How to react to the Corona crisis? Last month it seemed far away and contained in China. Now here in Europe people are dying, there is not enough protective equipment, people are queuing in front of the supermarkets, nobody is allowed to leave the house for anything else than urgent errands. What to do?

It is clear: in times of Covid-19 optimizing finances should take a backseat. Cheering cheaper stock prices or lamenting lower boni during a time where people are dying and worried for their jobs is cynic and heartless. These days those who are healthy and still have a job are the lucky ones. As corporate desk person I am working from home and have nothing to complain.

Of course my portfolio was beaten up and I am sitting on huge paper losses, but who cares? I have doctors and nurses in my family who have to worry about getting sick or running out of masks and equipment.

Having said that, the crisis is a good trial run to test personal risk tolerance and to cultivate renaissance (wo)man skills, such as cutting ones own hair, improving cooking skills and in my case baking bread:

My self made bread

Baking bread is a good renaissance(wo)man skill to have: disolve 1 package of dry yeast in 450ml of warm water, mix it with 500 g flour (whatever you like), two tablespoons salt, grains and stuff if you like. Let it sit at room temperature for some hours covered by a wet towel. Put into a baking form and move to the not preheated oven. 240 degrees celsius, one hour and done! Just 5 minutes work for a loaf of bread.

Staying at home increases resilience. One example was my wife’s birthday cake. I used to just buy one from the bakery. As going outside is not encouraged I just baked her a cake this time. Using simple recipes the result was not all that bad!

Other idea: make authentic Spaghetti Carbonara

Takes 10 minutes and you can practice your italian accent!

Italian cooking is pretty easy to learn, satisfying and you can save lots of money. Also if you are still dating, some nice pasta and wine is more enticing than Netflix if you want to get that special person to visit your apartment, ahem.

Ok, enough with the life skills. How did the portfolio do during this difficult time?

March expense report

| March expenses | |||

| Category | EUR | SGD | USD |

| Groceries | -504 | -788 | -551 |

| Travel | -445 | -696 | -486 |

| Car | -312 | -488 | -341 |

| Eyes, Hair, Health | -234 | -366 | -256 |

| Utilities | -188 | -294 | -205 |

| Gifts | -174 | -272 | -190 |

| Stuff | -173 | -271 | -189 |

| Other | -123 | -192 | -134 |

| Cleaning & Ironing | -98 | -153 | -107 |

| Business | -60 | -94 | -66 |

| Eating out | -42 | -66 | -46 |

| Charity | -10 | -16 | -11 |

| Canteen | -5 | -8 | -5 |

| Bars | 0 | 0 | 0 |

| Clothes | 0 | 0 | 0 |

| Entertainment | 0 | 0 | 0 |

| Uber | 0 | 0 | 0 |

| Total | -2,368 | -3,704 | -2,588 |

Spending was down a bit at SGD 3,704. Most of the month I spent locked down at home, as our office shut down and we have to work from home without leaving the house. This resulted in higher groceries spending, since I had to buy quite a bit of food to stay at home and not eat out.

At the beginning of the month I bought a trip to Spain which I had to cancel and was cancelled anyway by the airline. Refunds are not possible as the airline refuses and is nearly bankrupt.

I guess spending will be down further in April. I do not need to buy much except groceries.

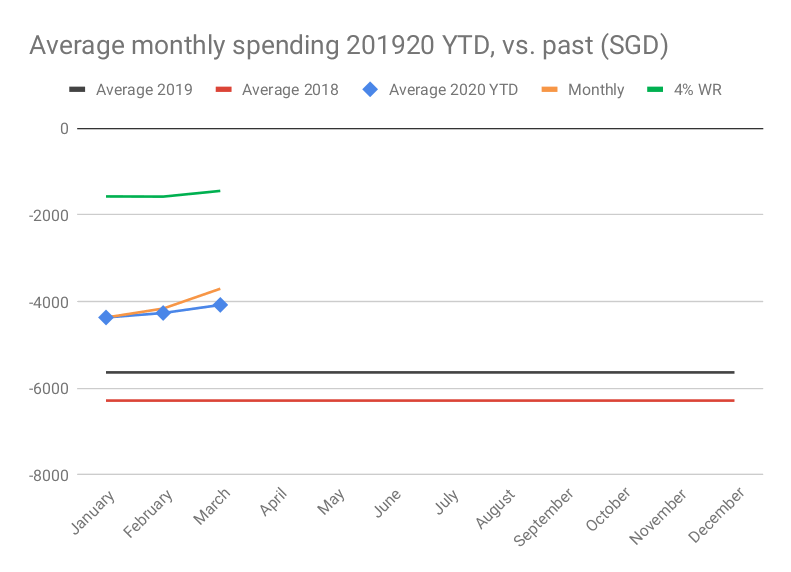

Spending is on a positive trend.

