November is rainy and gloomy in Europe and I miss my former home Singapore tremendously. During rainy November I often missed a steaming bowl of real Laksa. The version I can concoct myself is a bad substitute at best. How did my personal finances do in this rainy autumn month?

November expense report

| November expenses | |||

| Category | EUR | SGD | USD |

| Travel | -1454 | -2196 | -1614 |

| Other | -661 | -998 | -734 |

| Eating out | -328 | -495 | -364 |

| Car | -255 | -385 | -283 |

| Eyes, Hair, Health | -205 | -310 | -228 |

| Business | -200 | -302 | -222 |

| Uber | -194 | -293 | -215 |

| Utilities | -188 | -284 | -209 |

| Cleaning & Ironing | -113 | -171 | -125 |

| Bars | -107 | -162 | -119 |

| Gifts | -77 | -116 | -85 |

| Canteen | -27 | -40 | -29 |

| Groceries | -24 | -36 | -27 |

| Entertainment | 0 | 0 | 0 |

| Total | -3,833 | -5,788 | -4,254 |

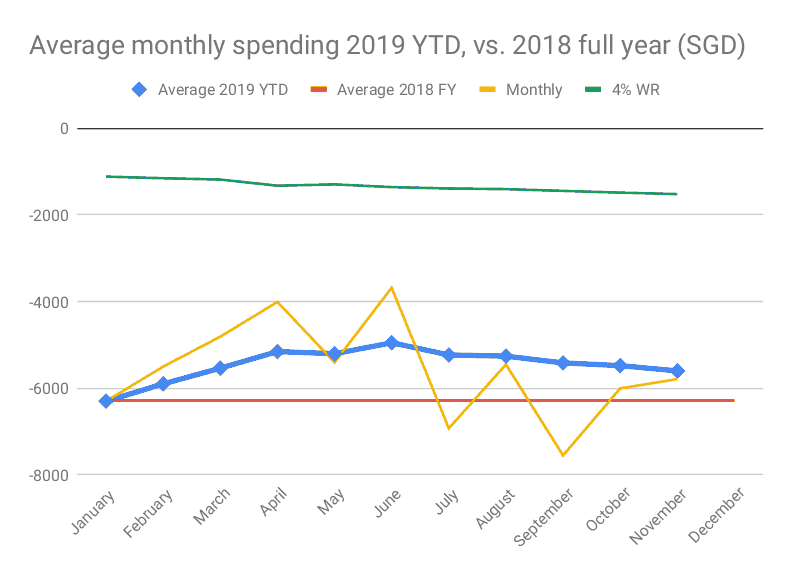

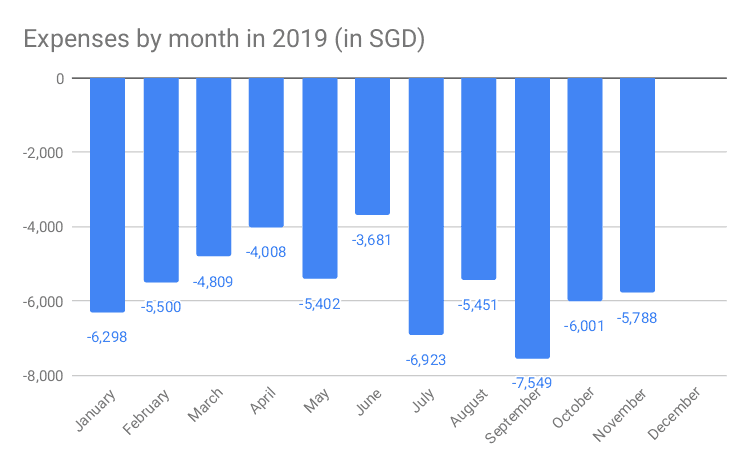

Spending SGD 5,788 when I do not have to pay rent is ridiculous. Saving rate in October was just 55%. Year-to-date saving rate is 64%.

I do not regret the high travel spending though, as I had a trip with my parents and spent quality time with them. Some costs for this trip were already paid in the previous month.

The yearly expenses show a deteriorating picture in the second half of the year – I lost discipline in the second half.

I wasted so much money this year, but hope to come out lower than last year.

Portfolio update

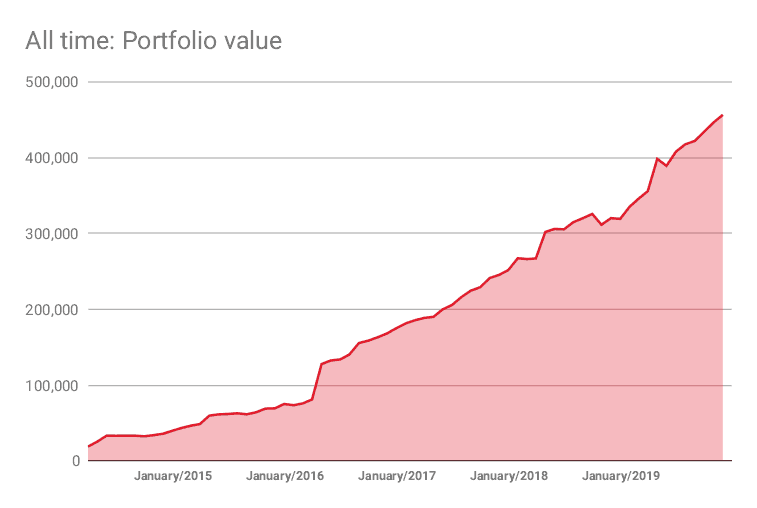

Portfolio increased by SGD 10,348 to SGD 456,425 (~USD 335,600). Fresh investments of SGD 6,464 and gains of SGD 3,884 contributed.

