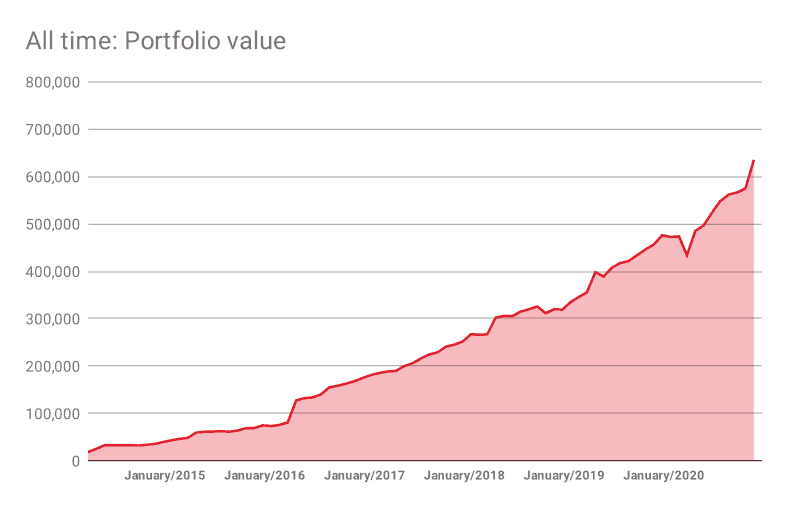

just four months after I crossed the SGD 500k threshold, the frothing bull market pushed my portfolio to over SGD 600,000.

November expense report

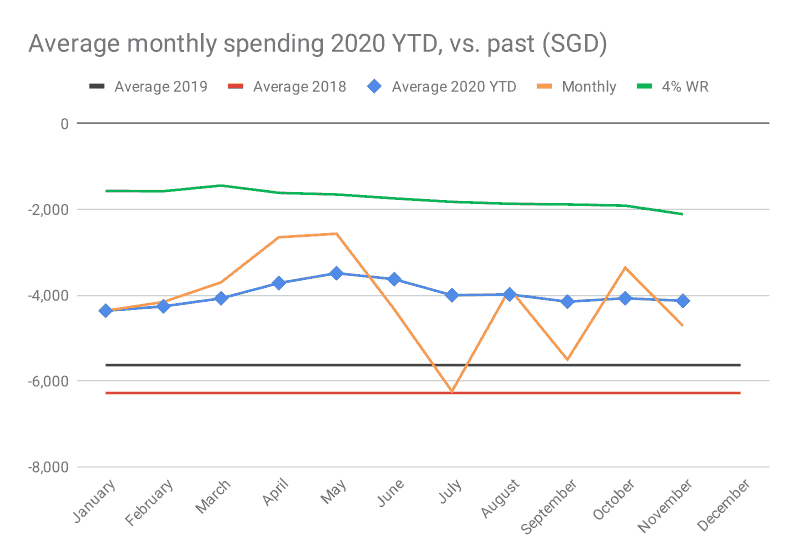

I spent SGD 4,715 in November, with grocery spending being way too high, because I hosted friends at my apartment often and bought nice stuff. Furthermore I bought some Christmas presents for family members and used the sales season to buy cheap toiletries in bulk.

Saving rate

Saving rate in November was 68%.

Portfolio update

In November my portfolio increased from SGD 574,784 by SGD 60,228 to SGD 635,012 (~USD 476,100). Fresh investments of SGD 9,016 were supported by massive gains of SGD 51,212.

Progress to retirement

Investments vs. plan

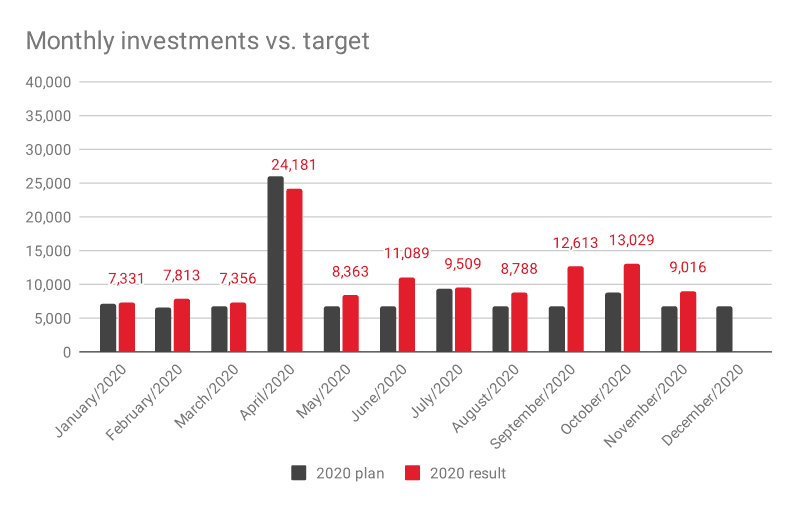

I invested SGD 9,016 into my portfolio which was much more than planned (SGD 6,700).

