After reviewing my performance for last year it is now time to create a proper investment plan for 2016! One thing is clear: it needs to be more ambitious than last year’s plan.

Read on to find out what I am planning to do different this year…

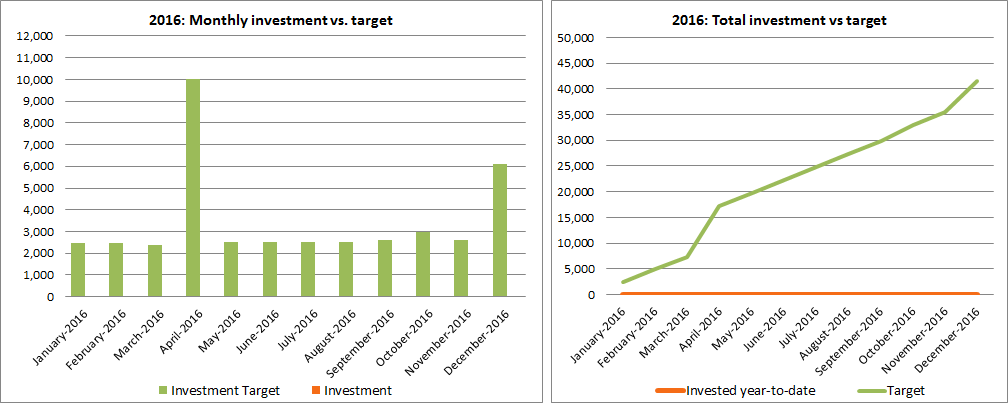

Monthly investment plan:

Last year I planned to invest SGD 31,400 and ended up investing SGD 39,566. This year I have decided to invest at least SGD 41,600 and hope to significantly exceed this plan again.

The increase between last year’s real investment and this year’s planned investment amount is rather small, I have to admit that. The reasons for this are:

- Besides investing I need to increase my cash buffer for potential expenses of leaving Singapore or switching jobs

- I want to set a challenging goal that I can beat

- My bonus will be smaller than last year and I do not expect any salary increase – the reasons for this being are the tough state of the economy and the difficult situation which my company is facing

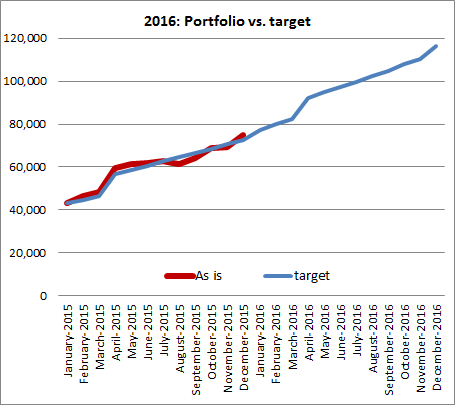

Assuming flat market performance my portfolio should finish 2016 around SGD 115,000. Not much for most people but definitely a feat for me. Sometime in August/September the portfolio should cross SGD 100,000 and I can finally add one digit!

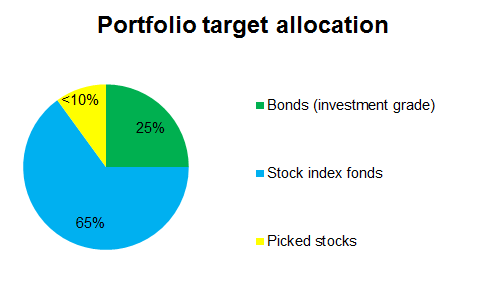

Target portfolio allocation

I have decided to slightly reduce my bond allocation to 25%. I will probably need to invest in some bonds soon to improve my asset allocation.

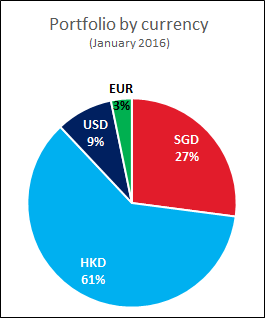

The issue: high dependency on USD

As you can see a larger part of my portfolio is currently in Hong Kong Dollar (HKD) and USD. As the HKD is pegged to the USD I am facing quite a bit of currency exchange rate risk for my investments. This is somewhat increased by the fact that the USD/HKD is very strong compared to the SGD.

While this development buffered my portfolio against even worse drops in 2015 things could change fast once the trend changes. Thus I have decided to increase my investments in SGD, ideally to about 35-40%.

Singapore’s stock exchange is still lagging behind Hong Kong when it comes to good choice of ETFs, but I still have not given up hope that Vanguard might list some ETFs here one day. One can dream!

So bring it on, 2016! Let’s hope for the best!

Hi, it is my first visit to your site and I would like to comment that your site is informative and balanced. I hope you can share with the readers of your site:

1) How do you determine the year in which you want to achieve financial freedom.

2) Hkw do you determine how much to invest each year?

3) How do you keep track that you are align to reach your financial freedom goals.

Thank you very much.