Oh man, April is nearly finished and I only manage the March update now. Too many places to visit, bands to see, new things to try that I did not find the time until now. How has the portfolio developed in this action packed month? Am I still on track to invest SGD 100k this year?

Of course I am! Despite my lazy posting schedule I am still very much committed to my goal of achieving financial independence as soon as possible.

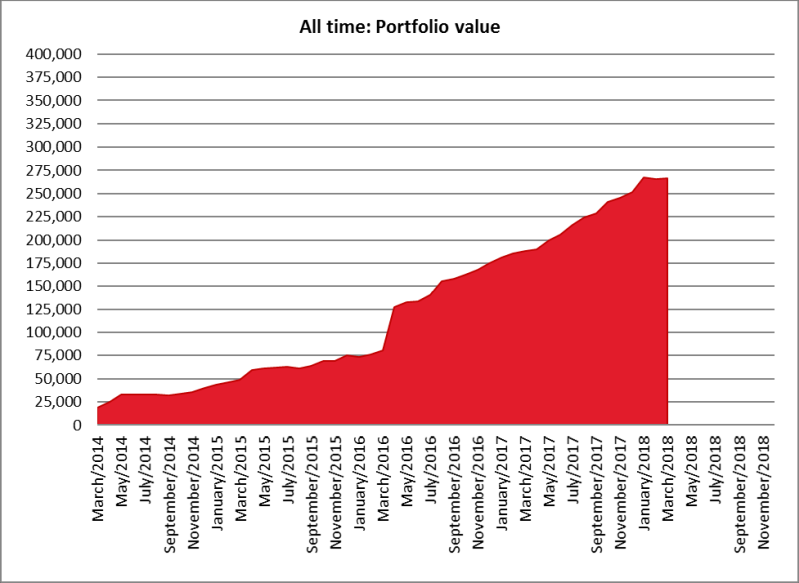

In March my portfolio increased by SGD 846 or 0.3% to SGD 266,936 (=USD 203,084). Fresh investments of SGD 6,140 were largely offset by a decline in portfolio value of SGD 5,294.

These months the markets are not doing too well and there is more volatility. The best is not to check the portfolio values too often – something I am not very good at as you can imagine!

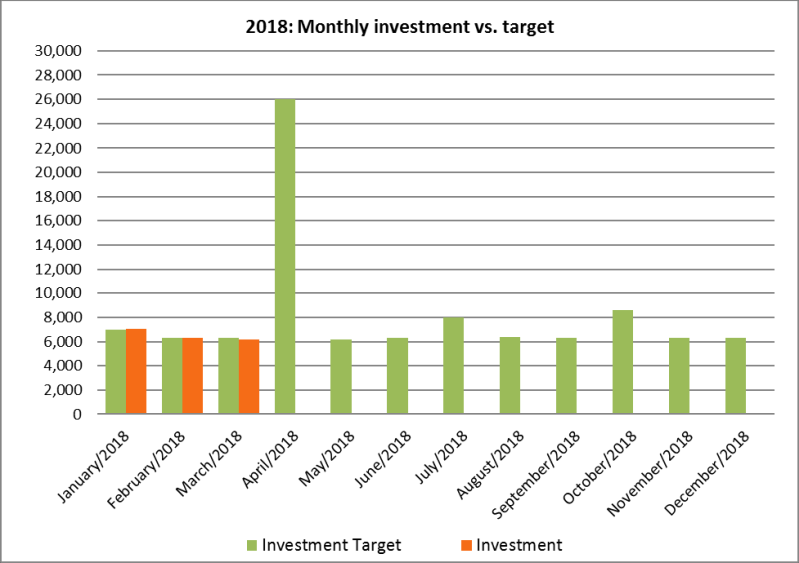

Investments vs. plan

In March I invested SGD 6,140 – a bit below plan, but April should more than compensate.

PRIIPS Regulation

I know the European Union means well with their PRIIPS regulation, but it is totally messing up my plan. I cannot buy ETFs in Singapore anymore as my Singaporean broker has locked all Europe based clients out until they can figure out the impact of this legislation.

Existing investments are not affected, but for all new investments I had to sign up with an European broker. This means I must put up with the European tax implications, which sucks. Foreign dividends remain tax free for me, but my holdings with the European broker will be taxed.