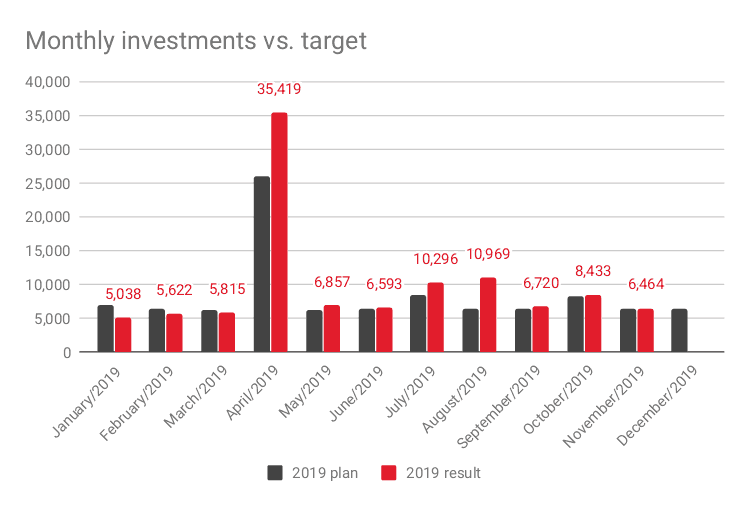

Investments vs. plan

I invested SGD 6,464 into my portfolio which was more than planned (SGD 6,300).

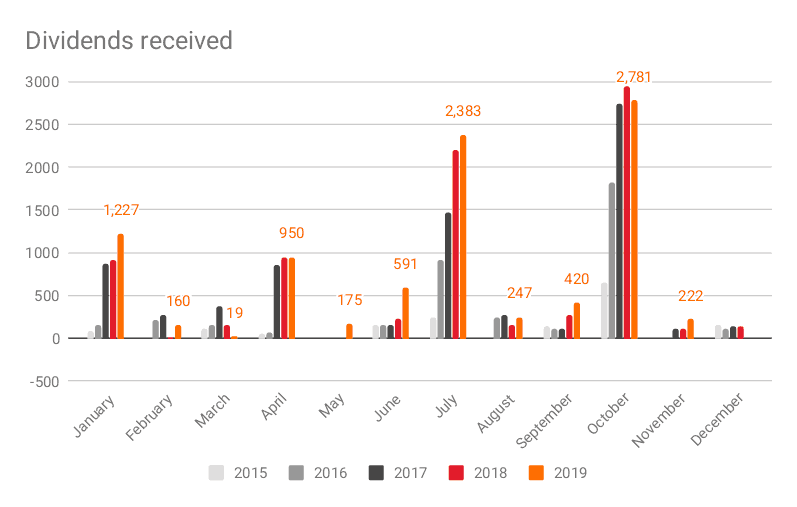

Dividends received

SGD 222.

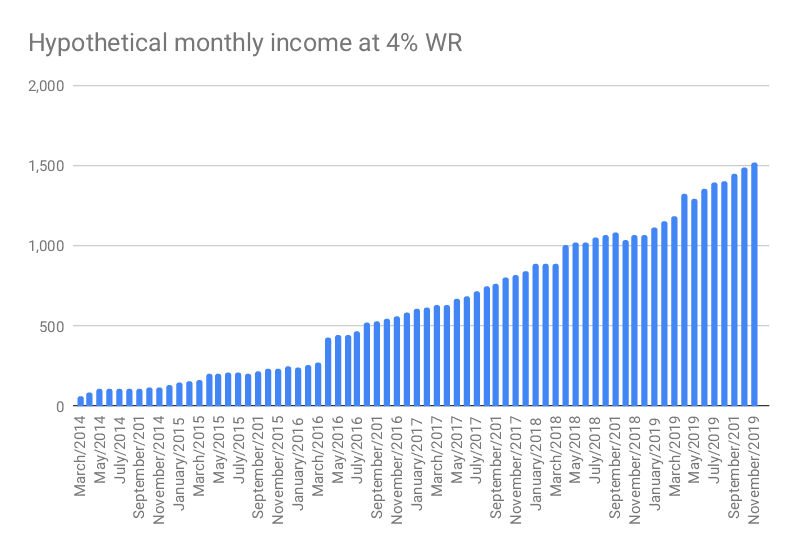

Hypothetical monthly income

SGD 1,521.

Outlook

Personal life a bit in a mess, but can only get better. Markets seem to be pricing in a major recovery next year, but I am not as optimistic. Europe still looks in pretty bad shape, especially Germany. Will 2020 be the recovery year? Or will things get worse?

Hey man, hang in there. The wealth front looks good though. Have a Merry Christmas and a Happy new year.

Thanks Kyith! Have a great Xmas and a Happy New Year too! Have a Laksa for me!

Hi Singvestor,

Really like your blog and how you show all your real life spending in full glory 🙂

I live in Australia and want to buy a particular mutual fund in the US. The fund is BFOCX Berkshire Focus. Are you able to invest in US mutual funds with your brokerage in Singapore?

Thanks!

Hi Karl, thanks 🙂 I am no expert in mutual funds – normally I prefer low cost passive ETFs. Sorry that I cannot help here