | -10 | -16 | -11 |

| Canteen | 0 | 0 | 0 |

| Clothes | 0 | 0 | 0 |

| Travel | 0 | 0 | 0 |

| Uber | 0 | 0 | 0 |

| Total | EUR -2,746 | SGD -4,333 | USD -3,113 |

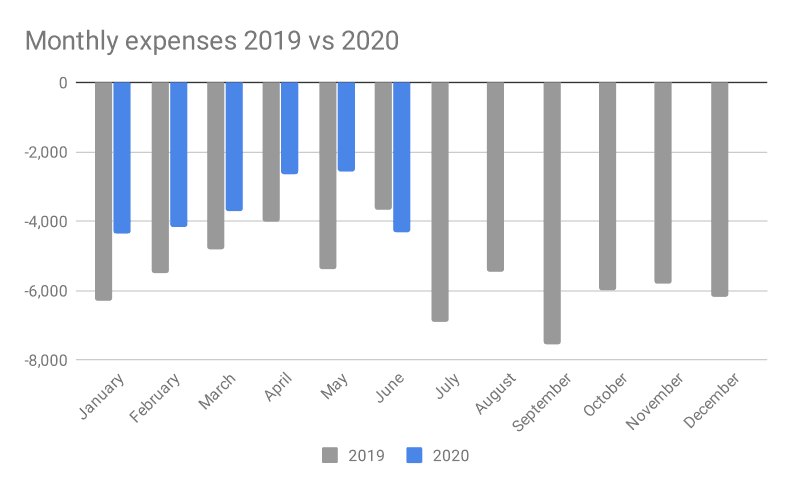

Spending was much higher than during peak Covid times and came in at SGD 4,333. My car was only moved once, but needed costly maintenance, a tire change and so on.

Spending on utilities was quite high, since I had to pay for yearly home burglary insurance (a must in my city as 20% of my colleagues got their house broken into – man, I miss Singapore) and I had to pay the yearly water bill.

Saving rate

The “official” saving rate in June was just 54%, because I buffered cash for emergencies and job loss/crisis. I got a surprisingly large salary increase, but did not invest it all.

Portfolio update

In June my portfolio increased from SGD 496,768 to SGD 524,235. I invested SGD 11,089 and capital gains of SGD 13,378 made up the rest.

This is the first time my portfolio exceeded SGD 500,000. Feels like a crazy milestone, which seemed far away when I started logging my finances in this blog six years ago.

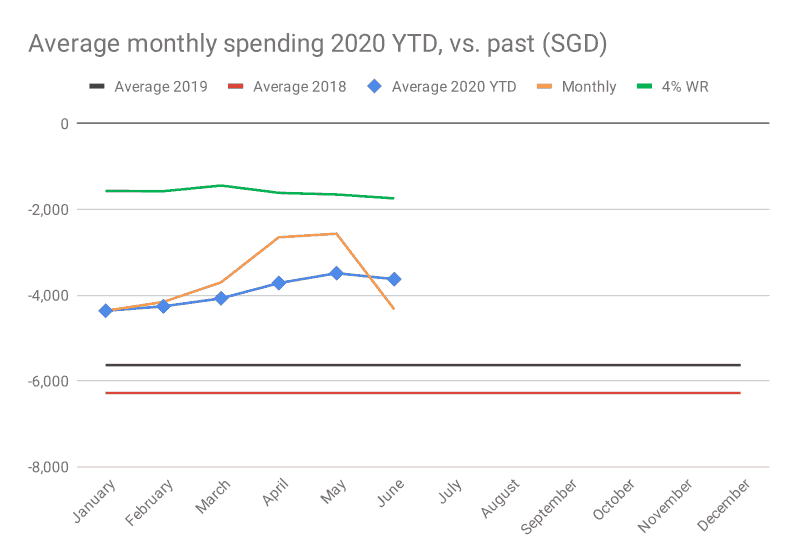

Progress to retirement

As soon as the green and blue lines cross I can start considering my retirement.

