Some days I feel I should rather write a travel blog: In July I spent 23 days spent on the road, 19 of which in China for business and 4 for a short diving holiday in Bali. While diving with Manta rays in Bali is a priceless experience I also realize that I have been spending way too much for travelling and am looking forward to a no-travel August back home in Singapore.

| Total portfolio value | SGD | EUR | USD |

| 33,194 | 19,877 | 26,555 |

In July I made a rather different “investment”: I bargained hard with my health insurance company and got a 5% discount by switching my payment frequency to yearly instead of monthly. While this is a nice guaranteed return and frees up cash flow in the following months I will have to fork over a whopping SGD 6,000 after discounts on August 1. Thus I did only make small investments this month.

But first things first:

Happy dividend month

Dividend wise it was a fantastic month as I received the following dividends:

| Item | Cost basis | Dividend received this July | “Yield” (for July dividend payment) |

| Industrial and Commercial Bank of China | HKD 9,280 | HKD 592.63 | 6.39% |

| Bank of China | HKD 6,820 | HKD 444.58 | 6.52% |

| Vanguard FTSE Asia Ex Japan Index ETF | HKD 55,356 | HKD 364 | 0.66% |

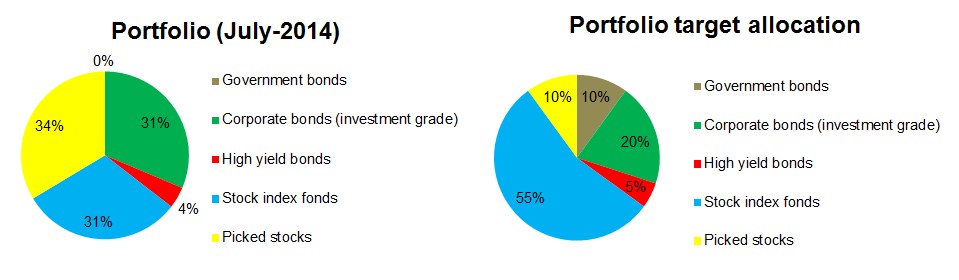

In July I was paid a total of HKD 1401.21 or SGD 224.44 in dividends. Not bad! As you can see in my portfolio, my stock picking performance is terrible and I am trying hard to reduce the number of picked stocks in favor of low cost index funds. However buying a small amount of shares of two leading Chinese banks worked out quite well, thanks to their generous dividend payments.

Transactions made

I reinvested all dividends and added some additional funds to buy a total of 200 shares of Vanguard’s FTSE Asia ex Japan High Dividend Yield Index ETF which further improved my target allocation:

Fortunately the dreaded picked stock section is slowly shrinking as it underperforms the low cost index funds and all dividends get re-invested into index funds.

Vanguard’s FTSE Asia ex Japan High Dividend Yield Index ETF seems quite a nice choice overall, thanks to its broad diversification and cheap expense ratio of 0.45%. And after all, nothing beats getting nice quarterly dividends, right?

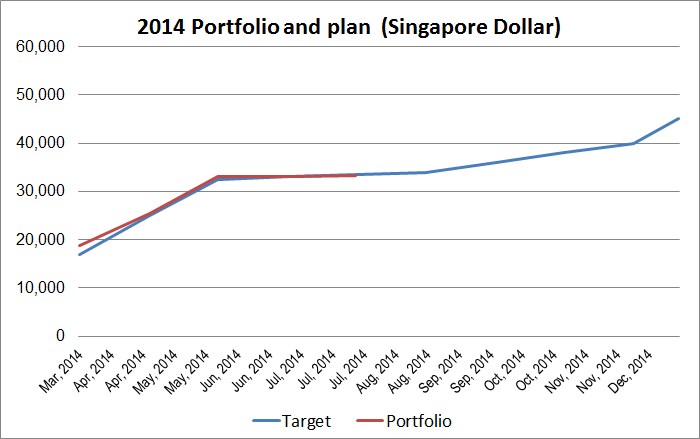

Portfolio performance

Portfolio performance is more or less as budgeted, nothing exciting thanks to the huge health insurance payment which even depleted some of my cash savings.