Fortunately, there is a way out: my current country does not have a capital gains tax (unless I hold funds/shares less than 6 months) and taxes only dividends. Thus, I will just buy low cost accumulating ETFs that reinvest and not distribute the dividends and I should be in the clear.

It was a fun project to research the tax implications, find a new broker etc. The Bogleheads wiki turned out to be fantastic for this.

The only thing that irks me is that I cannot continue to grow my dividends while in Europe. It is completely irrational of course as the additional dividends are just invested in the background now, but I will miss the comfort of having them appear in my account!

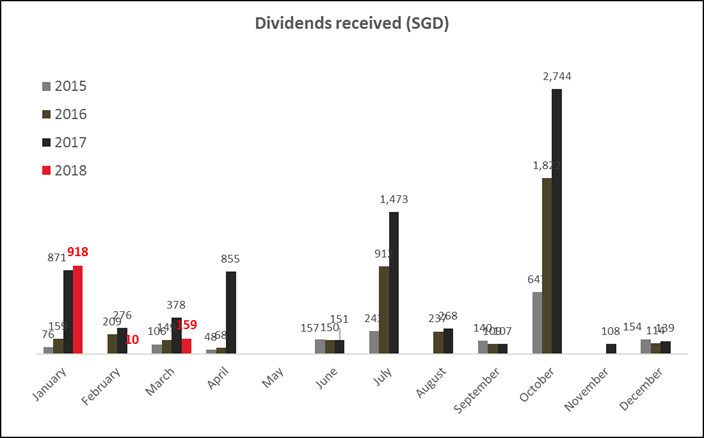

Dividends received

SGD 159.

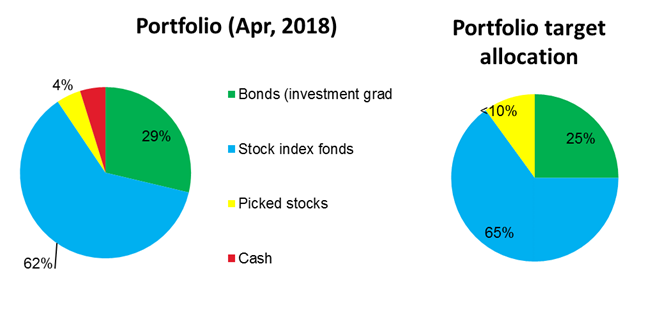

Portfolio allocation

All on track. A bit light on the stock index funds, will buy some more in April.

All on track. A bit light on the stock index funds, will buy some more in April.

Outlook

April is the month in which our yearly bonus will be paid out and I expect a nice boost to the portfolio then. Life in Europe is great as always – I can’t believe a third of my assignment is already finished! If only there was a good kopitiam with Laksa, Mee Rebus and some curries here 🙂

It stinks that the new laws are impacting your taxes in this way and your ability to buy investments per usual. I hope the work around you settled on is good.

Hi Singvestor, don’t worry about the dividends. It should come to you indirectly. I went to dbs vickers and read it, and it seems it does not affect equity investments.

How does the PRIIPs Regulation impact me?

If the residential address of your account’s beneficial owner in our records is in the EEA (regardless of nationality), the PRIIPs Regulation will impact DBS Vickers Securities’ ability to continue to offer to you structured notes, currency linked investments and other products falling within the scope of the PRIIPs Regulation.

As our product manufacturers are still evaluating the impact of the PRIIPs Regulation, KIDs will not be available for any of these products (regardless of issuer) on our product platform for the moment. As such, until further notice, these products will no longer be available to you from 1 January 2018.

For investment funds and/or exchange-traded funds available online, please refrain from transacting in these products.

However, you may continue to transact the following through DBS Vickers Securities:

direct investments in equities

UCITs funds

Thanks Kyith! The banks in Singapore are handling the issue quite differently. DBS has posted a warning message and asks customers not to buy non-UCITs ETFs, while Standard Chartered has blocked me from buying anything whatsoever via their online trading. Unfortunately there seem be no UCITs ETFs listed in Singapore or Hong Kong, but the current solution also works because of the tax situation in my current country. You are totally right about the dividends of course. European regulations are so troublesome – I miss Singapore’s efficiency so much 🙂