Another quarter is over, how did my portfolio do?

Terrible numbers incoming…

Q3 2023: Overview

- Salary: SGD 11,640

- Other income: SGD 2,866 +

- Dividends received (before tax): SGD 3,711 =

- Total income: SGD 18,217

- Expenses: SGD 18,381

- Savings: SGD 8,214 (came from cash buffer which had built up before)

This kind of spending is not sustainable, luckily I still had a cash buffer saved up from previous months.

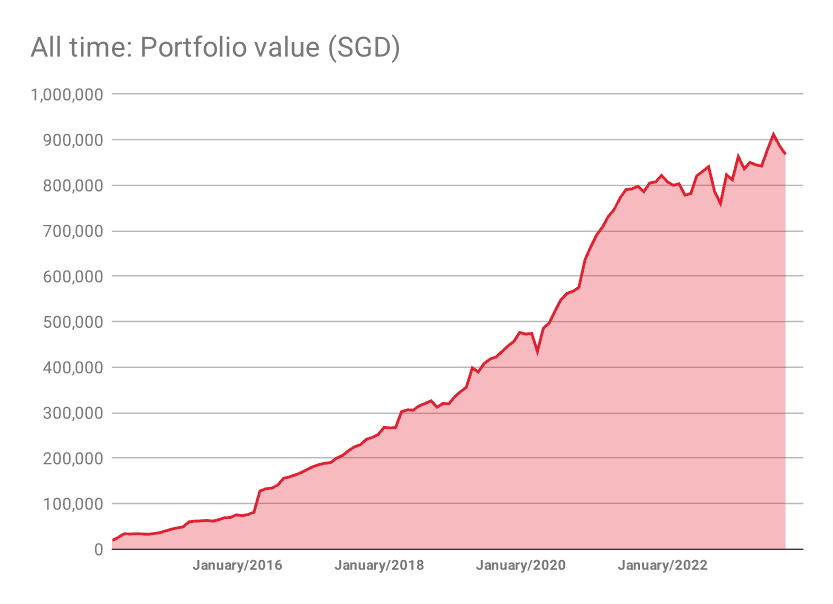

Portfolio update

Current portfolio value: ~SGD 865,000 / €600,243 / ~USD 631,000

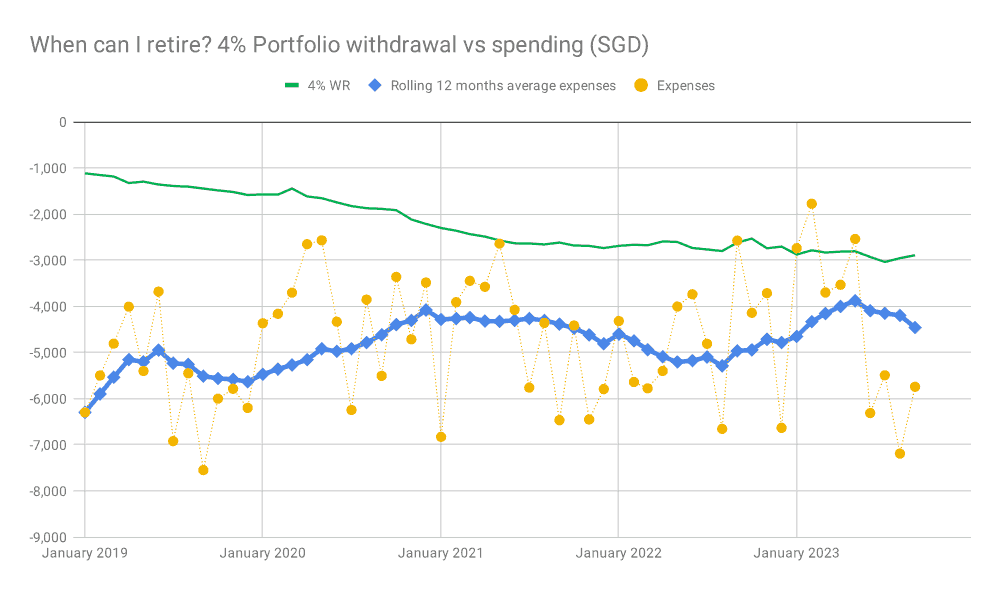

The key chart

Updates and outlook

I still am working fully remote and do not have to set foot in an office, so I cannot complain too much. In some ways I feel semi-retired.

I spent way too much money and only could still invest and “save” because I had a buffer from earlier in the year. The reasons for this spending are complicated…

I had to help a friend in financial trouble with a few hundred Euros. Technically, I lent her the money, but I am aware that I will not get it back and wrote it off as a gift.

Each month I spent over a thousand Euros to travel, as I lived out of Airbnbs and took a lot of trains etc

Generally, the months were very stressful and I focused on day-to-day issues rather than optimizing spending.

Right now, things have calmed down and I am feeling better, plus my financial situation is bound to improve as our startup has reached a milestone and my net income will increase from ~SGD 3,900 to ~SGD 6,100 net per month. This is still a fraction of my old salary, but should give me more room to save. I hope for this increase to be completed soon, as the CEO has been dragging this on, waiting for a formal agreement to be signed before counting the milestone.