Portfolio update

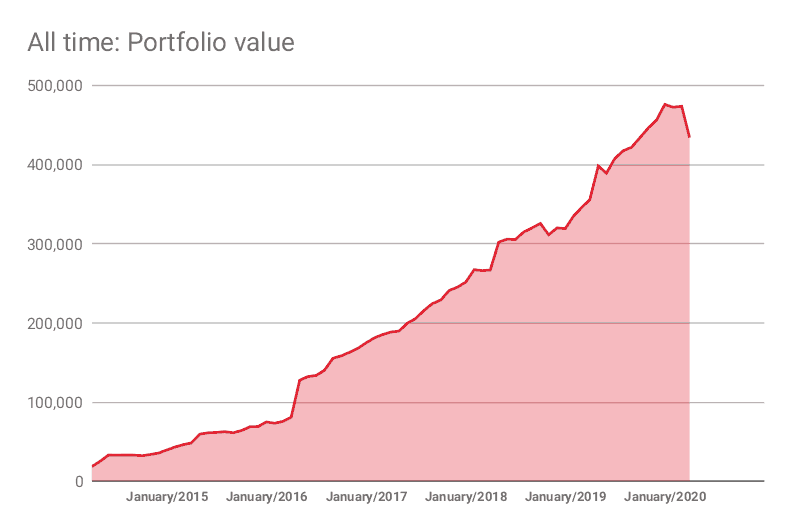

In March my portfolio heavily decreased heavily from SGD 473,700 by SGD -36,632 to SGD 434,068 (~USD 303,065). I invested SGD 7,356, but experienced huge devaluation of the portfolio by a whopping SGD -46,988.

Investments vs. plan

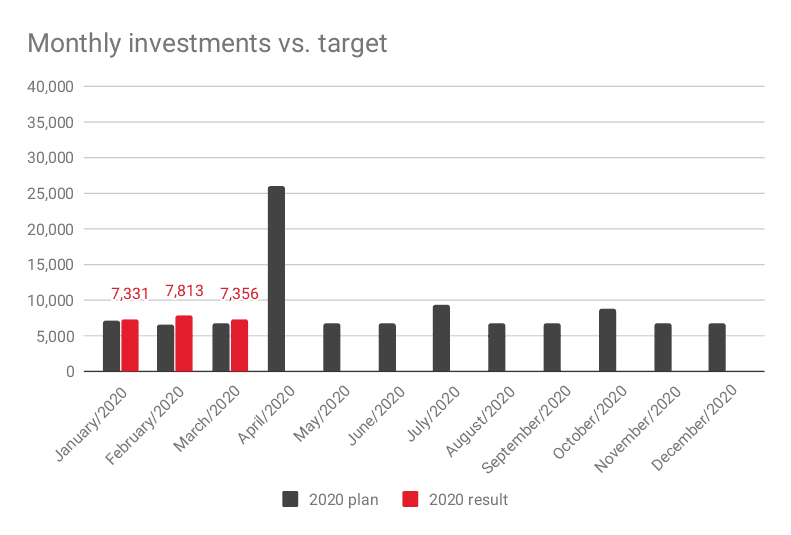

I invested SGD 7,356 into my portfolio which was a lot more than planned (SGD 6,700).

Saving rate in March was 60%.

The big portfolio restructuring

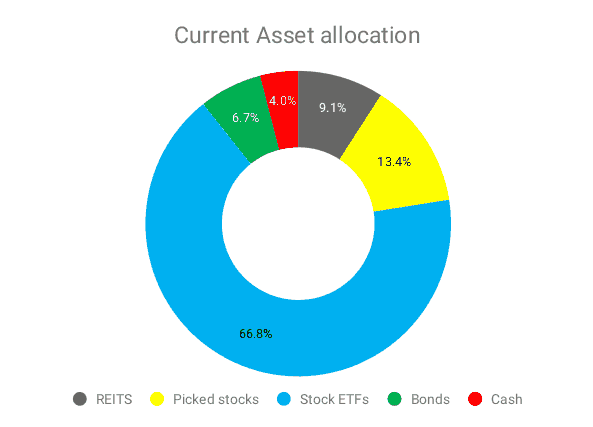

In the middle of March I decided to sell down my bond holdings and dramatically reduced my cash positions. All in all I invested around SGD 78,500 into stocks and REITs by reducing bonds and cash.