Portfolio allocation

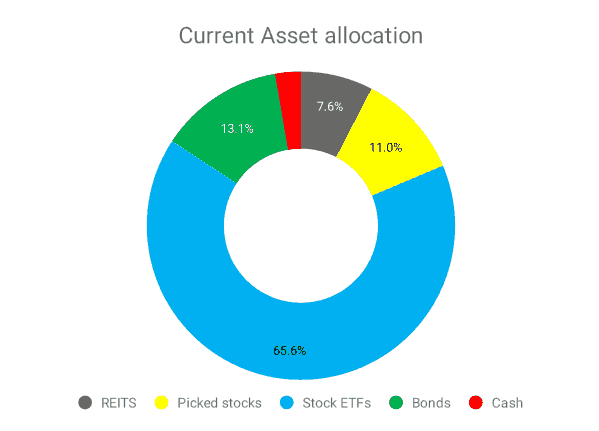

Bit too high on the picked stocks and too low on the bonds. I sold most bonds in March to hunt for bargains during the market crash, now I am buying them back with the target allocation of 20%.

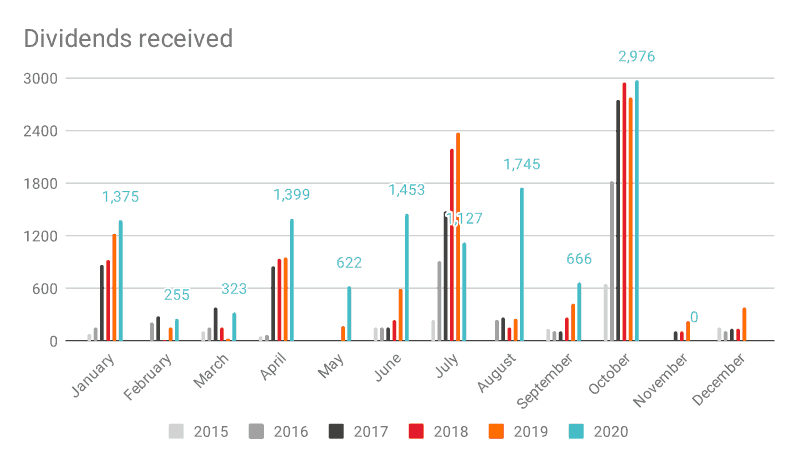

Dividends received

No dividends received in November.

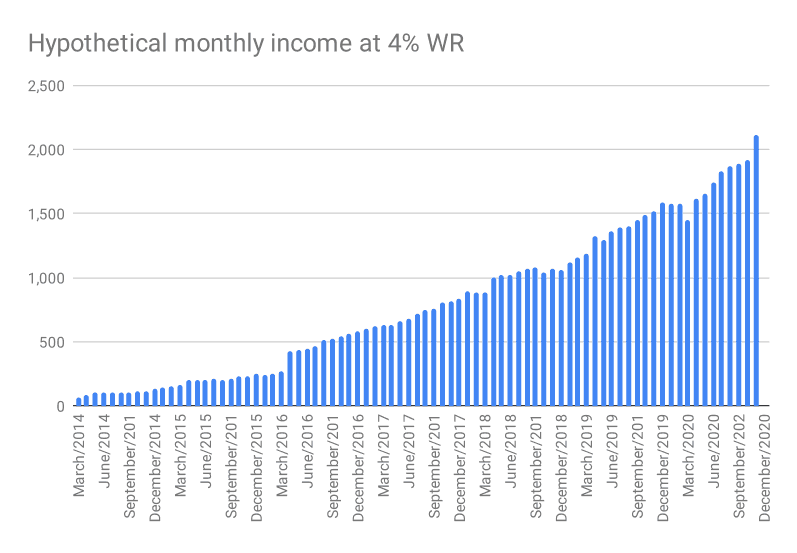

Hypothetical monthly income

SGD 2,177 – first time over SGD 2,000

Financial independence is looking more and more feasible… In Europe a pretty good life is possible in many places on a small budget. A man can dream!

Hi there! I’m a novice investor who just stumbled upon your blog and am very impressed with the content you’ve been writing, I’m currently serving National Service currently and am wondering what sort of advice you could give me, let’s say if you were my age and wanted to plan for the future. Currently, I am slowly investing in the stock market, but as I’m young I want to get alot more aggressive eventually, aiming to follow David Swensen’s asset allocation ratios to hopefully turn my 40k savings into hopefully something alot more substantial.

Looking forward to your reply!

Thank You!

