After eight weeks working from home I realized that the Covid-19 crisis is having an unexpected impact on my life.

As weird as it is, life seems somehow better now as I do not have to do so many things anymore:

- Attend boring social events, such as weddings, baby showers, Sunday brunches with not-so-close friends and their noisy children or dreaded afterwork events with colleagues

- Wear suits and shirts and get things ironed and dry cleaned

- Commute to and from the office by car in heavy traffic for over an hour each day

- It is ok not to cram a ton of activities into the weekend, such as trying new restaurants, seeing exhibitions or constantly having to do things

- Spending 10 hours a day in my office, having to do smalltalk with colleagues

no more suits and office wear for me!

no more suits and office wear for me!

Instead I can:

- Talk to old friends in long video calls

- Cut my own hair, clean my own flat, cook my own meals and bake my own bread

- Play computer games for hours if I want

- Take an hour nap after lunch and just work an hour more at night to make up for it

- Wear what I want instead of office clothes

- Read all the books I have been wanting to read

- Get online certified for various skills

Life feels a lot calmer and I realize how exhausted I was prior to Corona. As horrible the crisis is, it has also had its good sides. I notice how little I really need and how much I hate traditional corporate life. Time to step up the efforts to become financially independent!

How about you? How are you experiencing the COVID-19 times?

April expense report

| April expenses | |||

| Category | EUR | SGD | USD |

| Groceries | -463 | -715 | -507 |

| Stuff | -279 | -431 | -305 |

| Car | -207 | -320 | -227 |

| Utilities | -173 | -267 | -189 |

| Other | -158 | -244 | -173 |

| Gifts | -134 | -207 | -147 |

| Business | -125 | -193 | -137 |

| Eyes, Hair, Health | -85 | -131 | -93 |

| Clothes | -75 | -116 | -82 |

| Charity | -20 | -31 | -22 |

| Travel | 0 | 0 | 0 |

| Cleaning & Ironing | 0 | 0 | 0 |

| Eating out | 0 | 0 | 0 |

| Canteen | 0 | 0 | 0 |

| Bars | 0 | 0 | 0 |

| Entertainment | 0 | 0 | 0 |

| Uber | 0 | 0 | 0 |

| Total | -1,719 | -2,653 | –1,881 |

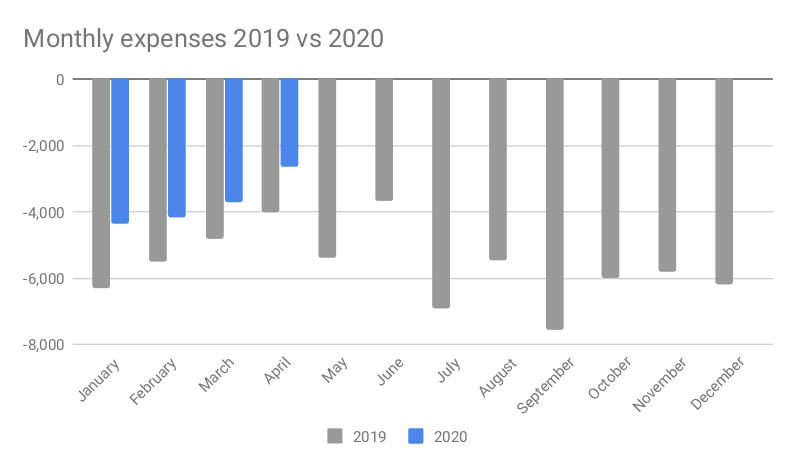

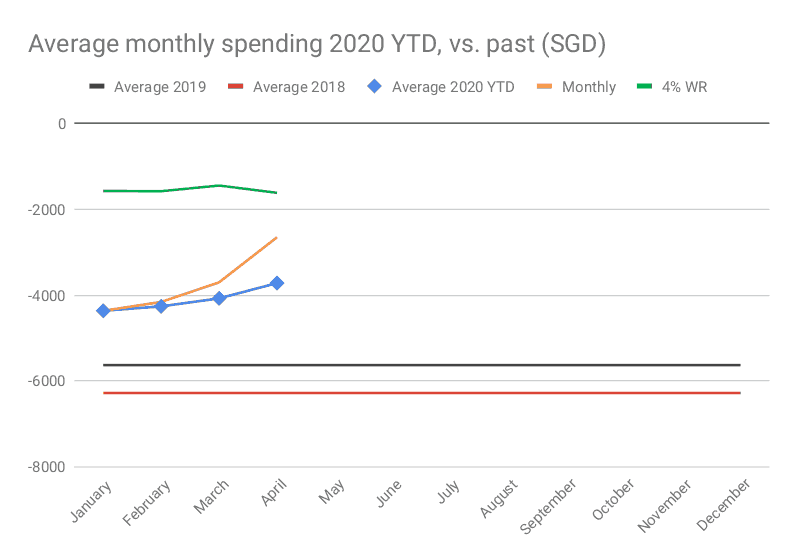

Spending decreased further to SGD 2,653. Unfortunately I spent quite a lot of money on stuff and grocery expenses were also high, as we cooked all our meals at home. Also I bought craft beer and other expensive stuff as part of the groceries budget. The actual grocery spending was much higher, as we used our company meal vouchers as well.