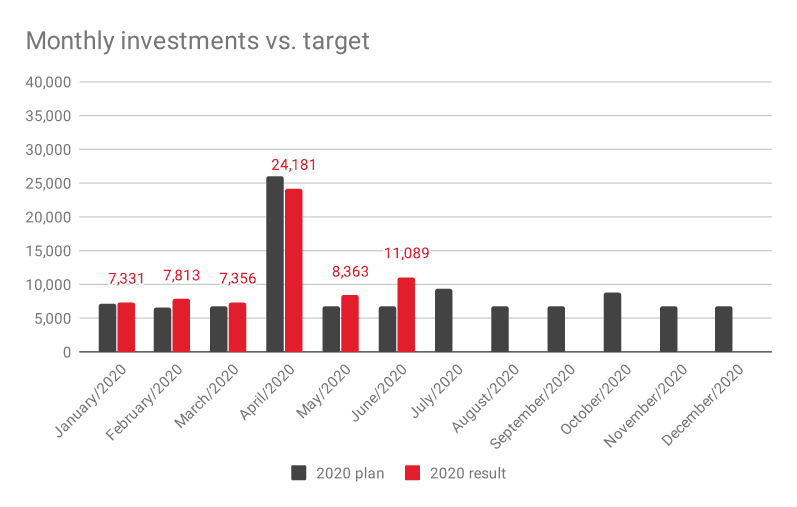

Investments vs. plan

I invested SGD 8,363 into my portfolio which was more than planned (SGD 6,700).

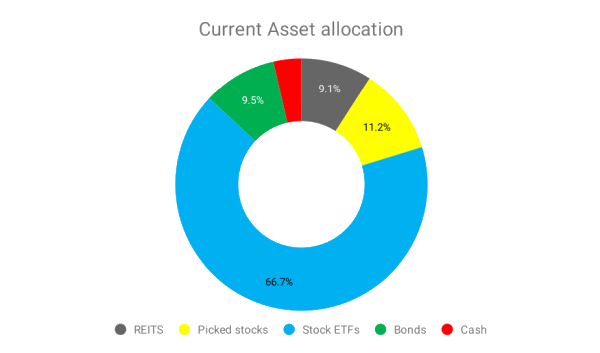

Portfolio allocation

Bought some further bonds and some stock indexes to get closer to my allocation. Too heavy on picked stocks and REITs.

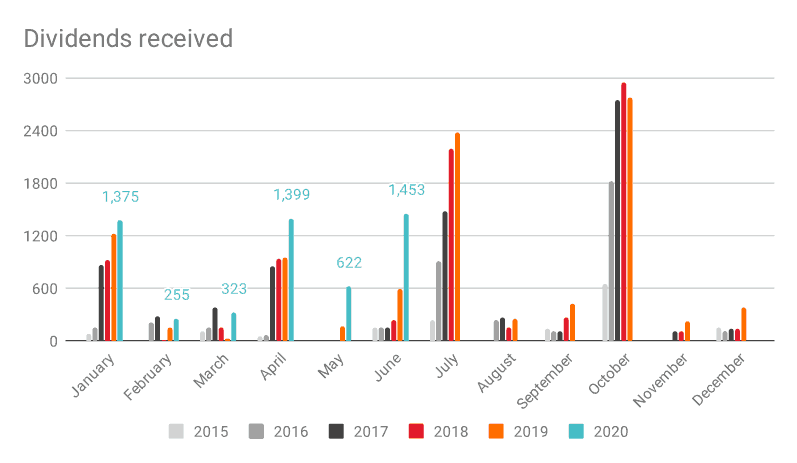

Dividends received

SGD 1,452

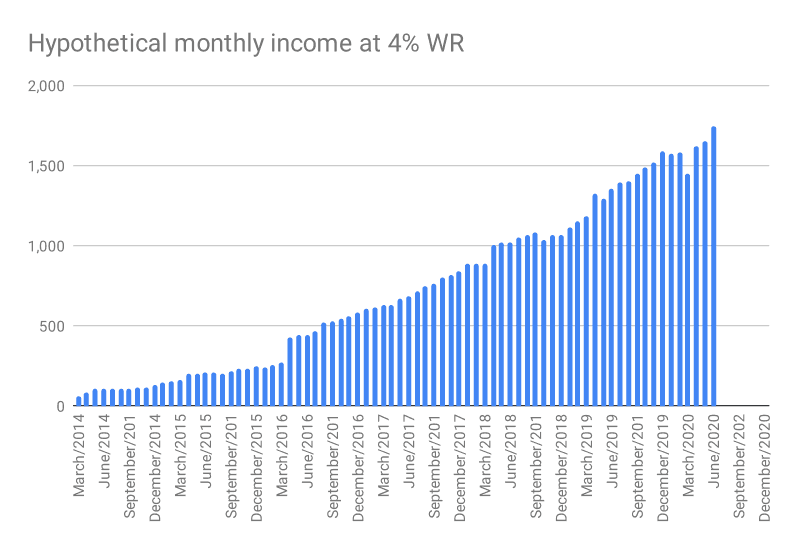

Hypothetical monthly income

SGD 1,747 – it is increasing nicely, but keeping spending under control is the key.

Outlook

Life is in a chaos, but job looks surprisingly stable. I got strong reviews and have good projects, so hopefully I can survive a layoff round if it comes. My expat assignment is only supposed to end in 2022, by the time the worst should hopefully be over…