March proved rather happening and my portfolio rebounded from a very difficult January and February. I enjoyed a wonderful holiday in Taiwan and spent way too much money, so am I still on track with my goals?

During my trip to Taiwan I cycled across the country. It was a good exercise and gave me some good ideas for things to do once I retire. I covered about 430 kilometers on my bike and it was unforgettable.

Cycling on some of Taiwan’s finest roads

But now back to the topic… How is my portfolio doing?

Portfolio performance

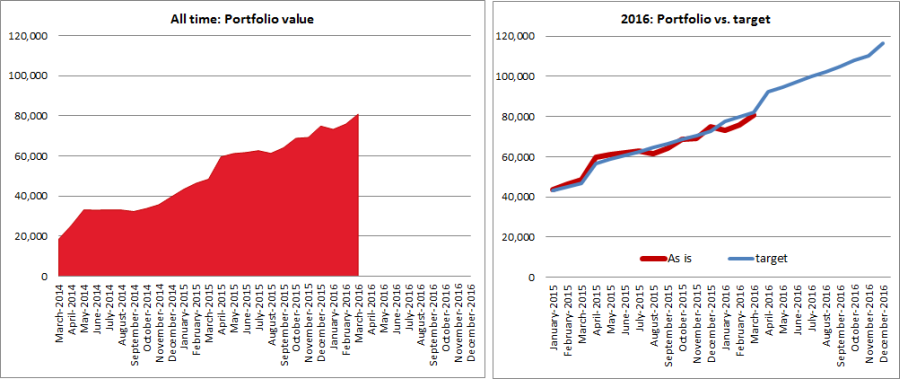

The value of my portfolio increased by 6.6% or SGD 5,009 to SGD 80,909. For the first time my portfolio broke the 80,000 barrier and six digits are now finally in sight! March’s gain was made up of portfolio gains of SGD 2,557 and fresh investments of SGD 2,452. This strong month decreased the year-to-date unrealized loss to SGD 2,008.

Investment target

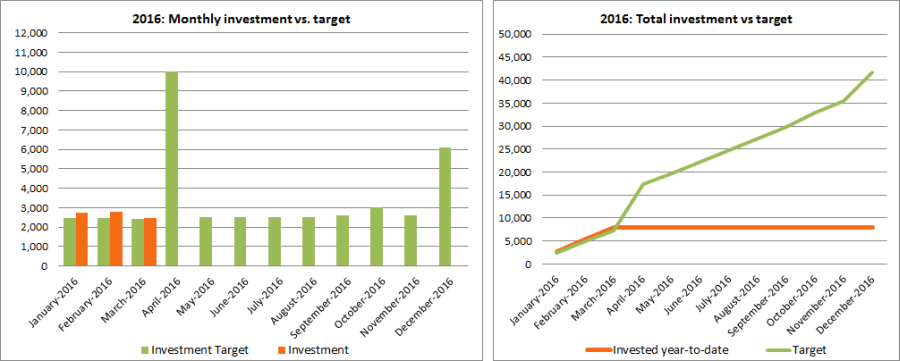

In March I invested SGD 2,452, a tiny bit more than I had originally planned. I was hoping to do better, but all this traveling messes with my savings rate.

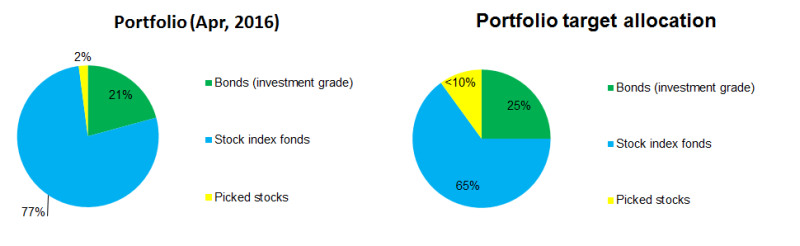

Portfolio allocation

Dividends received

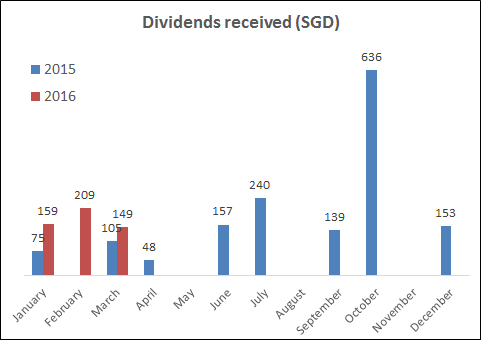

In March I received SGD 149 in dividends from my bond holdings. Nice!