Covid-19 makes money saving easy, as we cannot do anything but stay home or exercise by ourselves outside in nature.

Saving rate

The Saving rate in April was 84%, because I got paid my yearly bonus which I invested.

Portfolio update

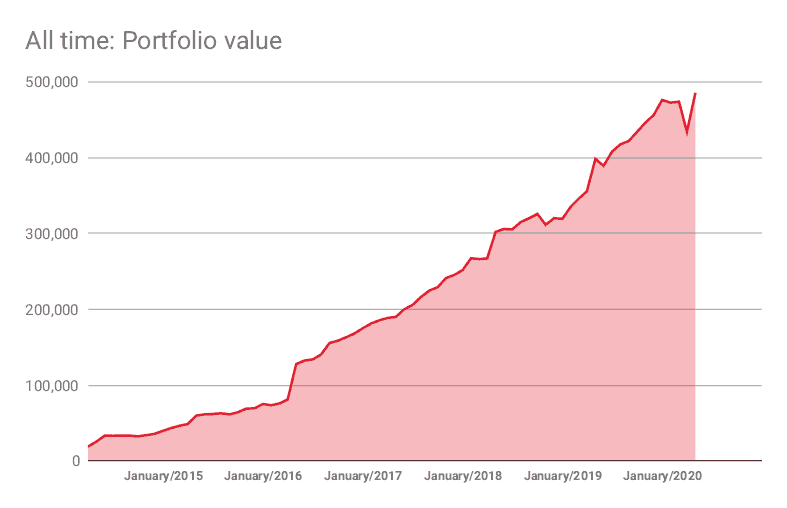

In April my portfolio heavily increased from SGD 434,068 to 485,422. I invested SGD 24,181 and capital gains of SGD 27,173 made up the rest.

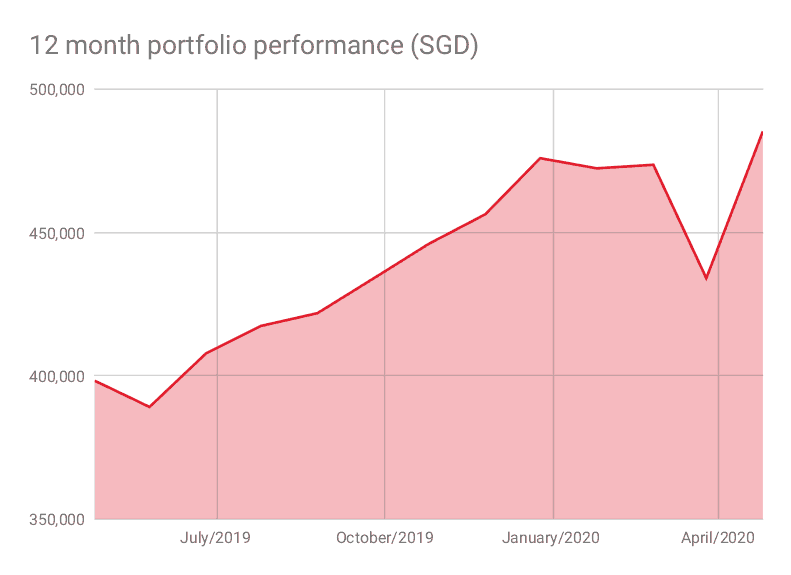

The 12 month view is interesting – during the accumulation phase downturns do not have such a big effect.

The market is behaving so strangely. Economy is crumbling, but the stock market keeps going up. So far my gamble to shift SGD 78,000 from cash and bonds to stocks in March seems to be paying off, but who knows if it will go up or maybe crash again when the second wave comes.

