Early January I wrote a cautionary post on the need to be prepared for the next bear market. How did my investments do in January?

Portfolio update

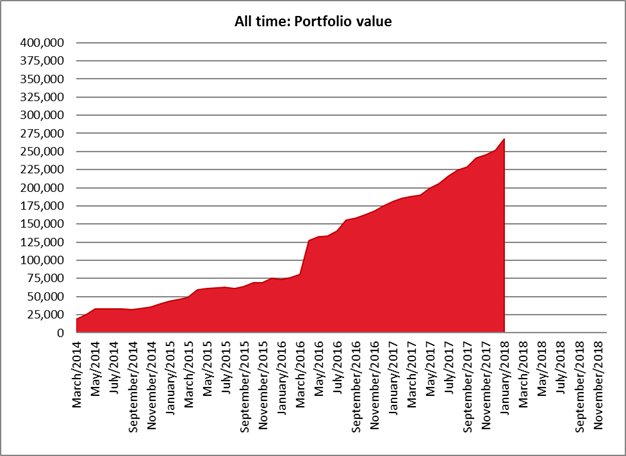

In January, my portfolio increased by a massive SGD 15,624 (6.2%) to SGD 267,227 (~USD 202,520). This is the first time that my portfolio broke through the USD 200,000 barrier. SGD 7,022 of the increase came from fresh investments, SGD 8,602 from market gains in January’s frothy market

This bull market cannot go on forever and at some time there will be another bear market. Of course nobody knows when that will happen.

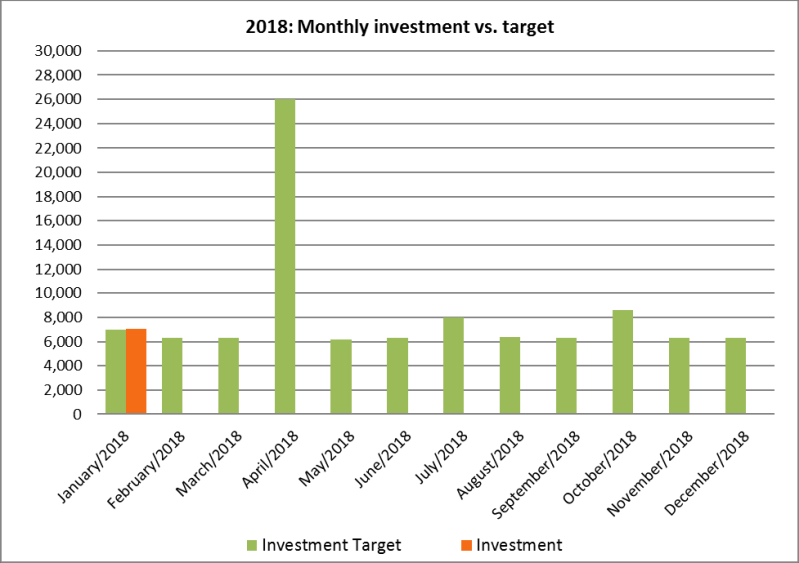

Investments in January

In January I invested SGD 7,022 as part of my plan to invest a total of SGD 100,000 in 2018. This will need quite a lot of disciplin and saving to accomplish. Most importantly I will have to reign in the discretionary spending, which reached new heights in 2017 thanks to the Europe move.

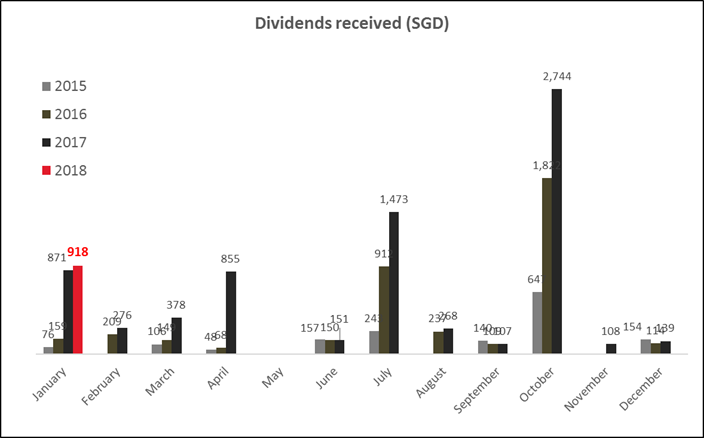

Dividends received

In January I received SGD 918 in dividends. Nice!

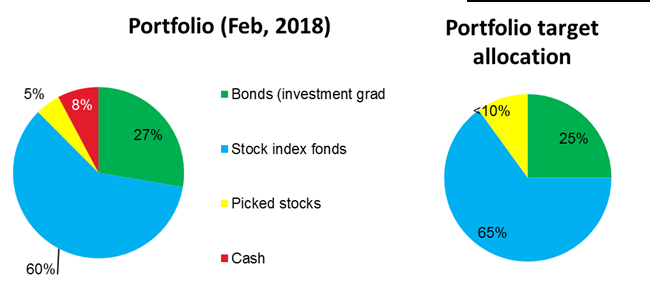

Portfolio allocation

In early January I reduced my stock holdings a little bit and decided to keep a small cash position. Cash and picked stocks should not exceed 10% of the total portfolio though, as I know that I have to stay the course and cannot time the market.

I feel that having a larger cash position can help in times of volatility and I will convert it to stocks again in the near future. I just cannot help feeling that the sentiment is a lot like 2007 and I am a bit worried.

Outlook

February has already started and the year of the dog is coming soon. Time flies! Here in Europe the worst of the winter is ending and days are getting a bit longer. Soon I can wear the sunglasses again when driving to the office 🙂

Ghosts of 2007 definitely feel like they are exposing themselves. I think you are smart to have a slightly bigger cash-cushion.