Regards, Kai Jun

40k savings in NS is so impressive! I wish I had been that disciplined… I did not start investing until I was 32 or so – just spent all my money before that… If you continue living below your means you will be quite successful, as nothing beats the time in the market. From my experience buying index funds is the way to go, but I also am always tempted to buy individual stocks. You could easily be a millionaire before 30. If I had to give some advice, I would recommend focusing on personal development. Get good education, go out and date interesting people, read some good books (also novels, not just non-fiction) and look for opportunities outside the standard path. One example is working in China for a bit – would broaden the horizons. The twenties are a great time, you are in peak physical shape and health, have the most opportunities and chances. Don’t waste it! Good luck to you!

Agree with Singvestor. For financial security, making more money is more important than saving, based on my experience. I’ve saved just 50-100k in my first 5 years of working, and it’s now probably about 150k. In comparison, I can save 100k per year now, as I make 5-7 times more than I did in the first years. So the initial saving accounts for just a small share of portfolio now. Think 30-40 age is the key period to build up saving.

Some ads/link brought me here. I found your posts super interesting. Moreover, your numbers are very close to my personal portfolio which started in 2015 after moving to Singapore and now also 600-700k!

To share my experience, I regularly invest in unit trusts that focus on these sectors: biotech, healthcare, technology, India and ASEAN, and China tech after the US-China tension. They have given me pretty good return over the years. I believe these sectors and area will outgrow others in 15-20 years.

I also pick stocks and alternative assets but trade less than 5 times a year except this year when I traded close to 10 times. This year has been amazing as I bought gold, Bitcoin, and a copper miner and got a return of over 100%. The logic was simple, I just bought them when they were close to the cost of production in Mar/Apr.

I also read a lot, and believe having a good philosophy is more important than short term analysis. Some books that helped me over the years:

Fooled by randomness

Signal and noise

Superforecasting

The most important thing

Think twice

Principle

The intelligent investor

Also, Howard Mark’s notes and Mauldine economics subscription also helped to clear my thinking.

Hi Jeff, seems you did great! You built up your portfolio so fast, impressive! Seems you also have a knack for picking good sectors. The only issue might be the cost ratios of the unit trusts, the ones I screened charged quite a lot of fees. Thanks for the book recommendations, I will look at them. New books are always great. My personal favorite is probably Early Retirement Extreme by Jacob Lund Fisker. Eye opening for me… Also I really enjoy the Financial Times subscription – I learned that via the chat function I could haggle a bit and lower the price 😉

Thanks for your reply. I am aware of unit trust fee, but on the other hand, I find withholding tax for US stocks and ETF is also costly 🙂 There is really no free investment…

Stumbled onto your blog and this is impressive!

I spent quite a while digging into your portfolio and reading your posts. As a newbie investor who is looking to start investing, I am particularly curious on the aversion towards US Vanguard ETF that tracks against the S&P. I understand the pain of the 30% withholding tax – question, would it still pay out better vs the other ETFs in your portfolio even after accounting for withholding tax? I am highly tempted to go with that and other emerging markets ETFs but thought I hear more views.

Hi Pointman, if you like a fund that tracks the SP500 I would recommend investing in the one listed in Hong Kong to optimize taxes. Here is a link to the product, the ticker code is 3140 in HK: https://www.vanguard.com.hk/portal/mvc/detail/etf/overview?portId=9583&assetCode=EQUITY##overview I am not against US stocks, I am holding quite a bit in FTSE All World and MSCI World funds… Please note though: past returns are not indicative of future returns. SP500 had a great run, but nobody knows if it will outperform in the future. Just my personal 2 cents 🙂

Thank you – this is most appreciated.

Just a couple other questions if I may

1. Would you advise dollar cost averaging monthly/quarterly?

2. Similar to 1, would you advise rebalancing your portfolio annually? Do you have any thoughts on how you go about doing this w/o over incurring too much in fees?

3. Last but not least, any thoughts on using Robo advisors like Autowealth, Stashaway vs DIY?

Thank you once again – immensely appreciated and hoping I can grow my portfolio like you.

Hi Pointman, I am not a professional, just an average guy when it comes to investing. So take my answers with a grain of salt 🙂

Regarding your questions, my personal opinion is:

1) Investing in regular intervals is good, as you then do not have to be concerned too much about volatility at the beginning. I invest every month, because I also get paid monthly. I used to just invest the money to prevent me from spending it 🙂 Here is a nice article from Vanguard: https://www.vanguard.com.au/personal/education-centre/en/insights-article/a-new-dawn-for-dollar-cost-averaging

2) Normally one shold rebalance as soon as the asset allocation moves too far off the target. In the accumulation stage I just do this by buying more of the asset class I am low on whenever I contribute new funds. Right now I am too low on my bond allocation, so I buy bonds until I reach about 20% in bonds again.

3) I have not looked at them in detail, because I am more a DIY guy, but Stashaway does not look too bad… Fees seem quite reasonable. Much better than most unit trusts in terms of fees.