The main chart shows nicely how I am crawling towards early retirement

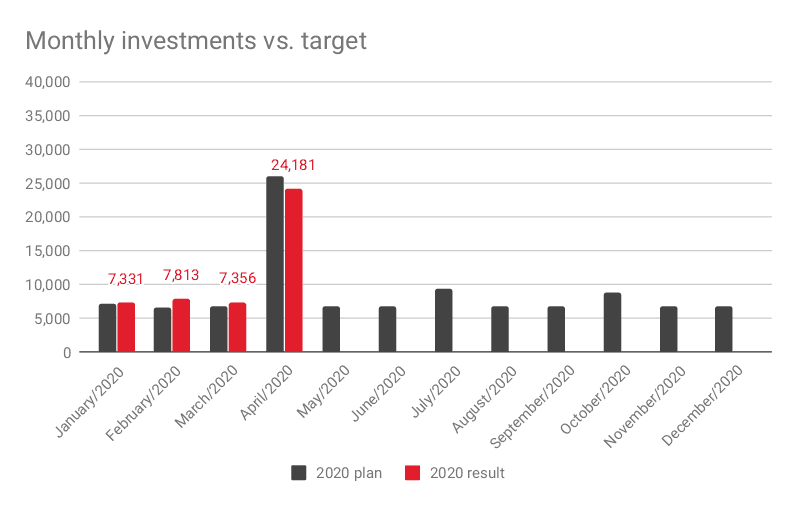

Investments vs. plan

I invested SGD 24,181 into my portfolio which was less than planned (SGD 26,000).

My bonus this year was the lowest in eight years and about half of last year. Still I won’t complain, I am lucky to get a bonus at all.

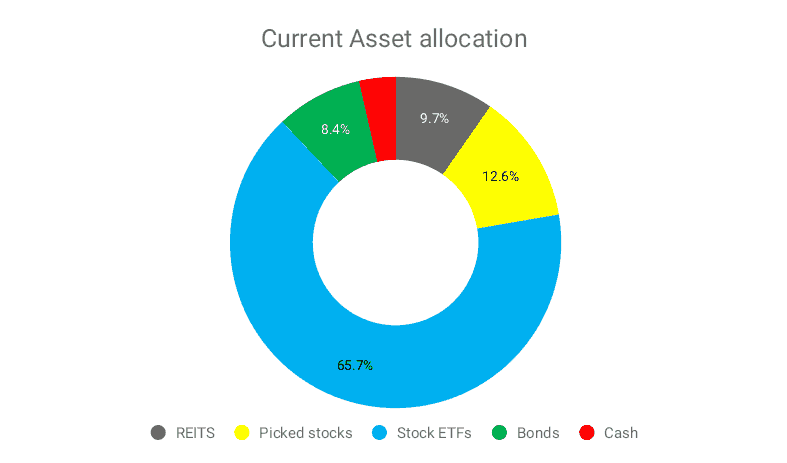

Portfolio allocation

This month I bought a chunk of bonds back, as stocks are not as cheap anymore. Still I bought some more stock index funds, to get back to the target allocation.

Am holding quite a lot of industrial and healthcare REITs. Normally I am not a big fan of REITs, but the prices mid March were very attractive to me, so I went “bargain hunting” using cash and proceeds from selling bonds.

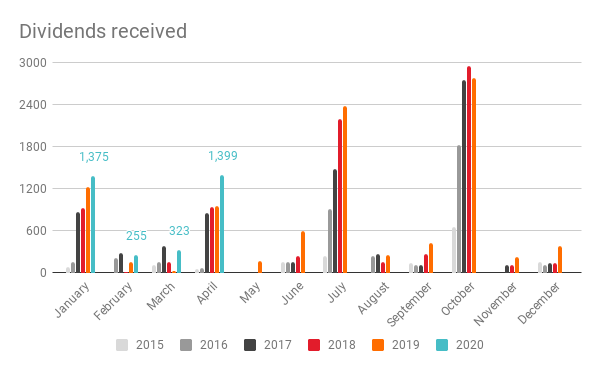

Dividends received

SGD 1,399

Outlook

Am worried that my cushy expat life might end soon… The company is struggling in the crisis and at some point they must realize that I could do the same job back home in Singapore on local terms. On the bright side that would reunite me with good weather, Laksa and Char Kway Teow 😉

HAHAHA I found someone else that doesn’t like those social fluff activities in you! How many more years before you achieve some form of FIRE, you think?

Social obligations can be tedious hahaha… I guess in 3 years I will have achieved LeanFIRE, 4 years more for full FIRE. This is a conservative guess, somehow progress has been faster than expected. I guess I will not stop working, but try our fun or different work experiences like you did in your “lost trio” – if someone wants to hire me at 45 years old that is!

Hey man,

Chanced upon your blog and it was enjoyable to read through quite a number of your older posts.

Just wanted to say great work on the path to FIRE! 🙂

Thank you 🙂