May was a turbulent month to say the least. Portfolio value increased slightly to SGD 33,176 with the terrible performance of the stocks bought during my silly stock picking days dragging down the overall performance considerably.

Unfortunately I did not manage to save a lot of money as I went on a trip to Europe with the girlfriend, booked another week-long trip to sunny Cambodia as well as a short diving trip to Bali. With lots of unexpected charges and costs, including getting in an accident with a rental car it was a fun, but financially speaking not a successful month.

| Total portfolio value | SGD | EUR | USD |

| 33,176 | 19,401 | 26,541 |

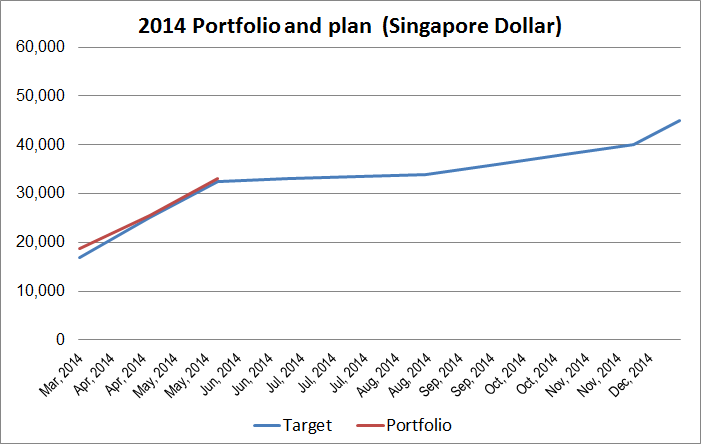

Total portfolio value vs target:

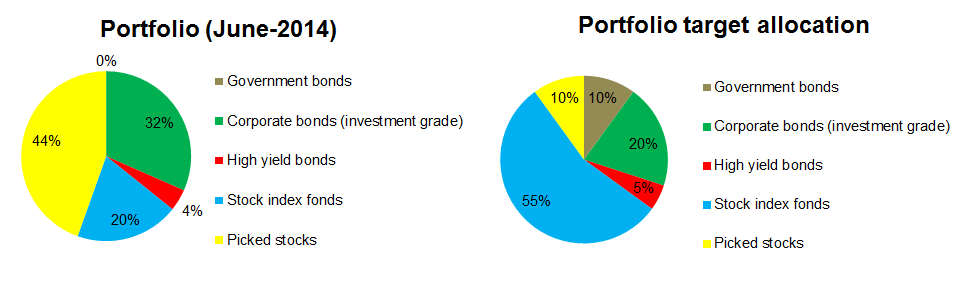

Allocation vs. target allocation

Picked stocks still make up for a way too large portion of the portfolio but as I slowly keep adding more and more index funds things should balance out sooner or later.

Dividends received and mistakes made

My Evonik shares paid a dividend of EUR 1.00 per share, but as I had to find out Singaporean investors get charged a whopping 26.375% withholding tax on dividends paid by Frankfurt listed companies. Instead of the expected EUR 170 I therefore only received EUR 125.16.

Needless to say this withholding tax makes investments in Frankfurt listed dividend stocks from Singapore very unattractive. To illustrate this here is my example: On average I paid EUR 30.8 per share for the Evonik stock, which at a dividend of EUR 1.00 means a yield of 3.25%. After tax the dividend is just EUR 0.74 per share, lowering the yield to a meager 2.4%.

Withholding tax is also charged to dividends from US listed stocks, so Singapore investors beware! Edit/Update: Read more: Why it is a bad idea to invest in foreign dividend paying stocks and funds from Singapore

As of now I would recommend staying away from US and German dividend paying stocks and funds when investing in Singapore.

Hi sinvestor

Thanks for the informative article. Did you manage to check why the withholding tax rates with Germany differs from the DTA listed on iras?

https://www.iras.gov.sg/IRASHome/uploadedFiles/IRASHome/Quick_Links/newgermanysingaporedtaratified12dec2006.pdf

Hi Alred, I am no expert especially on the German-Singaporean tax treaties, which seem highly complex. My source of data is the information from S&P Dow Jones, the latest version is available here: http://us.spindices.com/documents/additional-material/withholding-tax-index-values.pdf