Outlook

April will be bonus month and hopefully I will be able to make a nice big contribution to my investments. Also I have to get spending under control – need to be well behaved after my long holiday!

Hi Singvestor,

Just curious, but how old are you currently? Are you a corporate high flyer?

I have this impression you are very young and honestly quite impressed that you can save ~$40k every year. I am a typical 34 year old Singapore PMET earning ~$70k a year. After CPF deductions and taxes I am left with only $54k and honestly there is no way I can save remotely close to what you are doing.

I am now saving $12k a year for investment and already find it quite hard. It will take me at least 13 more years to reach your current portfolio size assuming returns are average 5-7% annual.

Hi Sad_PMET,

Interestingly we are exactly the same age! I would not consider myself a corporate high flyer, but I earn a rather high salary. I do not really know your circumstances (do you rent, have kids, live with parents or did you buy an HDB?) What do you typically spend your money on? Investing $12k a year would mean that your saving rate is 22.2% which is quite solid!

In my personal opinion the key to saving money in Singapore is to enjoy a minimalist lifestyle and to reduce fixed costs (Starhub/Mio TV, expensive phone contracts, gym memberships) etc. These things add up quite fast. Many of my peers in my company buy cars, expensive handbags and eat at expensive restaurants all the time. Apart from my love of traveling I have very few indulgences. I do not have a car, a TV or a phone contract. My gym costs SGD 5 per entry and I enjoy hawker centers and happy hour beers…

Wow what a coincidence we are same age. I wish I could earn high salary like you, but as you can see my pay so far is typical average in Singapore and I don’t think I will ever make it to those high paying levels :'(

I have already tried to cut down expenses as much as possible, but honestly after monthly expenses on parents and the family, almost no luxuries (Stay in HDB, public transport with occasional taxi, no branded except buy my wife 1 branded bag every year). The only thing I spend on extra is cable TV and the occasional dine outs. Even holidays also go nearby within Asia on cheap budgets for the family. I know a few colleagues spend all their savings for family to go on $10k+ Europe/US trips every year, I wonder how long they can sustain.

My wife & I only started to save 2 years ago after everything settle down and now doing some basic calculations it seems like we need to work till at least 62 in order to retire safely.

Thanks for the sharing your portfolio. I will try and read up more and maybe do something like you as currently all my savings are now in bank or unit trust and so far not making much.

Seriously, I think you are doing pretty well already! At the beginning things can seem very daunting, but if you manage to save and invest SGD 12k per year you will cross the SGD 100k mark in just 7 years assuming a conservative return of 5% per year. Thanks to compound interest the following SGD 100k will then only take 5.5 years and so on… You are also still relatively early in your career and you should have options to grow your responsibilities and salary. After all we both are still young, right?

At the beginning of the journey things seem very difficult and I can remember being quite desperate about it just a few years back. You have already started and that is the most important part 🙂 Personally I can recommend creating a nice Excel sheet with your goals and investments and treating it as a sport. It motivated me quite a bit! Keep going and I am sure your will be transformed to happy PMET soon 🙂

Dear Singinvestor,

I am 31 year old male, interested to pick up investing. I would like to seek an advise/tip from you on how i can bring myself to knowledge on how i can start. I thought of starting with POSB smart investor or Maybank monthly investment plan. SGD300- SGD500/monthly. Kindly let me know which platform would be better, Alternatively you recommend something that as a beginner might be easier for me to digest.

Hi Navin!

If you want to invest about SGD 300-500 monthly both the POSB Invest Saver or Maybank Kim Eng monthly investment plan might be a good idea! They are attractive since fees are much lower than unit trusts and you can automate your investments. This of course depends on for what objective you are investing. If you will need the money in the short term (less than 3-5 years) Singapore Saving Bonds might be a better option. You can also read my “Getting started investing in Singapore” post. Needless to say I am not a professional advisor, just a guy with a website that likes investing and making graphs.

I can really recommend the official Singaporean government website MoneySENSE: http://www.moneysense.gov.sg/

It gives a great overview about the options you have available and I feel that it is a good resource.