Portfolio allocation

Too heavy on picked stocks, because of “bargain hunting”. More REITs as well… Future contributions will go into stock index funds and then again into bonds once the market has rebounded.

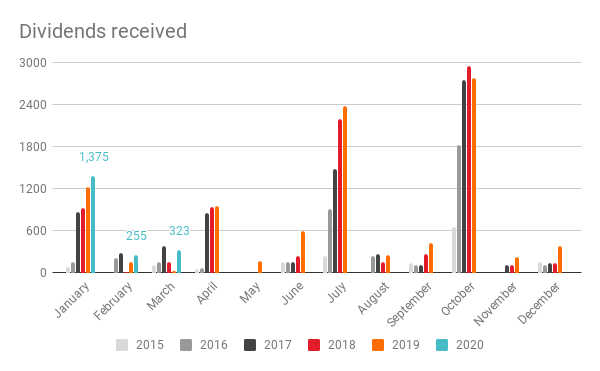

Dividends received

SGD 323

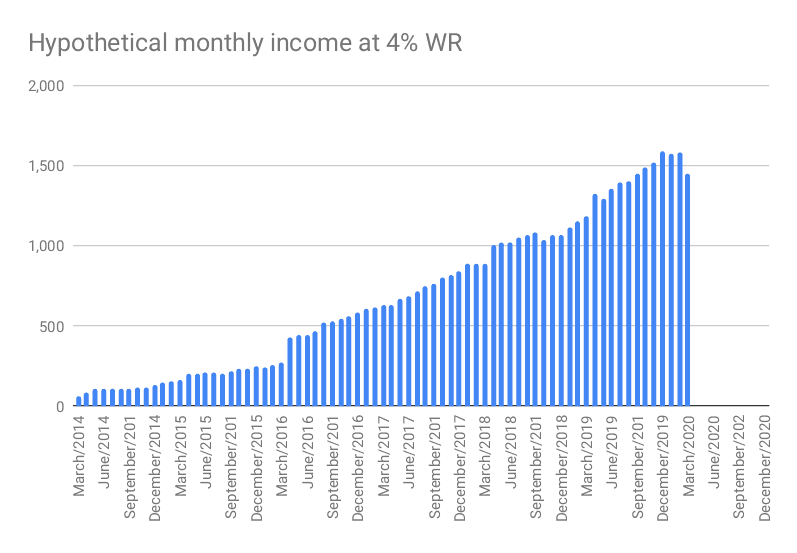

Hypothetical monthly income

SGD 1,447.

Outlook

Last time I wrote that my job was safe… That might have been a hasty assumption. The business is tanking fast and hard. My only hope is that we will have a V shape recovery which seems less likely every day. Possible outcomes for me include:

– Being sent back home to Singapore to end my expensive expat assignment before the end of the year (Likelihood 30%)

– Being placed on short working hours, forced leave (Likelihood 80%)

– Being made redundant with a package (Likelihood 5%)

All in all I am optimistic that I will survive, being in the head office and connected to some current projects. I am working quite hard and trying to tap into some hot topics to pretend that my work is relevant in this crisis (which it obviously isn’t)

Hey Singvestor, I was checking in on your blog to see when you’d put up the next post. Glad to see your optimism or a more apt label would be pragmatism I suppose. Also, the fact that you are so consistent in this.

The last several weeks have been somewhat anxiety-ridden I reckon for most of us on our path to FI. I’m not as far along as you in your journey so I have much to learn from your experience – thanks for sharing. The job security question must be on every non-FI person’s mind and reminds us that much more to stay the course through what appears to be the makings of a once in a few decades opportunity.

Interesting to see some new charts from you – avg monthly spending comparison and hypothetical income based on 4% WR. I’ve been taking a page from your book in supplementing my own trackers (of which I have far too many now I think). Thankfully, most of them are automated and I am able to apply my data science leanings from my day job to this noble cause 🙂

I tell myself, you and anyone else listening to take heart, keep your head down and once again: Stay. The. Course.

Like everything else before it, this too shall pass.

Haha yes, I am guilty of too many trackers as well! Always coming up with new ways to make charts. How are your investments surviving this crisis?

Far too late in my reply as I make my monthly rounds of your website – sorry about that bro. But I must say the investments have seen better days. Although given a long enough time-frame, these are no more than little speed bumps in our grand. Now if only my head would be able to explain that to my heart, we would get along swimmingly. Nice to see your portfolio is ‘back online’ again.

Looking at your PIE chart, you invested 66.80 in ETF. May i ask , what are the ETF did you invested in ? Did you only invest in STI ETF or diversify into other ETF ?

Hi faith, I have quite a few ETFs – you can see my portfolio here: https://singvestor.com/portfolio/